Zynga 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

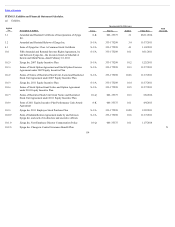

12. Commitments and Contingencies

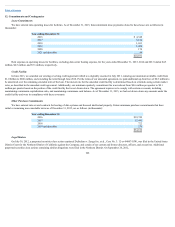

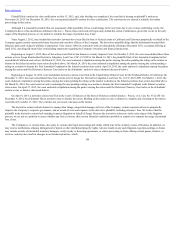

LeaseCommitments

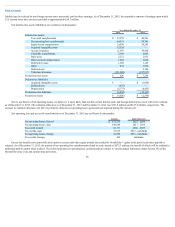

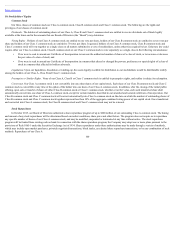

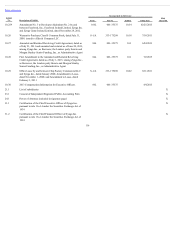

We have entered into operating leases for facilities. As of December 31, 2015, future minimum lease payments related to these leases are as follows (in

thousands):

Year ending December 31:

2016 $ 4,348

2017 3,154

2018 1,693

2019 1,458

2020 174

2021 and thereafter 44

$10,871

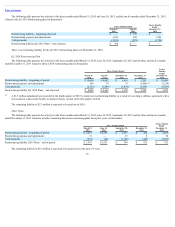

Rent expense on operating leases for facilities, excluding data center hosting expense, for the years ended December 31, 2015, 2014 and 2013 totaled $4.5

million, $4.5 million, and $7.3 million, respectively.

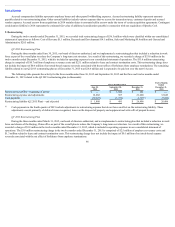

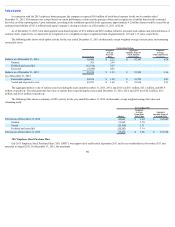

CreditFacility

In June 2013, we amended our existing revolving credit agreement which we originally executed in July 2011, reducing our maximum available credit from

$1.0 billion to $200 million, and extending the term through June 2018. Per the terms of our amended agreement, we paid additional up-front fees of $0.3 million to

be amortized over the remaining extended term of the loan. The interest rate for the amended credit facility is determined based on a formula using certain market

rates, as described in the amended credit agreement. Additionally, our minimum quarterly commitment fee was reduced from $0.6 million per quarter to $0.1

million per quarter based on the portion of the credit facility that is not drawn down. The agreement requires us to comply with certain covenants, including

maintaining a minimum capitalization ratio, and maintaining a minimum cash balance. As of December 31, 2015, we had not drawn down any amounts under the

credit facility and were in compliance with these covenants.

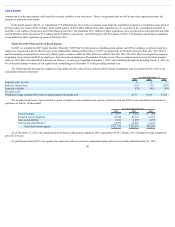

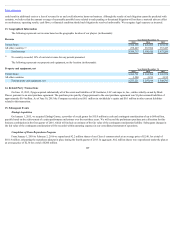

OtherPurchaseCommitments

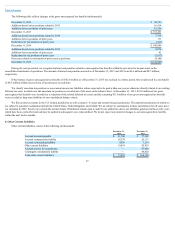

We have entered into several contracts for hosting of data systems and licensed intellectual property. Future minimum purchase commitments that have

initial or remaining non-cancelable terms as of December 31, 2015, are as follows (in thousands):

Year ending December 31:

2016 $19,749

2017 13,441

2018 722

2019 and thereafter 270

$34,182

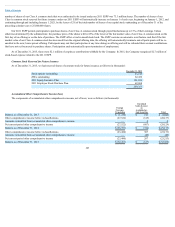

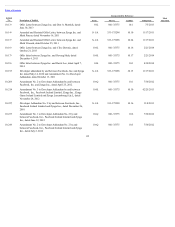

LegalMatters

On July 30, 2012, a purported securities class action captioned DeStefano v. Zynga Inc. et al., Case No. 3: 12-cv-04007-JSW, was filed in the United States

District Court for the Northern District of California against the Company, and certain of our current and former directors, officers, and executives. Additional

purported securities class actions containing similar allegations were filed in the Northern District. On September 26, 2012,

106