Allstate 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

increase in freeze related claims, driven by winter weather in the first quarter of 2009. Theft claims also drove part of the

increase in frequencies in 2009 compared to 2008. In 2009, homeowner claims severity, excluding catastrophes,

increased compared to 2008.

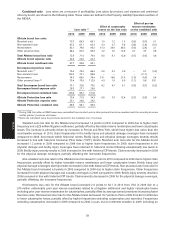

Expense ratio for Allstate Protection increased 0.5 points in 2010 compared to 2009. Restructuring costs

decreased 0.3 points in 2010 compared to 2009, driven by prior year costs associated with claim office consolidations,

reorganization of Business Insurance and technology prioritization and efficiency efforts. Excluding restructuring, the

expense ratio for Allstate Protection increased 0.8 points in 2010 compared to 2009, driven by additional marketing

expenses and increases in net costs of employee benefits, partially offset by reduced guaranty fund accrual levels and

improved operational efficiencies. The expense ratio for Allstate Protection decreased 0.4 points in 2009 compared to

2008 primarily due to the impact of lower earned premium offset by improved operational efficiencies and more focused

spending, particularly on technology, and decreases in the net cost of benefits due to favorable investment results.

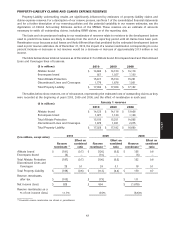

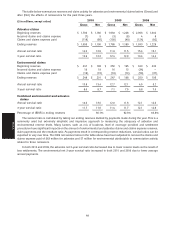

The impact of specific costs and expenses on the expense ratio are included in the following table.

Allstate brand Encompass brand Allstate Protection

2010 2009 2008 2010 2009 2008 2010 2009 2008

Amortization of DAC 14.0 14.2 14.4 18.3 18.5 19.9 14.2 14.5 14.7

Other costs and expenses 10.8 9.9 10.2 9.7 8.3 8.9 10.8 9.7 10.2

Restructuring and related charges 0.1 0.4 0.1 0.5 0.3 — 0.1 0.4 0.1

Total expense ratio 24.9 24.5 24.7 28.5 27.1 28.8 25.1 24.6 25.0

The expense ratio for the standard auto and homeowners businesses generally approximates the total Allstate

Protection expense ratio. The expense ratio for the non-standard auto business generally is lower than the total Allstate

Protection expense ratio due to lower agent commission rates and higher average premiums for non-standard auto as

compared to standard auto. The Encompass brand DAC amortization is higher on average than Allstate brand DAC

amortization due to higher commission rates.

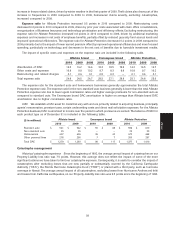

DAC We establish a DAC asset for costs that vary with and are primarily related to acquiring business, principally

agents’ remuneration, premium taxes, certain underwriting costs and direct mail solicitation expenses. For the Allstate

Protection business, DAC is amortized to income over the period in which premiums are earned. The balance of DAC for

each product type as of December 31 is included in the following table.

Allstate brand Encompass brand Allstate Protection

($ in millions)

2010 2009 2010 2009 2010 2009

Standard auto $ 541 $ 542 $ 55 $ 68 $ 596 $ 610

Non-standard auto 25 35 — — 25 35

Homeowners 437 426 36 42 473 468

Other personal lines 276 290 7 7 283 297

Total DAC $ 1,279 $ 1,293 $ 98 $ 117 $ 1,377 $ 1,410

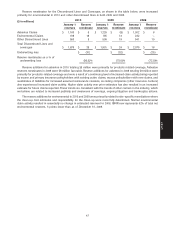

Catastrophe management

Historical catastrophe experience Since the beginning of 1992, the average annual impact of catastrophes on our

Property-Liability loss ratio was 7.5 points. However, this average does not reflect the impact of some of the more

significant actions we have taken to limit our catastrophe exposure. Consequently, it is useful to consider the impact of

catastrophes after excluding losses that are now partially or substantially covered by the California Earthquake

Authority (‘‘CEA’’), the Florida Hurricane Catastrophe Fund (‘‘FHCF’’) or placed with a third party, such as hurricane

coverage in Hawaii. The average annual impact of all catastrophes, excluding losses from Hurricanes Andrew and Iniki

and losses from California earthquakes, on our Property-Liability loss ratio was 6.5 points since the beginning of 1992.

39

MD&A