Zynga 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

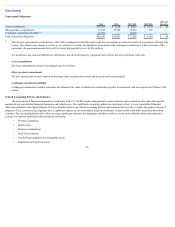

Table of Contents

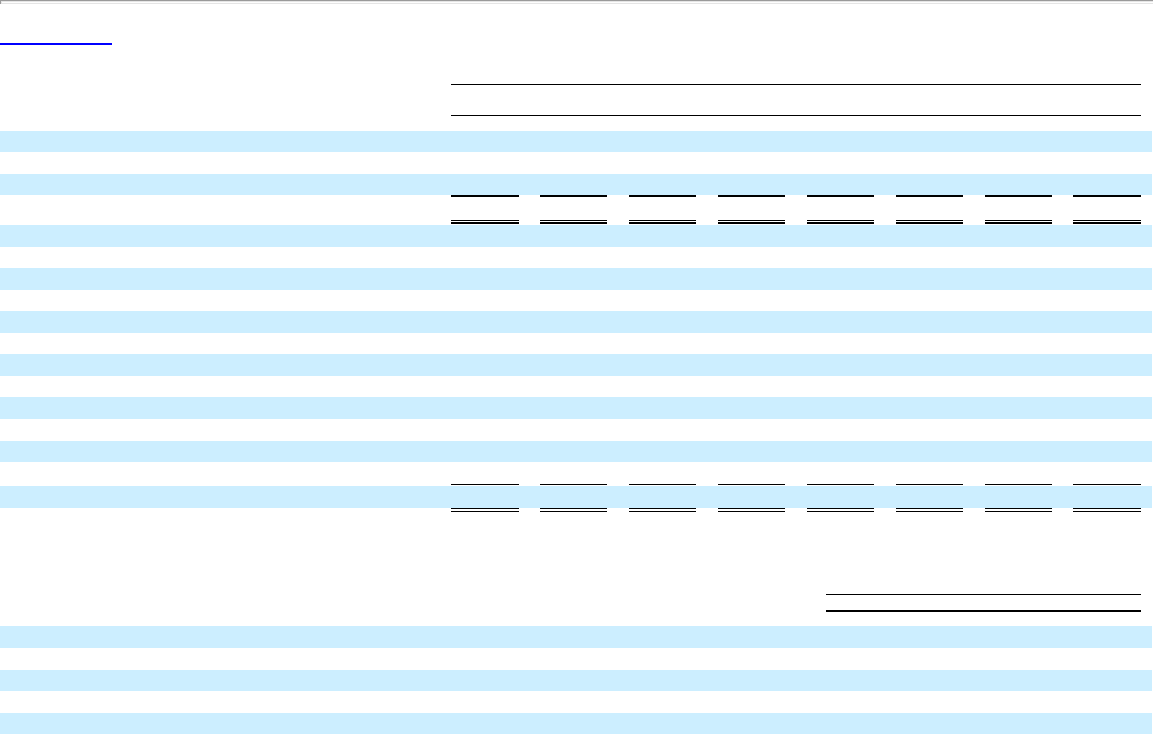

For the Three Months Ended

Dec 31,

2015

Sep 30,

2015

Jun 30,

2015

Mar 31,

2015

Dec 31,

2014

Sep 30,

2014

Jun 30,

2014

Mar 31,

2014

(in thousands)

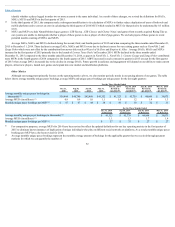

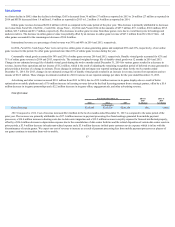

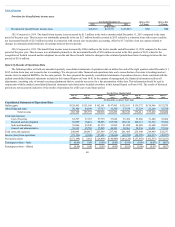

Reconciliation of Revenue to Bookings:

Revenue $185,769 $ 195,737 $199,918 $183,293 $192,547 $176,611 $ 153,232 $168,020

Change in deferred revenue (3,665) (19,758) (25,456) (15,883) (10,195) (1,123) 21,870 (6,662)

Bookings $182,104 $ 175,979 $174,462 $167,410 $182,352 $175,488 $ 175,102 $161,358

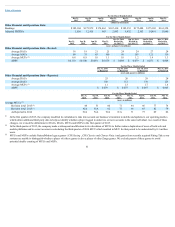

Reconciliation of Net Income (Loss) to Adjusted EBITDA:

Net income (loss) $ (51,198) $ 3,052 $ (26,868) $ (46,496) $ (45,126) $ (57,058) $ (62,533) $ (61,183)

Provision for (benefit from) income taxes (1,862) (9,381) 991 1,580 2,547 (783) (2,012) (7,079)

Other income (expense), net (1,463) (2,285) (1,199) (8,359) (5,580) (647) (896) (1,125)

Interest income (603) (566) (605) (794) (779) (841) (776) (870)

Restructuring expense, net 19,748 416 12,855 3,461 (3,391) 287 (2,270) 29,655

Gain (loss) on legal settlements — (1,681) — — 5,250 — — —

Depreciation and amortization 11,966 11,287 13,340 17,722 18,341 19,283 19,926 25,344

Contingent consideration fair value adjustment (3,288) — — 9,400 12,600 6,750 12,070 1,280

Acquisition-related transaction expenses 249 895 — — — — 265 6,160

Stock-based expense 31,772 30,436 27,905 41,462 35,765 36,295 28,847 28,326

Change in deferred revenue (3,665) (19,758) (25,456) (15,883) (10,195) (1,123) 21,870 (6,662)

Adjusted EBITDA $ 1,656 $ 12,415 $ 963 $ 2,093 $ 9,432 $ 2,163 $ 14,491 $ 13,846

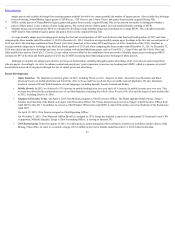

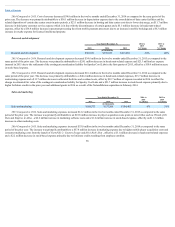

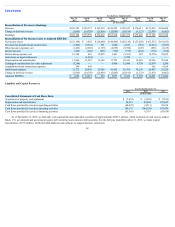

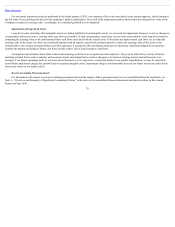

Liquidity and Capital Resources

Year Ended December 31,

2015 2014 2013

(in thousands)

Consolidated Statements of Cash Flows Data:

Acquisition of property and equipment $ (7,832) $ (9,201) $ (7,813)

Depreciation and amortization 54,315 82,894 129,047

Cash flows provided by (used in) operating activities (44,447) (4,511) 28,674

Cash flows provided by (used in) investing activities 749,573 (344,159) 147,476

Cash flows provided by (used in) financing activities (93,545) 15,119 (95,818)

As of December 31, 2015, we had cash, cash equivalents and marketable securities of approximately $987.3 million, which consisted of cash, money market

funds, U.S. government and government agency debt securities and corporate debt securities. For the full year ended December 31, 2015, we made capital

expenditures of $7.8 million, which included hardware and software to support business operations.

62