Chevron 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 Annual Report

BCxFC.cg.JPG.indd 1 3/29/10 10:26 AM

Table of contents

-

Page 1

2009 Annual Report -

Page 2

...improves the world's quality of life. This year, we have streamlined our printed Annual Report and developed an online version that contains additional information about our company, as well as videos you can watch to learn more about our projects. We invite you to visit our Web site at: Chevron.com... -

Page 3

...value for investors while producing the energy that makes our quality of life possible. As your Chairman, I'm committed to building on that legacy. It's an honor to lead Chevron into a future where energy will continue to be a foundation for global economic growth. > Chevron Corporation 2009 Annual... -

Page 4

..., dedication and values of our employees worldwide - position us to achieve growth while helping meet long-term global demand for energy...Our world grows more complex every day. We face increased challenges - geopolitical, environmental, regulatory and technical. But Chevron employees have risen to... -

Page 5

... on aligning our downstream businesses with the strongest market opportunities. Chevron's core strengths - starting with the talent, dedication and values of our employees worldwide - position us to achieve growth while helping meet long-term global demand for energy. The values of The Chevron Way... -

Page 6

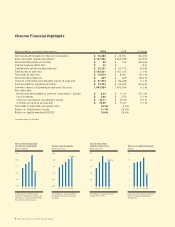

...) Per-share data Net income attributable to Chevron Corporation - diluted Cash dividends Chevron Corporation stockholders' equity Common stock price at year-end Total debt to total debt-plus-equity ratio Return on stockholders' equity Return on capital employed (ROCE) *Includes equity in affiliates... -

Page 7

... equity in affiliates, except number of employees Liquids consist of crude oil, condensate, natural gas liquids and synthetic oil. For 2009, includes 460 million barrels of synthetic oil from Canadian oil sands. None are included for 2008. At the end of the year Excludes service station personnel... -

Page 8

...explore for, produce and transport crude oil and natural gas; refine, market and distribute transportation fuels and other energy products; manufacture and sell petrochemical products; generate power and produce geothermal energy; provide energy efficiency solutions; and develop the energy resources... -

Page 9

... value creation. Our downstream operations include refining, fuels and lubricants marketing, supply and trading, and transportation. In 2009, we processed approximately 1.9 million barrels of crude oil per day and averaged approximately 3.3 million barrels per day of refined product sales worldwide... -

Page 10

... economic benefits arising from the other assets acquired in a business combination that are not individually identified and separately recognized. Margin The difference between the cost of purchasing, producing and/or marketing a product and its sales price. Return on capital employed (ROCE) Ratio... -

Page 11

...Assets Held for Sale 68 Note 26 Earnings Per Share 68 Five-Year Financial Summary 69 Five-Year Operating Summary 70 Supplemental Information on Oil and Gas Producing Activities 71 32 Consolidated Financial Statements Report of Management 32 Report of Independent Registered Public Accounting Firm 33... -

Page 12

...To sustain its long-term competitive position in the upstream business, the company must develop and replenish an inventory of projects that offer attractive ï¬nancial returns for the investment required. Identifying promising areas for exploration, acquiring the necessary rights to explore for and... -

Page 13

...Cubic Feet (right scale) Production in Millions of Cubic Feet per Day (left scale) Average prices decreased 53 percent to $3.73 during 2009. Production was 7 percent lower due to natural field declines and sales of properties. - U.S. Natural Gas Chevron#011 Corporation 2009 Annual Report Prices 11... -

Page 14

.... The company completed sales of marketing businesses during 2009 in certain countries in Latin America and Africa. The company plans to discontinue, by mid-2010, sales of Chevron- and Texacobranded motor fuels in the mid-Atlantic and other eastern states, where the company sold to retail customers... -

Page 15

... partners reached ï¬nal investment decision to proceed with the development of the Gorgon Project, located offshore Western Australia, in which Chevron has a 47.3 percent-owned and operated interest as of December 31, 2009. In addition, the company ï¬nalized long-term sales agreements for delivery... -

Page 16

... generation businesses, the various companies and departments that are managed at the corporate level, and the company's investment in Dynegy prior to its sale in May 2007. Earnings are also presented for the U.S. and international geographic areas of the upstream and downstream business segments... -

Page 17

... on lower sales of jet fuel and fuel oil. United States International Downstream earnings decreased 84 percent from 2008 due to lower margins on the sale of refined products. *Includes equity in afï¬liates Sales volumes of reï¬ned products were 1.40 million barrels per day in 2009, a decrease of... -

Page 18

...WW Chemicals Earnings - v2 businesses, worldwide cash management and debt ï¬nancing activities, corporate administrative functions, insurance operations, real estate activities, alternative fuels and technology companies, and the company's interest in Dynegy, Inc. prior to its sale in May 2007. Net... -

Page 19

... a $680 million gain on the sale of the company's investment in Dynegy common stock and a loss of approximately $175 million associated with the early redemption of Texaco Capital Inc. bonds. Consolidated Statement of Income Crude oil and product purchases in 2009 decreased $71.7 billion from 2008... -

Page 20

...a relatively low effective tax rate on the sale of the company's investment in Dynegy common stock and the sale of downstream assets in Europe. Refer also to the discussion of income taxes in Note 15 beginning on page 53. International Upstream Net Crude Oil and Natural Gas Liquids Production (MBPD... -

Page 21

... public bonds issued by major projects. Chevron Corporation, Chevron Corporation Proï¬t Sharing/ Savings Plan Trust Fund, Texaco Capital Inc. and Union Cash provided by operating activities was net of contribuOil Company of California. All of these securities are the tions to employee pension plans... -

Page 22

... Ratio 1.4 1.1 1.2 projects outside the United States. Spending in 2010 is priInterest Coverage Ratio 62.3 166.9 69.2 marily targeted for exploratory prospects in the U.S. Gulf of Debt Ratio 10.3% 9.3% 8.6% Mexico and major development projects in Angola, Australia, Brazil, Canada, China, Nigeria... -

Page 23

...2008 10 25.0 and 2007 due to lower before-tax income. 0 0.0 Debt Ratio - total debt 05 06 07 08 09 as a percentage of total debt Debt (left scale) plus Chevron Corporation CVX Stockholders' Equity (left scale) Stockholders' Equity. The Ratio (right scale) The ratio of total debt to total increase in... -

Page 24

... transactions for the purchase, sale and storage of crude oil, reï¬ned products, natural gas, natural gas liquids and feedstock for company reï¬neries. 22 Chevron Corporation 2009 Annual Report The company also uses derivative commodity instruments for limited trading purposes. The results... -

Page 25

... company had no interest rate swaps on ï¬xed-rate debt at year-end 2009. Transactions With Related Parties Chevron enters into a number of business arrangements with related parties, principally its equity afï¬liates. These arrangements include long-term supply or offtake agreements and long-term... -

Page 26

..., including MTBE, by the company or other parties. Such contingencies may exist for various sites, including, but not limited to, federal Superfund sites and analogous sites under state laws, reï¬neries, crude-oil ï¬elds, service stations, terminals, land development areas, and mining operations... -

Page 27

...$820 million related to the company's U.S. downstream operations, including reï¬neries and other plants, marketing locations (i.e., service stations and terminals), and pipelines. The remaining $695 million was associated with various sites in international downstream ($107 million), upstream ($369... -

Page 28

...- Management makes many estimates and assumptions in the application of generally accepted accounting principles (GAAP) that may have a material impact on the company's consolidated ï¬nancial statements and related disclosures and on the comparability of such information over different reporting... -

Page 29

... are the expected long-term rate of return on plan assets and the discount rate applied to pension plan obligations. For other postretirement beneï¬t (OPEB) plans, which provide for certain health care and life insurance beneï¬ts for qualifying retired employees and which are not funded, critical... -

Page 30

... rates of return on plan assets and discount rates may vary signiï¬cantly from estimates because of unanticipated changes in the world's ï¬nancial markets. In 2009, the company's pension plan contributions were $1.7 billion (including $1.5 billion to the U.S. plans). In 2010, the company estimates... -

Page 31

... to information beginning on page 59 in Note 21, Employee Beneï¬ts, for these disclosures. Transfers and Servicing (ASC 860), Accounting for Transfers of Financial Assets (ASU 2009-16) The FASB issued ASU 2009-16 in December 2009. This standard became effective for the company on January 1, 2010... -

Page 32

... of the Oil and Gas Reporting Requirements (the ï¬nal rule). The ï¬nal rule was issued on December 31, 2008. Refer to Table V - Reserve Quantity Information, beginning on page 76, for additional information on the ï¬nal rule and the impact of adoption. 30 Chevron Corporation 2009 Annual Report -

Page 33

..., value-added and similar taxes: End of day price. The company's common stock is listed on the New York Stock Exchange (trading symbol: CVX). As of February 19, 2010, stockholders of record numbered approximately 195,000. There are no restrictions on the company's ability to pay dividends. Chevron... -

Page 34

... standards of the Public Company Accounting Oversight Board (United States). The Board of Directors of Chevron has an Audit Committee composed of directors who are not ofï¬cers or employees of the company. The Audit Committee meets regularly with members of management, the internal auditors and the... -

Page 35

Report of Independent Registered Public Accounting Firm To the Stockholders and the Board of Directors of Chevron Corporation: In our opinion, the accompanying consolidated balance sheets and the related consolidated statements of income, comprehensive income, equity and cash ï¬,ows present fairly... -

Page 36

... interests Net Income Attributable to Chevron Corporation Per-Share of Common Stock Net Income Attributable to Chevron Corporation - Basic - Diluted *Includes excise, value-added and similar taxes. See accompanying Notes to the Consolidated Financial Statements. $ 167,402 3,316 918 171... -

Page 37

...ï¬ned beneï¬t plans sponsored by equity afï¬liates Income taxes on deï¬ned beneï¬t plans Total Other Comprehensive (Loss) Gain, Net of Tax Comprehensive Income Comprehensive income attributable to noncontrolling interests Comprehensive Income Attributable to Chevron Corporation See accompanying... -

Page 38

...Equity Short-term debt Accounts payable Accrued liabilities Federal and other taxes on income Other taxes payable Total Current Liabilities Long-term debt Capital lease obligations Deferred credits and other noncurrent obligations Noncurrent deferred income taxes Reserves for employee beneï¬t plans... -

Page 39

... to employee pension plans Other Net Cash Provided by Operating Activities Investing Activities Capital expenditures Proceeds and deposits related to asset sales Net sales of marketable securities Repayment of loans by equity afï¬liates Net sales (purchases) of other short-term investments Net... -

Page 40

... attributable to Chevron Corporation Cash dividends on common stock Adoption of new accounting standard for uncertain income tax positions Tax beneï¬t from dividends paid on unallocated ESOP shares and other Balance at December 31 Notes Receivable - Key Employees Accumulated Other Comprehensive... -

Page 41

...Accounting Policies General Exploration and production (upstream) operations consist of exploring for, developing and producing crude oil and natural gas and marketing natural gas. Reï¬ning, marketing and transportation (downstream) operations relate to reï¬ning crude oil into ï¬nished petroleum... -

Page 42

...end of its previously estimated useful life. Impaired assets are written down to their estimated fair values, generally their discounted future net before-tax cash ï¬,ows. For proved crude-oil and natural-gas properties in the United States, the company generally performs the impairment review on an... -

Page 43

... 342,000 shares remain available for issuance from the 800,000 shares of the company's common stock that were reserved for awards under the Chevron Corporation Non-Employee Directors' Equity Compensation and Deferral Plan (Non-Employee Directors' Plan). Chevron Corporation 2009 Annual Report 41 -

Page 44

... in 2008 and 2007 included shares purchased under the company's common stock repurchase programs. In 2009, "Net sales (purchases) of other short-term investments" consisted of $123 in restricted cash associated with capital-investment projects at the company's Pascagoula, Mississippi reï¬nery and... -

Page 45

... is the principal operator of Chevron's international tanker ï¬,eet and is engaged in the marine transportation of crude oil and reï¬ned petroleum products. Most of CTC's shipping revenue is derived from providing transportation services to other Chevron companies. Chevron Corporation has fully and... -

Page 46

... ranging up to 25 years, and options to purchase the leased property during or at the end of the initial or renewal lease period for the fair market value or other speciï¬ed amount at that time. At December 31, 2009, the estimated future minimum lease payments (net of noncancelable sublease rentals... -

Page 47

... purchase and normal sale - on the Consolidated Balance Sheet at fair value, with virtually all the offsetting amount to the Consolidated Statement of Income. For derivatives with identical or similar provisions as contracts that are publicly traded on a regular basis, the company uses the market... -

Page 48

... $123 of investments for restricted funds related to an international upstream development project and Pascagoula Reï¬nery projects, which are included in "Deferred charges and other assets" on the Consolidated Balance Sheet. Long-term debt of $5,705 and $1,221 had estimated fair values of $6,229... -

Page 49

...the annual capital and exploratory budgets. However, business-unit managers within the operating segments are directly responsible for decisions relating to project implementation and all other matters connected with daily operations. Company ofï¬cers who are Chevron Corporation 2009 Annual Report... -

Page 50

... businesses, worldwide cash management and debt ï¬nancing activities, corporate administrative functions, insurance operations, real estate activities, alternative fuels and technology companies, and the company's interest in Dynegy (through May 2007, when Chevron sold its interest). The company... -

Page 51

... from mining operations, power generation businesses, insurance operations, real estate activities and technology companies. Other than the United States, no single country accounted for 10 percent or more of the company's total sales and other operating revenues in 2009, 2008 and 2007. Year ended... -

Page 52

... heavyoil production and upgrading project. The project, located in Venezuela's Orinoco Belt, has a 25-year contract term. Prior to the formation of Petropiar, Chevron had a 30 percent interest in the Hamaca project. At December 31, 2009, the company's carrying value of its investment in Petropiar... -

Page 53

... Pipeline Company Chevron owns an approximate 23 percent equity interest in the Colonial Pipeline Company. The Colonial Pipeline system runs from Texas to New Jersey and transports petroleum products in a 13-state market. At December 31, 2009, the company's carrying value of its investment in... -

Page 54

... 52 Chevron Corporation 2009 Annual Report environmental harm, plus a health monitoring program. Until 1992, Texaco Petroleum Company (Texpet), a subsidiary of Texaco Inc., was a minority member of this consortium with Petroecuador, the Ecuadorian state-owned oil company, as the majority partner... -

Page 55

...income tax rate and the company's effective income tax rate is explained in the following table: Year ended December 31 2009 2008 2007 U.S. statutory federal income tax rate Effect of income taxes from international operations at rates different from the U.S. statutory rate State and local taxes on... -

Page 56

... low tax rates on asset sales, both related to an international upstream project. In addition, a greater proportion of before-tax income was earned in 2009 by equity afï¬liates than in 2008. (Equity-afï¬liate income is reported as a single amount on an after-tax basis on the Consolidated Statement... -

Page 57

...the world. For the company's major tax jurisdictions, examinations of tax returns for certain prior tax years had not been completed as of December 31, 2009. For these jurisdictions, the latest years for which income tax examinations had been ï¬nalized were as follows: United States - 2005, Nigeria... -

Page 58

... public bonds was issued, and $400 of Texaco Capital Inc. bonds matured. In 2008, debt totaling $822 matured, including $749 of Chevron Canada Funding Company notes. Note 18 New Accounting Standards Note 17 Long-Term Debt The FASB Accounting Standards Codiï¬cation and the Hierarchy of Generally... -

Page 59

... not under way or ï¬rmly planned for the near future. Additional drilling was not deemed necessary because the presence of hydrocarbons had already been established, and other activities were in process to enable a future decision on project development. Chevron Corporation 2009 Annual Report 57 -

Page 60

...form other than a stock option, stock appreciation right or award requiring full payment for shares by the award recipient. Texaco Stock Incentive Plan (Texaco SIP) On the closing of the acquisition of Texaco in October 2001, outstanding options granted under the Texaco SIP were converted to Chevron... -

Page 61

...other investment alternatives. The company also sponsors other postretirement (OPEB) plans that provide medical and dental beneï¬ts, as well as life insurance for some active and qualifying retired employees. The plans are unfunded, and the company and retirees share the costs. Medical coverage for... -

Page 62

...to the Consolidated Financial Statements Millions of dollars, except per-share amounts Note 21 Employee Benefit Plans - Continued Pension Beneï¬ts 2009 U.S. Int'l. U.S. 2008 Int'l. Other Beneï¬ts 2009 2008 Change in Beneï¬t Obligation Beneï¬t obligation at January 1 Service cost Interest cost... -

Page 63

...the projected beneï¬t obligation or market-related value of plan assets. The amount subject to amortization is determined on a plan-by-plan basis. During 2010, the company estimates actuarial losses of $318, $102 and $26 will be amortized from "Accumulated other comprehensive loss" for U.S. pension... -

Page 64

... in the expected long-term rate of return on plan assets since 2002 for U.S. plans, which account for 69 percent of the company's pension plan assets. At December 31, 2009, the estimated long-term rate of return on U.S. pension plan assets was 7.8 percent. The market-related value of assets of... -

Page 65

... period are outlined below: Fixed Income MortgageBacked Securities U.S. Equities Corporate Real Estate Other Total Total at December 31, 2008 Actual Return on Plan Assets: Assets held at the reporting date Assets sold during the period Purchases, Sales and Settlements Transfers in and/or out... -

Page 66

...'s investment performance, long-term asset allocation policy benchmarks have been established. For the primary U.S. pension plan, the Chevron Board of Directors has established the following approved asset allocation ranges: Equities 40-70 percent, Fixed Income and Cash 20-60 percent, Real Estate... -

Page 67

...60, respectively, were invested primarily in interest-earning accounts. Employee Incentive Plans Effective January 2008, the company established the Chevron Incentive Plan (CIP), a single annual cash bonus plan for eligible employees that links awards to corporate, unit and individual performance in... -

Page 68

... of $1,515, $820 related to the company's U.S. downstream operations, including reï¬neries and other plants, marketing locations (i.e., service stations and terminals), and pipelines. The remaining $695 was associated with various sites in international downstream ($107), upstream ($369), chemicals... -

Page 69

... discount rates. Accounting standards for asset retirement obligations primarily affect the company's accounting for crude-oil and natural-gas producing assets. No signiï¬cant AROs associated with any legal obligations to retire reï¬ning, marketing and transportation (downstream) and chemical long... -

Page 70

... stock dividend requirements and includes the effects of deferrals of salary and other compensation awards that are invested in Chevron stock units by certain ofï¬cers and employees of the company and the company's share of stock transactions of afï¬liates, which, under the applicable accounting... -

Page 71

... Dividends Per Share Balance Sheet Data (at December 31) Current assets Noncurrent assets Total Assets Short-term debt Other current liabilities Long-term debt and capital lease obligations Other noncurrent liabilities Total Liabilities Total Chevron Corporation Stockholders' Equity Noncontrolling... -

Page 72

... of cubic feet per day 2009 2008 2007 2006 2005 United States Gross production of crude oil and natural gas liquids1 Net production of crude oil and natural gas liquids1 Gross production of natural gas Net production of natural gas2 Net oil-equivalent production Reï¬nery input Sales of reï¬ned... -

Page 73

... section provides supplemental information on oil and gas exploration and producing activities of the company in seven separate tables. Tables I through IV provide historical cost information pertaining to costs incurred in exploration, property acquisitions and development; capitalized costs; and... -

Page 74

...include activities in Argentina, Australia, Brazil, Canada, Colombia, Denmark, the Netherlands, Norway, Trinidad and Tobago, the United Kingdom, Venezuela and other countries. Amounts for TCO represent Chevron's 50 percent equity share of Tengizchevroil, an exploration and production partnership in... -

Page 75

... 644 267 934 $ 5,816 $ Geographic presentation conformed to 2009 consistent with the presentation of the oil and gas reserve tables. Amounts for Afï¬liated Companies - Other conformed to agreements entered in 2007 and 2008 for Venezuelan afï¬liates. Chevron Corporation 2009 Annual Report 73 -

Page 76

... The company's results of operations from oil and gas producing activities for the years 2009, 2008 and 2007 are shown in the following table. Net income from exploration and production activities as reported on page 48 reï¬,ects income taxes computed on an effective rate basis. Income taxes in... -

Page 77

... Operations for Oil and Gas Producing Activities1 - Continued Consolidated Companies Afï¬liated Companies TCO Other Millions of dollars U.S. Africa Asia Other Total Year Ended Dec. 31, 20072 Revenues from net production Sales Transfers Total Production expenses excluding taxes3 Taxes other... -

Page 78

... As part of the internal control process related to reserves estimation, the com76 Chevron Corporation 2009 Annual Report pany maintains a Reserves Advisory Committee (RAC) that is chaired by the corporate reserves manager, who is a member of a corporate department that reports directly to the vice... -

Page 79

... and resources required to prepare detailed ï¬eld-level calculations. However, the use of the 12-month average price had an upward effect on reserves related to production-sharing and variable-royalty contracts as the 12-month average price for crude oil and Chevron Corporation 2009 Annual Report... -

Page 80

...related to capacity limitations at a synthetic oil project in Venezuela. Annually, the company assesses whether any changes have occurred in facts or circumstances, such as changes to development plans, regulations or government policies, which would warrant a revision to reserve estimates. For 2009... -

Page 81

... trends. Apart from acquisitions, the company's ability to add proved reserves is affected by, among other things, events and circumstances that are outside the company's control, such as delays in government permitting, partner approvals of development plans, declines in oil and gas prices, OPEC... -

Page 82

... and the United States accounted for 10 million barrels and 6 million barrels, respectively. Purchases In 2007, acquisitions of 316 million barrels for equity afï¬liates related to the formation of a new Hamaca equity afï¬liate in Venezuela. Sales In 2007, afï¬liated company sales of 432 million... -

Page 83

... companies, net increases of 346 BCF in Asia and 209 BCF in the United States were partially offset by downward revisions of 160 BCF in Africa and Other regions. In the Asia region, drilling activities in Thailand added 360 BCF, which were partially offset by downward revisions in Azerbaijan... -

Page 84

... equity afï¬liate in Venezuela. In 2009, worldwide sales of 117 BCF were related to consolidated companies. For the Other regions, the sale of properties in Argentina accounted for 84 BCF. The sale of properties in the Gulf of Mexico accounted for the majority of the 33 BCF decrease in the United... -

Page 85

...Total Total Consolidated and Afï¬liated Companies At December 31, 2009 Future cash inï¬,ows from production1 Future production costs Future development costs Future income taxes Undiscounted future net cash ï¬,ows 10 percent midyear annual discount for timing of estimated cash ï¬,ows Standardized... -

Page 86

... of discount Net change in income tax Net change for the year Present Value at December 31, 2007 Sales and transfers of oil and gas produced net of production costs Development costs incurred Purchases of reserves Sales of reserves Extensions, discoveries and improved recovery less related costs... -

Page 87

... second-largest U.S.-based energy company. Relocated corporate headquarters from San Francisco, California, to San Ramon, California. Acquired Unocal Corporation, an independent crude oil and natural gas exploration and production company. Unocal's upstream assets bolstered Chevron's already-strong... -

Page 88

... World Trade Organization from 2001 to June 2005. Previously she was Vice Chairman of Charles Schwab Corporation. She is a Director of Honeywell International Inc. (1) George L. Kirkland, 59 Vice Chairman of the Board since January 2010 and Executive Vice President, Global Upstream and Gas, since... -

Page 89

..., Europe Upstream Strategic Business Unit; and Manager, Investor Relations. Joined the company in 1989. Matthew J. Foehr, 52 Vice President and Comptroller since April 2010. Responsible for corporatewide accounting, financial reporting and analysis, internal controls, and Finance Shared Services... -

Page 90

... managers and representatives of financial institutions may contact: Investor Relations Chevron Corporation 6001 Bollinger Canyon Road San Ramon, CA 94583-2324 925 842 5690 Email: [email protected] Publications and Other News Sources The Annual Report, distributed in April, summarizes the company... -

Page 91

The Corporate Responsibility Report is available in May on the company's Web site, Chevron.com, or a copy may be requested by writing to: Policy, Government and Public Affairs Chevron Corporation 6001 Bollinger Canyon Road, A2177 San Ramon, CA 94583-2324 Details of the company's political ... -

Page 92

Chevron Corporation 6001 Bollinger Canyon Road San Ramon, CA 94583-2324 USA www.chevron.com Cert no. SGS-COC-005612 Recycled Recyclable 91 2- 0953