Allstate 2011 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

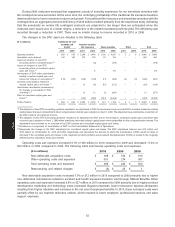

Ceded property-liability claims and claims expense decreased in 2010 and 2009 primarily due to amounts ceded to

National Flood Insurance Program.

For a detailed description of the MCCA, FHCF and Lloyd’s, see Note 9 of the consolidated financial statements. As

of December 31, 2010, other than the recoverable balances listed above, no other amount due or estimated to be due

from any single Property-Liability reinsurer was in excess of $17 million.

We enter into certain intercompany insurance and reinsurance transactions for the Property-Liability operations in

order to maintain underwriting control and manage insurance risk among various legal entities. These reinsurance

agreements have been approved by the appropriate regulatory authorities. All significant intercompany transactions

have been eliminated in consolidation.

Catastrophe reinsurance

Our catastrophe reinsurance program was designed, utilizing our risk management methodology, to address our

exposure to catastrophes nationwide. Our program provides reinsurance protection for catastrophes including storms

named or numbered by the National Weather Service, fires following earthquakes, earthquakes and wildfires including

California wildfires. These reinsurance agreements are part of our catastrophe management strategy, which is intended

to provide our shareholders an acceptable return on the risks assumed in our property business, and to reduce

variability of earnings, while providing protection to our customers.

While our catastrophe management strategy remains substantially unchanged we have redesigned our

catastrophe reinsurance program in 2011. Our new reinsurance program continues to support our goal to have no more

than a 1% likelihood of exceeding annual aggregate catastrophe losses by $2 billion, net of reinsurance, from

hurricanes and earthquakes, based on modeled assumptions and applications currently available. Since the 2006

inception of Allstate’s catastrophe reinsurance program, our exposure to wind loss has been materially reduced and we

have nearly eliminated our exposure to earthquake loss. Our redesigned program for 2011 responds to these exposure

changes by including coverage for multiple perils, in addition to hurricanes and earthquakes, in all but one of the

contracts comprising the program. In addition, the per occurrence structure effective June 1, 2011 facilitates the

program’s administration while providing greater potential with respect to loss recovery.

The new program, as described below, provides $3.25 billion of reinsurance coverage, above the retention, with

reinstatements of limits. It includes a Per Occurrence Excess Catastrophe Reinsurance agreement reinsuring our

personal lines property and auto excess catastrophe losses resulting from multiple perils, including those perils

currently reinsured under our existing program, in every state other than New Jersey and Florida. For June 1, 2011 to

May 31, 2012, the program consists of two agreements: a Per Occurrence Excess Catastrophe Reinsurance agreement

providing coverage in six layers and a Top and Drop Excess Catastrophe Reinsurance agreement which includes

Coverage A and Coverage B.

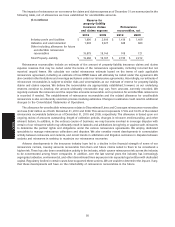

The Per Occurrence Excess Catastrophe Reinsurance agreement provides an initial $3.25 billion per occurrence

limit in excess of a $500 million retention and after the Company has incurred $250 million in losses ‘‘otherwise

recoverable.’’ The $250 million in losses otherwise recoverable applies once each contract year to the First Layer only

and losses from multiple qualifying occurrences can apply to this $250 million threshold in excess of $500 million per

occurrence. The Top and Drop Excess Catastrophe Reinsurance agreement provides $250 million of reinsurance limits

which may be used for Coverage A, Coverage B, or a combination of both. Coverage A reinsures the ‘‘Top’’ of the

program and provides 50% of $500 million excess of a $3.25 billion retention. Coverage B allows the program limit to

‘‘Drop’’ and provides reinsurance for $250 million in limits excess of a $750 million retention and after the Company has

incurred $500 million in losses ‘‘otherwise recoverable’’ under the agreement. Losses from multiple qualifying

occurrences, in excess of $750 million per occurence, can apply to this $500 million threshold.

The New Jersey and Florida components of the reinsurance program are designed separately from the other

components of the program to address the distinct needs of our separately capitalized legal entities in those states.

New Jersey catastrophe losses will be reinsured under a newly placed per occurrence agreement and under existing

agreements which expire respectively on May 31, 2012 and 2013. The Florida component will be placed in May of 2011.

Allstate Protection’s separate reinsurance programs in Pennsylvania and Kentucky will continue to address exposures

52

MD&A