Allstate 2011 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

based on separate account balances and guarantees for death and/or income benefits provided by our variable

products. In 2006, we disposed of substantially all of the variable annuity business through reinsurance agreements

with The Prudential Insurance Company of America, a subsidiary of Prudential Financial Inc. and therefore mitigated this

aspect of our risk. Equity risk for our variable life business relates to contract charges and policyholder benefits. Total

variable life contract charges for 2010 and 2009 were $80 million and $85 million, respectively. Separate account

liabilities related to variable life contracts were $775 million and $708 million in December 31, 2010 and 2009,

respectively.

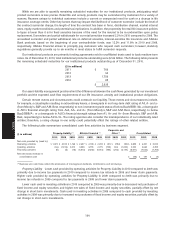

As of December 31, 2010 and 2009 we had $4.70 billion and $4.47 billion, respectively, in equity-indexed annuity

liabilities that provide customers with interest crediting rates based on the performance of the S&P 500. We hedge the

risk associated with these liabilities using equity-indexed options and futures, interest rate swaps, and eurodollar

futures, maintaining risk within specified value-at-risk limits.

Foreign currency exchange rate risk is the risk that we will incur economic losses due to adverse changes in

foreign currency exchange rates. This risk primarily arises from our foreign equity investments, including real estate

funds and private equity funds, and our Canadian and Northern Ireland operations. We also have certain funding

agreement liabilities and fixed income securities that are denominated in foreign currencies; however, derivatives are

used to hedge the foreign currency risk of these funding agreements and approximately 77% of the fixed income

securities. As of December 31, 2010 and 2009, we had $435 million and $713 million, respectively, in funding agreements

denominated in foreign currencies.

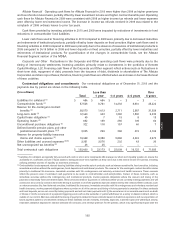

As of December 31, 2010, we had $1.70 billion in foreign currency denominated equity investments, $773 million net

investment in our foreign subsidiaries, and $91 million in unhedged non-dollar pay fixed income securities. These

amounts were $1.38 billion, $686 million, and $148 million, respectively, as of December 31, 2009. 90.5% of the foreign

currency exposure is in the Property-Liability business.

Based upon the information and assumptions used as of December 31, 2010, we estimate that a 10% immediate

unfavorable change in each of the foreign currency exchange rates to which we are exposed would decrease the value

of our foreign currency denominated instruments by $257 million, compared with an estimated $222 million decrease as

of December 31, 2009. The selection of a 10% immediate decrease in all currency exchange rates should not be

construed as our prediction of future market events, but only as an illustration of the potential effect of such an event.

Our currency exposure is diversified across 32 currencies as of December 31, 2010, compared to 39 currencies as of

December 31, 2009. Our largest individual foreign currency exposures as of December 31, 2010 were to the Canadian

dollar (37.0%) and the British Pound (13.3%). The largest individual foreign currency exposures as of December 31, 2009

were to the Canadian dollar (35.5%) and the Euro (22.9%). Our primary regional exposure is to Canada, with 37.0% as of

December 31, 2010, compared to Western Europe, with 40.5% as of December 31, 2009.

The modeling technique we use to report our currency exposure does not take into account correlation among

foreign currency exchange rates. Even though we believe it is very unlikely that all of the foreign currency exchange

rates that we are exposed to would simultaneously decrease by 10%, we nonetheless stress test our portfolio under this

and other hypothetical extreme adverse market scenarios. Our actual experience may differ from these results because

of assumptions we have used or because significant liquidity and market events could occur that we did not foresee.

Commodity price risk is the risk that we will incur economic losses due to adverse changes in the prices of

commodities. This risk arises from commodity linked investments, such as the Dow Jones AIG Commodity Index and

Goldman Sachs Commodity Index which is a broad based, oil dominated index. As of December 31, 2010 and 2009, we

had no exposure to the indices.

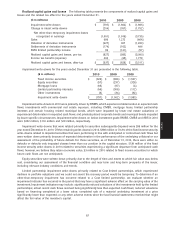

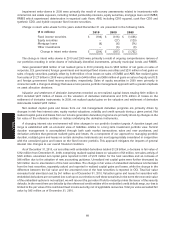

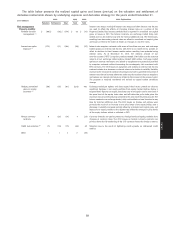

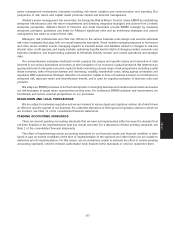

PENSION PLANS

We have defined benefit pension plans, which cover most full-time and certain part-time employees and employee-

agents. See Note 16 of the consolidated financial statements for a complete discussion of these plans and their effect on

the consolidated financial statements. The pension and other postretirement plans may be amended or terminated at

any time. Any revisions could result in significant changes to our obligations and our obligation to fund the plans.

We report unrecognized pension and other postretirement benefit cost in the Consolidated Statements of Financial

Position as a component of accumulated other comprehensive income in shareholders’ equity. It represents differences

between the fair value of plan assets and the projected benefit obligation for pension plans and the accumulated

postretirement benefit obligation for other postretirement plans that have not yet been recognized as a component of

net periodic cost. The measurement of the unrecognized pension and other postretirement benefit cost can vary based

upon the fluctuations in the fair value of the plan assets and the actuarial assumptions used for the plans as discussed

97

MD&A