Allstate 2011 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2011 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009, respectively, of net unrealized gains related to changes in valuation of the fixed income securities subsequent to

the impairment measurement date.

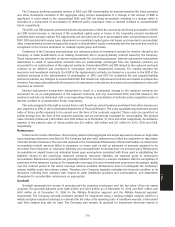

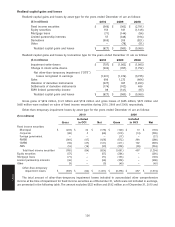

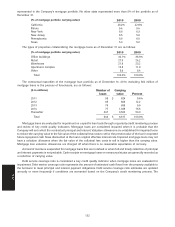

($ in millions) 2010 2009

Municipal $ (27) $ (10)

Corporate (31) (51)

RMBS (467) (594)

CMBS (49) (127)

ABS (41) (89)

Total $ (615) $ (871)

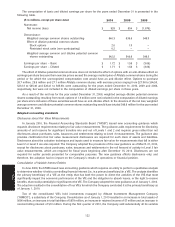

Rollforwards of the cumulative credit losses recognized in earnings for fixed income securities held as of

December 31 are as follows:

($ in millions) 2010 2009

Beginning balance $ (1,187) $ —

Beginning balance of cumulative credit loss for securities held as of April 1, 2009 — (1,357)

Cumulative effect of change in accounting principle 81 —

Additional credit loss for securities previously other-than-temporarily impaired (314) (136)

Additional credit loss for securities not previously other-than-temporarily impaired (312) (518)

Reduction in credit loss for securities disposed or collected 638 824

Reduction in credit loss for securities the Company has made the decision to sell or

more likely than not will be required to sell 43 —

Change in credit loss due to accretion of increase in cash flows 5 —

Ending balance $ (1,046) $ (1,187)

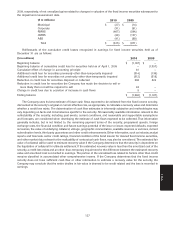

The Company uses its best estimate of future cash flows expected to be collected from the fixed income security,

discounted at the security’s original or current effective rate, as appropriate, to calculate a recovery value and determine

whether a credit loss exists. The determination of cash flow estimates is inherently subjective and methodologies may

vary depending on facts and circumstances specific to the security. All reasonably available information relevant to the

collectability of the security, including past events, current conditions, and reasonable and supportable assumptions

and forecasts, are considered when developing the estimate of cash flows expected to be collected. That information

generally includes, but is not limited to, the remaining payment terms of the security, prepayment speeds, foreign

exchange rates, the financial condition and future earnings potential of the issue or issuer, expected defaults, expected

recoveries, the value of underlying collateral, vintage, geographic concentration, available reserves or escrows, current

subordination levels, third party guarantees and other credit enhancements. Other information, such as industry analyst

reports and forecasts, sector credit ratings, financial condition of the bond insurer for insured fixed income securities,

and other market data relevant to the realizability of contractual cash flows, may also be considered. The estimated fair

value of collateral will be used to estimate recovery value if the Company determines that the security is dependent on

the liquidation of collateral for ultimate settlement. If the estimated recovery value is less than the amortized cost of the

security, a credit loss exists and an other-than-temporary impairment for the difference between the estimated recovery

value and amortized cost is recorded in earnings. The portion of the unrealized loss related to factors other than credit

remains classified in accumulated other comprehensive income. If the Company determines that the fixed income

security does not have sufficient cash flow or other information to estimate a recovery value for the security, the

Company may conclude that the entire decline in fair value is deemed to be credit related and the loss is recorded in

earnings.

127

Notes