Allstate 2011 Annual Report Download - page 248

Download and view the complete annual report

Please find page 248 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

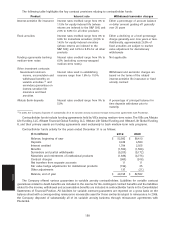

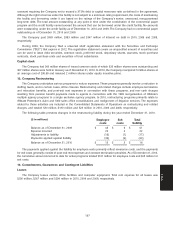

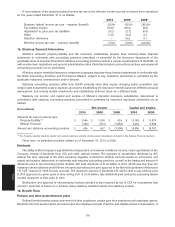

Minimum rental commitments under noncancelable capital and operating leases with an initial or remaining term

of more than one year as of December 31, 2010 are as follows:

($ in millions) Capital Operating

leases leases

2011 $ 7 $ 199

2012 7 157

2013 8 103

2014 6 62

2015 2 47

Thereafter 15 64

Total $ 45 $ 632

Present value of minimum capital lease payments $ 35

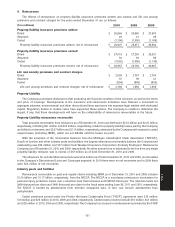

Shared markets and state facility assessments

The Company is required to participate in assigned risk plans, reinsurance facilities and joint underwriting

associations in various states that provide insurance coverage to individuals or entities that otherwise are unable to

purchase such coverage from private insurers. Underwriting results related to these arrangements, which tend to be

adverse, have been immaterial to the Company’s results of operations. Because of the Company’s participation, it may

be exposed to losses that surpass the capitalization of these facilities and/or assessments from these facilities.

Castle Key is subject to assessments from Citizens Property Insurance Corporation in the state of Florida (‘‘FL

Citizens’’), which was initially created by the state of Florida to provide insurance to property owners unable to obtain

coverage in the private insurance market. FL Citizens, at the discretion and direction of its Board of Governors (‘‘FL

Citizens Board’’), can levy a regular assessment on assessable insurers and assessable insureds for a deficit in any

calendar year up to a maximum of the greater of 6% of the deficit or 6% of Florida property premiums industry-wide for

the prior year. Prior to July 2008, the assessment rate was 10%. The base of assessable insurers includes all property and

casualty premiums in the state, except workers’ compensation, medical malpractice, accident and health insurance and

policies written under the NFIP. An insurer may recoup a regular assessment through a surcharge to policyholders. In

order to recoup this assessment, an insurer must file for a policy surcharge with the Florida Office of Insurance

Regulation (‘‘FL OIR’’) at least fifteen days prior to imposing the surcharge on policies. If a deficit remains after the

regular assessment, FL Citizens can also levy emergency assessments in the current and subsequent years. Companies

are required to collect the emergency assessments directly from residential property policyholders and remit to FL

Citizens as collected.

FL Citizens reported losses from Hurricane Wilma in 2005, which followed a deficit for the 2004 plan year. The FL

Citizens Board certified the 2005 FL Citizens deficit at $1.73 billion of which $920 million was to be funded through a

regular assessment. The Company paid its portion of the deficit assessment totaling $14 million during 2006 and has

recouped $12 million as of December 31, 2010. The remainder of the deficit was funded by bonds issued in 2006.

The Company is also subject to assessments from Louisiana Citizens Property Insurance Corporation (‘‘LA

Citizens’’). LA Citizens can levy a regular assessment on participating companies for a deficit in any calendar year up to

a maximum of the greater of 10% of the calendar year deficit or 10% of Louisiana direct property premiums

industry-wide for the prior calendar year.

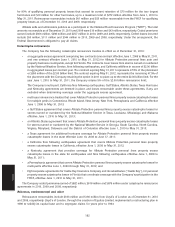

Florida Hurricane Catastrophe Fund

Castle Key participates in the mandatory coverage provided by the FHCF and therefore has access to

reimbursements on certain qualifying Florida hurricane losses from the FHCF (see Note 9), has exposure to

assessments and pays annual premiums to the FHCF for this reimbursement protection. The FHCF has the authority to

issue bonds to pay its obligations to insurers participating in the mandatory coverage in excess of its capital balances.

Payment of these bonds is funded by emergency assessments on all property and casualty premiums in the state,

except workers’ compensation, medical malpractice, accident and health insurance and policies written under the NFIP.

The FHCF emergency assessments are limited to 6% of premiums per year beginning the first year in which

reimbursements require bonding, and up to a total of 10% of premiums per year for assessments in the second and

subsequent years, if required to fund additional bonding. The FHCF issued $625 million in bonds in 2008, and the FL OIR

ordered an emergency assessment of 1% of premiums collected for all policies renewed after January 1, 2007. The FHCF

issued $676 million in bonds in 2010 and the FL OIR ordered an emergency assessment of 1.3% of premiums collected

168

Notes