Allstate 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

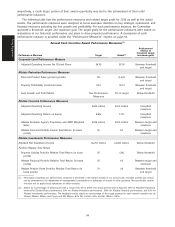

below targets. Mr. Winter’s annual cash incentive, as president of Allstate Financial, was the highest

amongst the named executives as Allstate Financial’s results were above target on all measures.

●Long-Term Equity Incentives. As of December 31, 2010, the value of stock options granted in 2010 is

essentially at-the-money as total stockholder return was 8.8% for the entire year.

●Long-Term Cash Incentive. There was no payout on the long-term cash incentive plan for the 2008-2010

cycle due to performance levels below threshold. This plan paid out at 45% and 50% of target respectively

in 2008 and 2009 reflecting strong financial results in 2006 and 2007. This plan is no longer in place based

on a compensation program design change made in 2009.

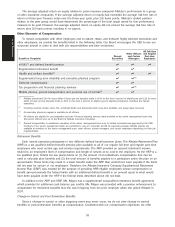

Allstate has made changes to its executive compensation program for 2011. We have eliminated any excise

tax gross-ups in new change-in-control agreements. Allstate has also made changes to the annual incentive

program for 2011 to continue to better align executive compensation with enterprise performance. The key

program change, which will apply to all bonus eligible employees across the enterprise, will be to reduce the

number of measures and provide for greater use of enterprise-wide corporate goals. We believe this action will

focus employees on those goals which will more effectively drive sustainable long-term growth for stockholders.

Compensation Philosophy

Our compensation philosophy is based on these central beliefs:

●Executive compensation should be aligned with performance and stockholder value. Accordingly, a

significant amount of executive compensation should be in the form of equity.

●The compensation of our executives should vary both with appreciation in the price of Allstate stock and

with Allstate’s performance in achieving strategic short and long-term business goals designed to drive

stock price appreciation.

●Our compensation program should inspire our executives to strive for performance that is better than the

industry average.

●A greater percentage of compensation should be at risk for executives who bear higher levels of

responsibility for Allstate’s performance.

●We should provide competitive levels of compensation for competitive levels of performance and superior

levels of compensation for superior levels of performance.

Our executive compensation program has been designed around these beliefs and includes programs and

practices that ensure alignment between the interests of our stockholders and executives and delivery of

compensation consistent with the corresponding level of performance. These objectives are balanced with the

goal of attracting, motivating, and retaining highly talented executives to compete in our complex and highly

regulated industry.

Some key practices we believe support this approach include:

●Providing a significant portion of executive pay through stock options, creating direct alignment with

stockholder interests.

●Establishment of stock ownership guidelines for senior executives that drive further alignment with

stockholder interests. The chief executive officer is required to hold Allstate stock worth seven times salary,

and each other named executive is required to hold four times salary.

●Stock option repricing is not permitted.

●A robust governance process for the design, approval, administration, and review of our overall

compensation program.

●Utilization of annual incentive plan caps to limit maximum award opportunities and support enterprise risk

management strategies.

●Inclusion of a clawback feature in the Annual Executive Incentive Plan and the 2009 Equity Incentive Plan

that provides the ability to recover compensation from the senior management team in the event of certain

financial restatements.

●Incorporation of discretion in the Annual Executive Incentive Plan to allow for the adjustment of awards to

reflect individual performance.

30

Proxy Statement