Allstate 2011 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

There were no capital contributions by AIC to ALIC in 2010. In 2009, capital contributions were paid in cash by AIC

to ALIC totaling $250 million. 2009 also included capital contributions to ALIC comprising the transfer to ALIC from AIC

of non-cash assets totaling $448 million and the transfer of a $25 million surplus note to Kennett Capital Inc. from ALIC

in exchange for a note receivable with a principal sum equal to that of the surplus note, which was originally issued to

ALIC by a subsidiary of ALIC. In 2008, funds paid by AIC to ALIC totaled $1.41 billion. The $1.41 billion includes capital

contributions paid in cash totaling $607 million and the issuance of two surplus notes, each with a principal sum of

$400 million, to AIC in exchange for cash totaling $800 million. 2008 also included capital contributions to ALIC

comprising the transfer to ALIC from AIC of non-cash assets totaling $342 million and the transfer of a $50 million

surplus note to Kennett Capital Inc. from ALIC in exchange for a note receivable with a principal sum equal to that of the

surplus note, which was originally issued to ALIC by a subsidiary of ALIC. One of the surplus notes issued to AIC in 2008

was subsequently canceled and forgiven by AIC resulting in the recognition of a capital contribution equal to the

outstanding principal balance of the surplus note of $400 million.

The Corporation has access to additional borrowing to support liquidity as follows:

• A commercial paper facility with a borrowing limit of $1.00 billion to cover short-term cash needs. As of

December 31, 2010, there were no balances outstanding and therefore the remaining borrowing capacity was

$1.00 billion; however, the outstanding balance can fluctuate daily.

• Our primary credit facility is available for short-term liquidity requirements and backs our commercial paper facility.

Our $1.00 billion unsecured revolving credit facility has an initial term of five years expiring in 2012 with two optional

one-year extensions that can be exercised at the end of any of the remaining anniversary years of the facility upon

approval of existing or replacement lenders providing more than two-thirds of the commitments to lend. The

program is fully subscribed among 11 lenders with the largest commitment being $185 million. The commitments of

the lenders are several and no lender is responsible for any other lender’s commitment if such lender fails to make a

loan under the facility. This facility contains an increase provision that would allow up to an additional $500 million

of borrowing provided the increased portion could be fully syndicated at a later date among existing or new lenders.

This facility has a financial covenant requiring that we not exceed a 37.5% debt to capital resources ratio as defined

in the agreement. This ratio as of December 31, 2010 was 19.4%. Although the right to borrow under the facility is

not subject to a minimum rating requirement, the costs of maintaining the facility and borrowing under it are based

on the ratings of our senior, unsecured, nonguaranteed long-term debt. There were no borrowings under the credit

facility during 2010. The total amount outstanding at any point in time under the combination of the commercial

paper program and the credit facility cannot exceed the amount that can be borrowed under the credit facility.

• A universal shelf registration statement was filed with the Securities and Exchange Commission on May 8, 2009. We

can use this shelf registration to issue an unspecified amount of debt securities, common stock (including

367 million shares of treasury stock as of December 31, 2010), preferred stock, depositary shares, warrants, stock

purchase contracts, stock purchase units and securities of trust subsidiaries. The specific terms of any securities we

issue under this registration statement will be provided in the applicable prospectus supplements.

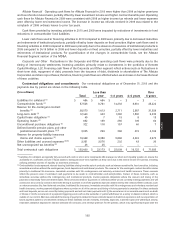

Liquidity exposure Contractholder funds as of December 31, 2010 were $48.20 billion. The following table

summarizes contractholder funds by their contractual withdrawal provisions as of December 31, 2010.

($ in millions) Percent to

total

Not subject to discretionary withdrawal $ 6,998 14.5%

Subject to discretionary withdrawal with adjustments:

Specified surrender charges (1) 19,815 41.1

Market value adjustments (2) 7,805 16.2

Subject to discretionary withdrawal without adjustments (3) 13,577 28.2

Total contractholder funds (4) $ 48,195 100.0%

(1) Includes $9.80 billion of liabilities with a contractual surrender charge of less than 5% of the account balance.

(2) $6.50 billion of the contracts with market value adjusted surrenders have a 30-45 day period at the end of their initial

and subsequent interest rate guarantee periods (which are typically 5 or 6 years) during which there is no surrender

charge or market value adjustment.

(3) 67% of these contracts have a minimum interest crediting rate guarantee of 3% or higher.

(4) Includes $1.23 billion of contractholder funds on variable annuities reinsured to The Prudential Insurance Company of

America, a subsidiary of Prudential Financial Inc., in 2006.

103

MD&A