Allstate 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

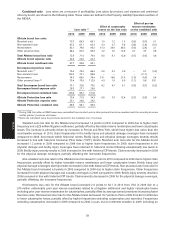

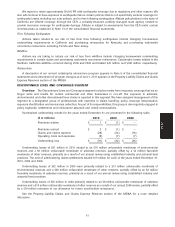

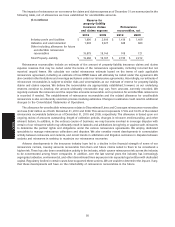

Comparatively, the average annual impact of catastrophes on the homeowners loss ratio for the years 1992 through

2010 is shown in the following table.

Average annual impact of catastrophes on the

Average annual impact of homeowners loss ratio excluding losses from

catastrophes on the hurricanes Andrew and Iniki, and losses from

homeowners loss ratio California earthquakes

Florida 97.9 47.5

Other hurricane exposure states 28.2 28.0

Total hurricane exposure states 33.8 29.6

All other 23.9 19.2

Total 29.2 24.8

Over time, we have limited our aggregate insurance exposure to catastrophe losses in certain regions of the country

that are subject to high levels of natural catastrophes. Limitations include our participation in various state facilities,

such as the CEA, which provides insurance for California earthquake losses; the FHCF, which provides reimbursements

to participating insurers for certain qualifying Florida hurricane losses; and other state facilities, such as wind pools.

However, the impact of these actions may be diminished by the growth in insured values, and the effect of state

insurance laws and regulations. In addition, in various states we are required to participate in assigned risk plans,

reinsurance facilities and joint underwriting associations that provide insurance coverage to individuals or entities that

otherwise are unable to purchase such coverage from private insurers. Because of our participation in these and other

state facilities such as wind pools, we may be exposed to losses that surpass the capitalization of these facilities and to

assessments from these facilities.

We continue to take actions to maintain an appropriate level of exposure to catastrophic events, including the

following:

• We have increased our utilization of wind storm pools. For example, in Texas we are ceding significant wind

exposure related to insured property located in wind pool eligible areas along the coast including the Galveston

Islands.

• We have ceased writing new homeowners business in California. We will continue to renew current

policyholders and have a renewal ratio of approximately 92% in California.

• Encompass Floridian Insurance Company and Encompass Floridian Indemnity Company ceased providing

property insurance in the State of Florida.

• We ceased offering renewals on certain homeowners insurance policies in New York in certain down-state

geographical locations. The level of non-renewals in New York is limited by state statute.

Hurricanes

We consider the greatest areas of potential catastrophe losses due to hurricanes generally to be major metropolitan

centers in counties along the eastern and gulf coasts of the United States. Usually, the average premium on a property

policy near these coasts is greater than in other areas. However, average premiums are not considered commensurate

with the inherent risk of loss. In addition and as explained in Note 13 of the consolidated financial statements, in various

states Allstate is subject to assessments from assigned risk plans, reinsurance facilities and joint underwriting

associations providing insurance for wind related property losses.

We have addressed our risk of hurricane loss by, among other actions, purchasing reinsurance for specific states

and on a countrywide basis for our personal lines property insurance in areas most exposed to hurricanes; limiting

personal homeowners new business writings in coastal areas in southern and eastern states; and not offering

continuing coverage on certain policies in coastal counties in certain states. We continue to seek appropriate returns

for the risks we write. This may require further actions, similar to those already taken, in geographies where we are not

getting appropriate returns. However, we may maintain or opportunistically increase our presence in areas where we

achieve adequate returns and do not materially increase our hurricane risk.

Earthquakes

Actions taken to reduce our exposure from earthquake coverage are substantially complete. These actions

included purchasing reinsurance on a countrywide basis and in the state of Kentucky; no longer offering new optional

earthquake coverage in most states; removing optional earthquake coverage upon renewal in most states; and entering

into arrangements in many states to make earthquake coverage available through other insurers for new and renewal

business.

40

MD&A