Zynga 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

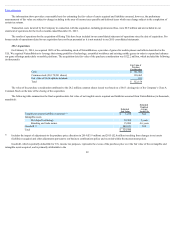

The information above provides a reasonable basis for estimating the fair values of assets acquired and liabilities assumed, however, the preliminary

measurements of fair value are subject to change including in the area of income taxes payable and deferred taxes which may change subject to the completion of

certain tax returns.

Transaction costs incurred by the Company in connection with the acquisition, including professional fees, were $0.9 million and are included in our

statement of operations for the twelve months ended December 31, 2015.

The results of operations for the acquisition of Rising Tide have been included in our consolidated statement of operations since the date of acquisition. Pro

forma results of operations related to our acquisition have not been presented as it is not material to our 2015 consolidated statements.

2014Acquisitions

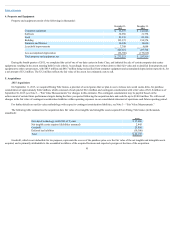

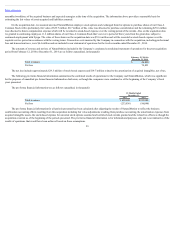

On February 11, 2014, we acquired 100% of the outstanding stock of NaturalMotion, a provider of games for mobile phones and tablets domiciled in the

U.K. We acquired NaturalMotion to leverage their strong portfolio of technology, assembled workforce and existing mobile games in order to expand and enhance

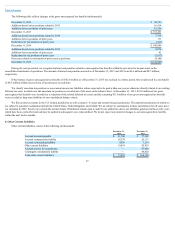

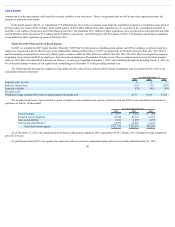

our game offerings particularly on mobile platforms. The acquisition date fair value of the purchase consideration was $522.2 million, which included the following

(in thousands):

Fair Value of

Purchase

Consideration

Cash $ 391,000

Common stock (28,178,201 shares) 130,465

Fair value of stock options assumed 693

Total $ 522,158

The value of the purchase consideration attributed to the 28.2 million common shares issued was based on a $4.63 closing price of the Company’s Class A

Common Stock on the date of the closing of the acquisition.

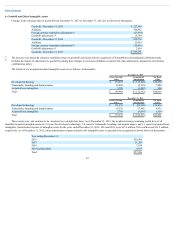

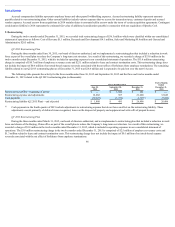

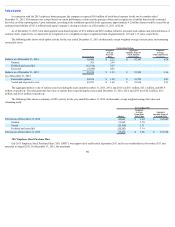

The following table summarizes the final acquisition date fair value of net tangible assets acquired and liabilities assumed from NaturalMotion (in thousands,

unaudited):

Estimated

Fair Value

Estimated

Weighted

Average

Useful Life

Tangible net assets (liabilities) assumed $ 1,259 N/A

Intangible assets

Developed technology 59,900 3 years

Branding and trade names 15,000 4.6 years

Goodwill 448,821 N/A

Total $ 524,980

Includes the impact of adjustments to the purchase price allocation in 2014 ($3.9 million) and 2015 ($2.8 million) resulting from changes in net assets

(liabilities) acquired and other adjustments pursuant to our business combinations policy and recorded within the measurement period.

Goodwill, which is partially deductible for U.S. income tax purposes, represents the excess of the purchase price over the fair value of the net tangible and

intangible assets acquired, and is primarily attributable to the

92

(1)

(1)

(1)