Allstate 2011 Annual Report Download - page 245

Download and view the complete annual report

Please find page 245 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276

|

|

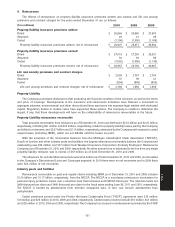

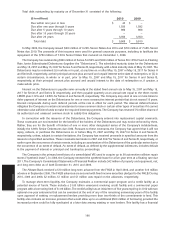

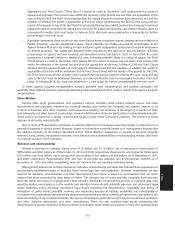

DSI activity for Allstate Financial, which primarily relates to fixed annuities and interest-sensitive life contracts, for

the years ended December 31 was as follows:

($ in millions) 2010 2009 2008

Balance, beginning of year $ 195 $ 453 $ 295

Impact of adoption of new OTTI accounting

guidance before unrealized impact (1) — (35) —

Impact of adoption of new OTTI accounting

guidance effect of unrealized capital gains and

losses (2) —35 —

Sales inducements deferred 14 28 47

Amortization charged to income (27) (129) (53)

Effect of unrealized gains and losses (96) (157) 164

Balance, end of year $ 86 $ 195 $ 453

(1) The adoption of new OTTI accounting guidance on April 1, 2009 resulted in an adjustment to DSI to reverse previously

recorded DSI accretion related to realized capital losses that were reclassified to other comprehensive income upon

adoption.

(2) The adoption of new OTTI accounting guidance resulted in an adjustment to DSI due to the change in unrealized

capital gains and losses that occurred upon adoption on April 1, 2009 when previously recorded realized capital losses

were reclassified to other comprehensive income. The adjustment was recorded as an increase of the DSI balance and

unrealized capital gains and losses.

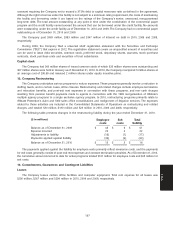

11. Capital Structure

Debt outstanding

Total debt outstanding as of December 31 consisted of the following:

($ in millions) 2010 2009

6.125% Senior Notes, due 2012 (1) $ 350 $ 350

7.50% Debentures, due 2013 250 250

5.00% Senior Notes, due 2014 (1) 650 650

6.20% Senior Notes, due 2014 (1) 300 300

6.75% Senior Debentures, due 2018 250 250

7.45% Senior Notes, due 2019 (1) 700 700

6.125% Senior Notes, due 2032 (1) 250 250

5.350% Senior Notes due 2033 (1) 400 400

5.55% Senior Notes due 2035 (1) 800 800

5.95% Senior Notes, due 2036 (1) 650 650

6.90% Senior Debentures, due 2038 250 250

6.125% Junior Subordinated Debentures, due 2067 500 500

6.50% Junior Subordinated Debentures, due 2067 500 500

Synthetic lease VIE obligations, floating rates, due 2011 42 42

Federal Home Loan Bank (‘‘FHLB’’) advances, due 2018 16 18

Total long-term debt 5,908 5,910

Short-term debt (2) ——

Total debt $ 5,908 $ 5,910

(1) Senior Notes are subject to redemption at the Company’s option in whole or in part at any time at the greater of either

100% of the principal amount plus accrued and unpaid interest to the redemption date or the discounted sum of the

present values of the remaining scheduled payments of principal and interest and accrued and unpaid interest to the

redemption date.

(2) The Company classifies any borrowings which have a maturity of twelve months or less at inception as short-term

debt.

165

Notes