Zynga 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

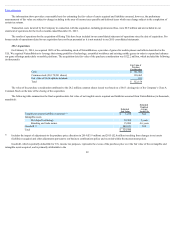

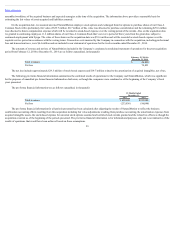

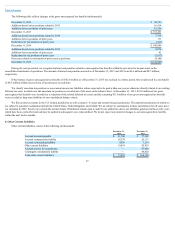

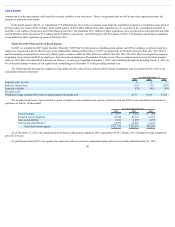

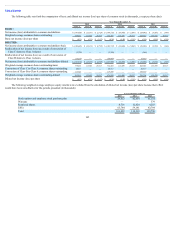

The following table reflects changes in the gross unrecognized tax benefits (in thousands):

December 31, 2012 $ 98,721

Additions based on tax positions related to 2013 16,414

Additions for tax positions of prior years 18,356

December 31, 2013 $ 133,491

Additions based on tax positions related to 2014 7,738

Additions for tax positions of prior years 171

Reductions for tax positions of prior years (511)

December 31, 2014 $ 140,889

Additions based on tax positions related to 2015 8,876

Additions for tax positions of prior years 82

Reductions for tax positions of prior years (2,817)

Decreases related to settlements of prior year tax positions (4,185)

December 31, 2015 $ (142,845)

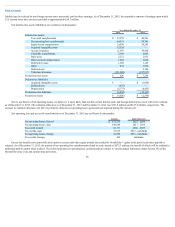

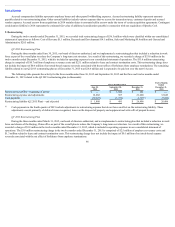

During all years presented, we recognized interest and penalties related to unrecognized tax benefits within the provision for income taxes on the

consolidated statements of operations. The amount of interest and penalties accrued as of December 31, 2015 and 2014 was $0.6 million and $0.7 million,

respectively.

If the balance of gross unrecognized tax benefits of $142.8 million as of December 31, 2015 was realized in a future period, this would result in a tax benefit

of $8.5 million within our provision of income taxes at such time.

We classify uncertain tax positions as non-current income tax liabilities unless expected to be paid within one year or otherwise directly related to an existing

deferred tax asset, in which case the uncertain tax position is recorded net of the asset on the balance sheet. At December 31, 2015, $91.8 million of our gross

unrecognized tax benefits were recorded as a reduction of the related deferred tax assets and the remaining $51.0 million of our gross unrecognized tax benefits

were recorded as long-term liabilities in our consolidated balance sheets.

We file income tax returns in the U.S. federal jurisdiction as well as many U.S. states and certain foreign jurisdictions. The material jurisdictions in which we

are subject to potential examination include the United States, United Kingdom, and Ireland. We are subject to examination in these jurisdictions for all years since

our inception in 2007. Fiscal years outside the normal statute of limitation remain open to audit by tax authorities due to tax attributes generated in those early years

which have been carried forward and may be audited in subsequent years when utilized. We do not expect any material changes to our unrecognized tax benefits

within the next twelve months.

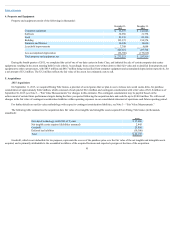

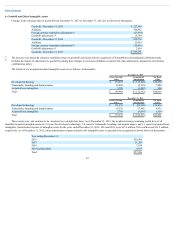

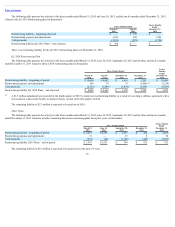

8. Other Current Liabilities

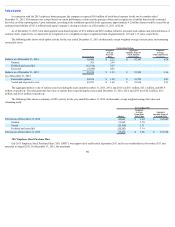

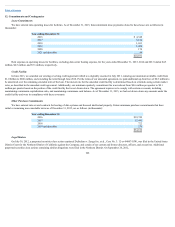

Other current liabilities consist of the following (in thousands):

December 31,

2015

December 31,

2014

Accrued accounts payable $ 31,700 $ 17,542

Accrued compensation liability 16,278 26,113

Accrued restructuring liability 9,859 7,214

Other current liabilities 19,854 20,955

Accrued escrow for acquisitions — 47,906

Contingent consideration liability — 44,420

Total other current liabilities $ 77,691 $ 164,150

97