Allstate 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276

|

|

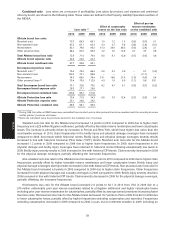

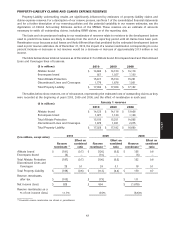

2008 Prior year reserve reestimates

($ in millions) 1998 &

prior 1999 2000 2001 2002 2003 2004 2005 2006 2007 Total

Allstate brand $ 56 $ (7) $ 9 $ 34 $ 1 $ (5) $ 13 $ 152 $ (71) $ (27) $ 155

Encompass brand 2 — 2 (1) 2 1 (1) 10 (20) 2 (3)

Total Allstate Protection 58 (7) 11 33 3 (4) 12 162 (91) (25) 152

Discontinued Lines and

Coverages 18 —————————18

Total Property-Liability $ 76 $ (7) $ 11 $ 33 $ 3 $ (4) $ 12 $ 162 $ (91) $ (25) $ 170

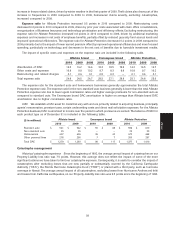

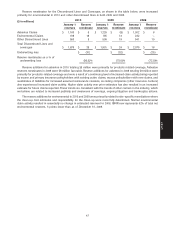

Allstate brand prior year reserve reestimates were $181 million favorable in 2010, $126 million favorable in 2009 and

$155 million unfavorable in 2008, respectively. In 2010, this was primarily due to favorable catastrophe reserve

reestimates and severity development that was better than expected, partially offset by litigation settlements. The

increased reserves in accident years 2000 & prior is due to the litigation settlements of $100 million, a reclassification of

injury reserves to older years and reserve strengthening. In 2009, this was primarily due to favorable reserve reestimates

from Hurricanes Ike and Gustav and a catastrophe related subrogation recovery. The shift of reserves to older accident

years is attributable to a reallocation of reserves related to employee postretirement benefits to more accident years,

and a reclassification of injury and 2008 non-injury reserves to older years. In 2008, this was primarily due to litigation

filed in conjunction with a Louisiana deadline for filing suits related to Hurricane Katrina.

These trends are primarily responsible for revisions to loss development factors, as previously described, used to

predict how losses are likely to develop from the end of a reporting period until all claims have been paid. Because these

trends cause actual losses to differ from those predicted by the estimated development factors used in prior reserve

estimates, reserves are revised as actuarial studies validate new trends based on the indications of updated

development factor calculations.

The impact of these reestimates on the Allstate brand underwriting income is shown in the table below.

($ in millions) 2010 2009 2008

Reserve reestimates $ (181) $ (126) $ 155

Allstate brand underwriting income 569 1,022 220

Reserve reestimates as a % of underwriting income 31.8% 12.3% (70.5)%

Encompass brand Reserve reestimates in 2010, 2009 and 2008 were related to lower than anticipated claim

settlement costs.

The impact of these reestimates on the Encompass brand underwriting (loss) income is shown in the table below.

($ in millions) 2010 2009 2008

Reserve reestimates $ (6) $ (10) $ (3)

Encompass brand underwriting (loss) income (43) 5 (31)

Reserve reestimates as a % of underwriting (loss) income 14.0% 200.0% 9.7%

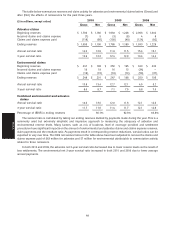

Discontinued Lines and Coverages We conduct an annual review in the third quarter of each year to evaluate

and establish asbestos, environmental and other discontinued lines reserves. Reserves are recorded in the reporting

period in which they are determined. Using established industry and actuarial best practices and assuming no change

in the regulatory or economic environment, this detailed and comprehensive grounds up methodology determines

reserves based on assessments of the characteristics of exposure (e.g. claim activity, potential liability, jurisdiction,

products versus non-products exposure) presented by policyholders.

46

MD&A