Chevron 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

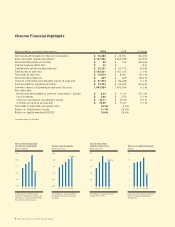

Millions of dollars, except per-share amounts 2009 2008 % Change

Net income attributable to Chevron Corporation $ 10,483 $ 23,931 (56.2)%

Sales and other operating revenues $ 167,402 $ 264,958 (36.8)%

Noncontrolling interests income $ 80 $ 100 (20.0)%

Interest expense (after tax) $ 22 $ — N /A

Capital and exploratory expenditures* $ 22,237 $ 22,775 (2.4)%

Total assets at year-end $ 164,621 $ 161,165 2.1 %

Total debt at year-end $ 10,514 $ 8,901 18.1 %

Noncontrolling interests $ 647 $ 469 38.0 %

Chevron Corporation stockholders’ equity at year-end $ 91,914 $ 86,648 6.1 %

Cash provided by operating activities $ 19,373 $ 29,632 (34.6)%

Common shares outstanding at year-end (Thousands) 1,993,554 1,990,064 0.2 %

Per-share data

Net income attributable to Chevron Corporation – diluted $ 5.24 $ 11.67 (55.1)%

Cash dividends $ 2.66 $ 2.53 5.1 %

Chevron Corporation stockholders’ equity $ 46.11 $ 43.54 5.9 %

Common stock price at year-end $ 76.99 $ 73.97 4.1 %

Total debt to total debt-plus-equity ratio 10.3% 9.3%

Return on stockholders’ equity 11.7% 29.2%

Return on capital employed (ROCE) 10.6% 26.6%

Chevron Financial Highlights

*Includes equity in affiliates

0.0

25.0

20.0

15.0

5.0

10.0

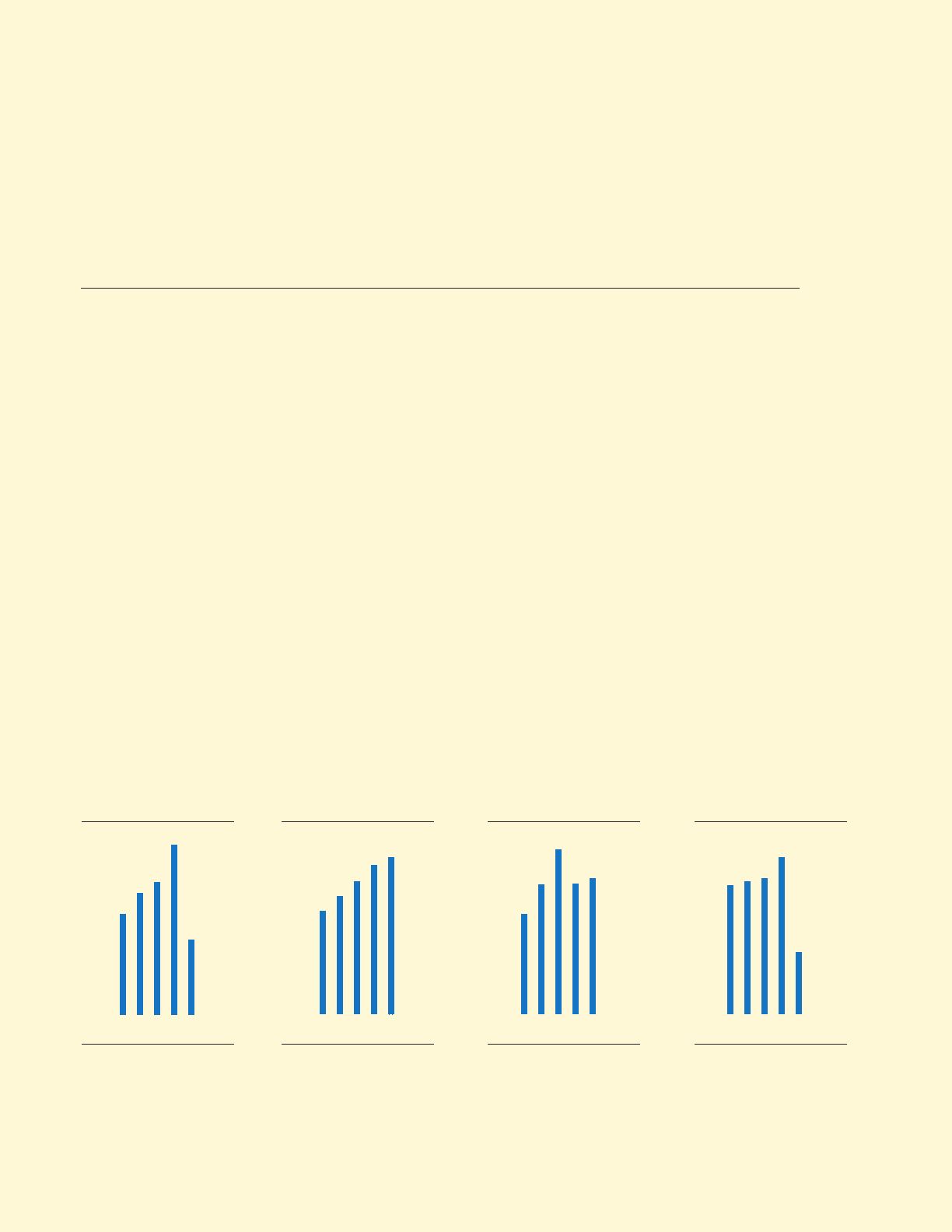

Net Income Attributable

to Chevron Corporation

Billions of dollars

The decrease in 2009 was due

mainly to the decline in earnings for

upstream, as a result of lower prices

for crude oil and natural gas.

05 07 08 09

$10.5

06

0.00

3.00

2.40

1.80

0.60

1.20

Annual Cash Dividends

Dollars per share

The company’s annual dividend

increased for the 22nd consecu-

tive year.

06

05 07 08 09

$2.66

0

100

80

60

40

20

Chevron Year-End

Common Stock Price

Dollars per share

The company’s stock price rose

4.1 percent in 2009.

0605 07 08 09

$76.99

0

30

24

18

12

6

Return on Capital Employed

Percent

Lower earnings reduced Chevron’s

return on capital employed to

10.6 percent.

0 60 5 07 08 09

10.6

4Chevron Corporation 2009 Annual Report

Narrative.cg_R6.indd 4 3/28/10 8:56 AM