Zynga 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

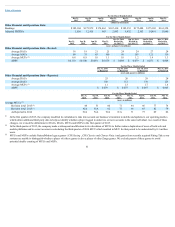

Generalandadministrative

Year Ended December 31, 2014 to 2015

% Change

2013 to 2014

% Change 2015 2014 2013

(in thousands)

General and administrative $143,284 $167,664 $162,918 (15)% 3%

2015 Compared to 2014. General and administrative expenses decreased $24.4 million in the twelve months ended December 31, 2015 as compared to the

same period of the prior year. The decrease was primarily attributable to a $21.8 million decrease in third party consulting and legal expenses and a $10.0 million

decrease in stock-based expense, offset by an $8.5 million increase in restructuring expense.

2014 Compared to 2013. General and administrative expenses increased $4.7 million in the twelve months ended December 31, 2014 as compared to the

same period of the prior year. The increase was primarily attributable to a $21.1 million increase in stock-based expense and a $16.5 million increase due to a lower

amount of facilities and overhead costs allocated out, partially offset by a $14.0 million decrease in headcount-related expense, a $9.8 million decrease in

depreciation expense and a $7.1 million decrease in restructuring expense.

Interestincome

Year Ended December 31, 2014 to 2015

% Change

2013 to 2014

% Change 2015 2014 2013

(in thousands)

Interest income $2,568 $3,266 $4,148 (21)% (21)%

2015 Compared to 2014. Interest income decreased $0.7 million in the twelve months ended December 31, 2015. The decrease was primarily attributed to

lower marketable security balances in 2015 compared to 2014.

2014 Compared to 2013. Interest income decreased $0.9 million in the twelve months ended December 31, 2014. The decrease was primarily attributed to

lower marketable security balances in 2014 compared to 2013.

Otherincome(expense),net

Year Ended December 31, 2014 to 2015

% Change

2013 to 2014

% Change 2015 2014 2013

(in thousands)

Other income (expense), net $13,306 $8,248 $(3,386) NM NM

2015 Compared to 2014. Other income (expense), net increased $5.1 million in the twelve months ended December 31, 2015 as compared to the same period

of the prior year. The increase was attributable to a $4.8 million increase of other income which was primarily related to the sale of an equity investment in the first

quarter of 2015 and a $1.2 million increase in net sublease rental income.

2014 Compared to 2013. Other income (expense), net increased $11.6 million in the twelve months ended December 31, 2014 as compared to the same

period of the prior year. The increase was primarily attributable to a $5.2 million decrease in interest expense which includes the $2.4 million expense in

connection with the termination of our interest rate swap agreement and repayment of our loan in the second quarter of 2013, a $4.6 million increase of other

income related to the sale of an equity investment in the fourth quarter of 2014 and a $2.3 million increase in net sublease rental income.

59