Allstate 2011 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MARKET RISK

Market risk is the risk that we will incur losses due to adverse changes in interest rates, credit spreads, equity

prices, commodity prices, or currency exchange rates. Adverse changes to these rates and prices may occur due to

changes in the liquidity of a market or market segment, insolvency or financial distress of key market makers or

participants or changes in market perceptions of credit worthiness and/or risk tolerance. Our primary market risk

exposures are to changes in interest rates, credit spreads and equity prices.

The active management of market risk is integral to our results of operations. We may use the following approaches

to manage exposure to market risk within defined tolerance ranges: 1) rebalancing existing asset or liability portfolios,

2) changing the character of investments purchased in the future and 3) using derivative instruments to modify the

market risk characteristics of existing assets and liabilities or assets expected to be purchased. For a more detailed

discussion of our use of derivative financial instruments, see Note 6 of the consolidated financial statements.

Overview In formulating and implementing guidelines for investing funds, we seek to earn returns that enhance

our ability to offer competitive rates and prices to customers while contributing to attractive and stable profits and

long-term capital growth. Accordingly, our investment decisions and objectives are a function of the underlying risks

and product profiles of each business.

Investment policies define the overall framework for managing market and other investment risks, including

accountability and controls over risk management activities. Subsidiaries that conduct investment activities follow

policies that have been approved by their respective boards of directors. These investment policies specify the

investment limits and strategies that are appropriate given the liquidity, surplus, product profile and regulatory

requirements of the subsidiary. Executive oversight of investment activities is conducted primarily through subsidiaries’

boards of directors and investment committees. For Allstate Financial, its asset-liability management (‘‘ALM’’) policies

further define the overall framework for managing market and investment risks. ALM focuses on strategies to enhance

yields, mitigate market risks and optimize capital to improve profitability and returns for Allstate Financial. Allstate

Financial ALM activities follow asset-liability policies that have been approved by their respective boards of directors.

These ALM policies specify limits, ranges and/or targets for investments that best meet Allstate Financial’s business

objectives in light of its product liabilities.

We manage our exposure to market risk through the use of asset allocation, duration, simulation, and as

appropriate, through the use of stress tests. We have asset allocation limits that place restrictions on the total funds that

may be invested within an asset class. We have duration limits on the Property-Liability and Allstate Financial

investment portfolios and, as appropriate, on individual components of these portfolios. These duration limits place

restrictions on the amount of interest rate risk that may be taken. Comprehensive day-to-day management of market

risk within defined tolerance ranges occurs as portfolio managers buy and sell within their respective markets based

upon the acceptable boundaries established by investment policies. For Allstate Financial, this day-to-day management

is integrated with and informed by the activities of the ALM organization. This integration is intended to result in a

prudent, methodical and effective adjudication of market risk and return, conditioned by the unique demands and

dynamics of Allstate Financial’s product liabilities and supported by the continuous application of advanced risk

technology and analytics.

Although we apply a similar overall philosophy to market risk, the underlying business frameworks and the

accounting and regulatory environments differ considerably between the Property-Liability and Allstate Financial

businesses affecting investment decisions and risk parameters.

Interest rate risk is the risk that we will incur a loss due to adverse changes in interest rates relative to the interest

rate characteristics of our interest bearing assets and liabilities. This risk arises from many of our primary activities, as

we invest substantial funds in interest-sensitive assets and issue interest-sensitive liabilities. Interest rate risk includes

risks related to changes in U.S. Treasury yields and other key risk-free reference yields.

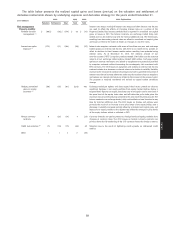

We manage the interest rate risk in our assets relative to the interest rate risk in our liabilities. One of the measures

used to quantify this exposure is duration. Duration measures the price sensitivity of the assets and liabilities to changes

in interest rates. For example, if interest rates increase 100 basis points, the fair value of an asset with a duration of 5 is

expected to decrease in value by 5%. As of December 31, 2010, the difference between our asset and liability duration

was (0.64) gap, compared to a (0.24) gap as of December 31, 2009. A negative duration gap indicates that the fair value

of our liabilities is more sensitive to interest rate movements than the fair value of our assets. The Property-Liability

segment generally maintains a positive duration gap between its assets and liabilities due to the relatively short duration

of auto and homeowners claims, which are its primary liabilities. The Allstate Financial segment may have a positive or

94

MD&A