Allstate 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

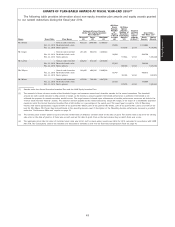

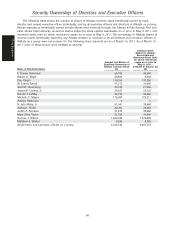

ESTIMATE OF POTENTIAL PAYMENTS UPON TERMINATION(1)

The table below describes the amount of compensation payable to each named executive or the value of

benefits provided to the named executives that exceed the compensation or benefits generally available to all

salaried employees in each termination scenario. The total column in the following table does not reflect

compensation or benefits previously accrued or earned by the named executives such as deferred compensation

and non-qualified pension benefits. The payment of the 2010 annual cash incentive award and any 2010 salary

earned but not paid in 2010 due to Allstate’s payroll cycle are not included in these tables because these

amounts are payable to the named executives regardless of termination, death, or disability. Benefits and

payments are calculated assuming a December 31, 2010, employment termination date.

Restricted Welfare Excise Tax

Stock Options— Stock Units— Benefits and Reimbursement

Unvested and Unvested and Outplacement and Tax

Severance Accelerated Accelerated Services Gross-Up(2) Total

Name ($) ($) ($) ($) ($) ($)

Mr. Wilson

Voluntary Termination/ Retirement(3) 00 0 0 0 0

Involuntary Termination 0 0 0 0 0 0

Termination due to Change-in-Control(4) 12,128,577 8,680,352 8,359,669 55,800(5) 0 29,224,398

Death 0 8,680,352 8,359,669 0 0 17,040,021

Disability 0 8,680,352 0 7,771,815(6) 0 16,452,167

Mr. Civgin

Voluntary Termination/ Retirement(3) 00 0 0 0 0

Involuntary Termination 0 0 0 0 0 0

Termination due to Change-in-Control(4) 3,492,589 2,327,045 1,873,173 35,164(5) 1,796,419 9,524,390

Death 0 2,327,045 1,873,173 0 0 4,200,218

Disability 0 2,327,045 0 3,289,101(6) 0 5,616,146

Mr. Lacher

Voluntary Termination/ Retirement(3) 00 0 0 0 0

Involuntary Termination 0 0 0 0 0 0

Termination due to Change-in-Control(4) 4,512,763 333,550 1,395,005 35,771(5) 2,124,612 8,401,701

Death 0 333,550 1,395,005 0 0 1,728,555

Disability 0 333,550 0 3,421,847(6) 0 3,755,397

Ms. Mayes

Voluntary Termination/ Retirement(3) 0 1,900,914 1,873,014 0 0 3,773,928

Involuntary Termination 0 0 0 0 0 0

Termination due to Change-in-Control(4) 3,429,694 1,900,914 1,873,014 25,944(5) 1,636,171 8,865,737

Death 0 1,900,914 1,873,014 0 0 3,773,928

Disability 0 1,900,914 0 985,427(6) 0 2,886,341

Mr. Winter

Voluntary Termination/ Retirement(3) 00 0 0 0 0

Involuntary Termination 0 0 0 0 0 0

Termination due to Change-in-Control(4) 4,189,038 121,150 934,212 35,761(5) 1,561,672 6,841,833

Death 0 121,150 934,212 0 0 1,055,362

Disability 0 121,150 0 2,220,468(6) 0 2,341,618

(1) A ‘‘0’’ indicates that either there is no amount payable to the named executive or no amount payable to the named executive that is

not also made available to all salaried employees.

(2) Certain payments made as a result of a change in control are subject to a 20% excise tax imposed on the named executive by

Section 4999 of the Code. The Excise Tax Reimbursement and Tax Gross-up is the amount Allstate would pay to the named executive

as reimbursement for the 20% excise tax plus a tax gross-up for any taxes incurred by the named executive resulting from the

reimbursement of such excise tax. The estimated amounts of reimbursement of any resulting excise taxes were determined without

regard to the effect that restrictive covenants and any other facts and circumstances may have on the amount of excise taxes, if any,

that ultimately might be payable in the event these payments were made to a named executive which is not subject to reliable

advance prediction or a reasonable estimate. Allstate believes providing an excise tax gross-up mitigates the possible disparate tax

treatment for similarly situated employees and is appropriate in this limited circumstance to prevent the intended value of a benefit

from being significantly and arbitrarily reduced. However, starting in 2011, new change-in-control agreements will not include an

excise tax gross-up provision.

(3) As of December 31, 2010, only Ms. Mayes is eligible to retire in accordance with Allstate’s policy and the terms of its equity incentive

compensation and certain benefit plans.

Footnotes continue

51

Proxy Statement