Chevron 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 Chevron Corporation 2009 Annual Report

FS-PB

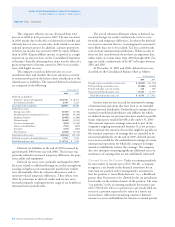

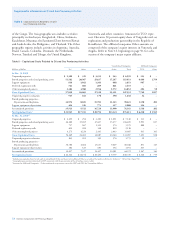

Assumptions The following weighted-average assumptions were used to determine benefit obligations and net periodic benefit costs

for years ended December 31:

Pension Benefits

2009 2008 2007 Other Benefits

U.S. Int’l. U.S. Int’l. U.S. Int’l. 2009 2008 2007

Assumptions used to determine

benefit obligations

Discount rate 5.3% 6.8% 6.3% 7.5 % 6.3% 6.7% 5.9% 6.3% 6.3%

Rate of compensation increase

4.5% 6.3% 4.5% 6.8% 4.5% 6.4% N/A 4.0% 4.5%

Assumptions used to determine

net periodic benefit cost

Discount rate 6.3% 7.5% 6.3% 6.7% 5.8% 6.0% 6.3% 6.3% 5.8%

Expected return on plan assets

7.8% 7.5% 7.8% 7. 4 % 7.8% 7.5% N/A N/A N/A

Rate of compensation increase

4.5% 6.8% 4.5% 6.4% 4.5% 6.1% N/A 4.5% 4.5%

Expected Return on Plan Assets The company’s estimated

long-term rates of return on pension assets are driven pri-

marily by actual historical asset-class returns, an assessment

of expected future performance, advice from external actu-

arial firms and the incorporation of specific asset-class risk

factors. Asset allocations are periodically updated using pen-

sion plan asset/liability studies, and the company’s estimated

long-term rates of return are consistent with these studies.

There have been no changes in the expected long-term

rate of return on plan assets since 2002 for U.S. plans, which

account for 69 percent of the company’s pension plan assets.

At December 31, 2009, the estimated long-term rate of

return on U.S. pension plan assets was 7.8 percent.

The market-related value of assets of the major U.S. pen-

sion plan used in the determination of pension expense was

based on the market values in the three months preceding

the year-end measurement date, as opposed to the maximum

allowable period of five years under U.S. accounting rules.

Management considers the three-month time period long

enough to minimize the effects of distortions from day-to-

day market volatility and still be contemporaneous to the

end of the year. For other plans, market value of assets as of

year-end is used in calculating the pension expense.

Discount Rate The discount rate assumptions used to deter-

mine U.S. and international pension and postretirement

benefit plan obligations and expense reflect the prevailing

rates available on high-quality, fixed-income debt instruments.

At December 31, 2009, the company selected a 5.3 percent

discount rate for the U.S. pension plan and 5.8 percent for

the U.S. postretirement benefit plan. This rate was based on

a cash flow analysis that matched estimated future benefit

payments to the Citigroup Pension Discount Yield Curve

as of year-end 2009. The discount rates at the end of 2008

and 2007 were 6.3 percent for the U.S. pension plan and the

OPEB plan.

Note 21 Employee Benefit Plans – Continued

Other Benefit Assumptions For the measurement of accumu-

lated postretirement benefit obligation at December 31, 2009,

for the main U.S. postretirement medical plan, the assumed

health care cost-trend rates start with 7 percent in 2010 and

gradually decline to 5 percent for 2018 and beyond. For this

measurement at December 31, 2008, the assumed health care

cost-trend rates started with 7 percent in 2009 and gradually

declined to 5 percent for 2017 and beyond. In both measure-

ments, the annual increase to company contributions was

capped at 4 percent.

Assumed health care cost-trend rates can have a signifi-

cant effect on the amounts reported for retiree health care

costs. The impact is mitigated by the 4 percent cap on the

company’s medical contributions for the primary U.S. plan.

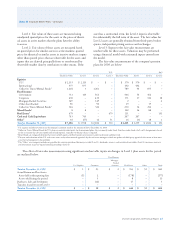

A one-percentage-point change in the assumed health care

cost-trend rates would have the following effects:

1 Percent 1 Percent

Increase Decrease

Effect on total service and interest cost components $ 10 $ (9)

Effect on postretirement benefit obligation $ 102 $ (87)

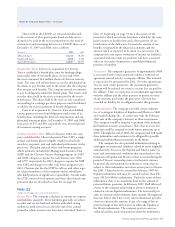

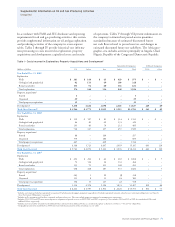

Plan Assets and Investment Strategy Effective December 31,

2009, the company implemented the expanded disclosure

requirements for the plan assets of defined benefit pension

and OPEB plans (ASC 715) to provide users of financial state-

ments with an understanding of: how investment allocation

decisions are made; the major categories of plan assets; the

inputs and valuation techniques used to measure the fair value

of plan assets; the effect of fair-value measurements using

unobservable inputs on changes in plan assets for the period;

and significant concentrations of risk within plan assets.

The fair-value hierarchy of inputs the company uses to

value the pension assets is divided into three levels:

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts