Allstate 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Peer Insurance Companies

ACE Ltd.* Manulife Financial Corporation*

AFLAC Inc.* MetLife Inc.

The Chubb Corporation The Progressive Corporation

The Hartford Financial Services Group, Inc. Prudential Financial, Inc.

Lincoln National Corporation The Travelers Companies, Inc.

* Added in 2010

In addition, in its executive pay discussions, the Committee considers proxy information from select S&P 100

companies that had between $15 and $60 billion in fiscal 2009 revenue. These are publicly traded companies with

which we compete for executive talent.

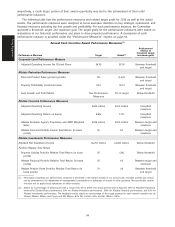

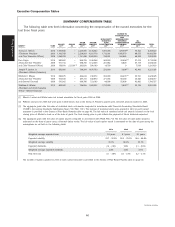

Core Elements of Executive Compensation Program

Our executive compensation program design balances fixed and variable compensation elements and

provides alignment with both short and long term business goals through annual and long-term incentives. Our

incentives are designed to balance overall corporate, business unit, and individual performance with respect to

measures we believe correlate to the creation of stockholder value and align with our strategic vision and

operating priorities. The following table lists the core elements of our executive compensation program.

Potential for Variability

Core Element Purpose with Performance

Annual salary Provides a base level of competitive cash

compensation for executive talent Low

Annual cash incentive awards Reward performance on key strategic, operational,

and financial measures over the year High

Long-term equity incentive Align the interests of executives with long-term

awards shareholder value and retain executive talent Moderate to High

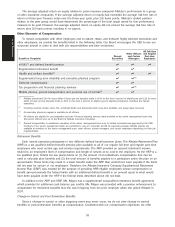

Salary

Executive salaries are set by the Board based on the recommendations of the Committee. In recommending

executive base salary levels, the Committee uses the 50th percentile of our peer insurance companies as a

guideline to align with Allstate’s pay philosophy for competitive positioning in the market for executive talent.

●The average enterprise-wide merit and promotional increases are based on a combination of U.S. general

and insurance industry market data and are set at levels intended to be competitive.

●Annual merit increases for the named executives other than the CEO are based on evaluations of their

performance by the CEO, the Committee, and the Board, using the average enterprise-wide merit increase

as a guideline. An annual merit increase for the CEO is based on an evaluation by the Committee and the

Board of his performance and market conditions.

●Mr. Wilson began fiscal year 2010 with an annual base salary of $1,060,000, which was established in

2008 when he assumed the role of Chairman. The Committee established a new base salary of

$1,100,000, effective in March of 2010, taking into consideration his performance and current economic

conditions.

●The Committee reviewed the base salaries for each other named executive in February of 2010. The

Committee established a new base salary for Mr. Civgin and Ms. Mayes based on individual

performance and in line with the enterprise-wide merit increase. Mr. Civgin’s salary was $550,000, and

the Committee approved an increase to $565,000. Ms. Mayes’ salary was $554,190, and the Committee

approved an increase to $568,000.

●The Committee did not adjust the base salaries for Messrs. Lacher and Winter, which had just been

established in the last quarter of 2009 when they joined the corporation.

Incentive Compensation

The Committee approves performance measures and goals for cash incentive awards during the first quarter

of the year. The performance measures and goals are aligned with Allstate’s objectives and tied to our strategic

32

Proxy Statement