Zynga 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

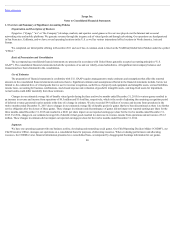

For our annual impairment analysis performed in the fourth quarter of 2015, our estimates of fair value were based on the market approach, which estimated

the fair value of our reporting unit based on the company’s market capitalization. The result of the impairment analysis showed that the estimated fair value of the

Company exceeded its carrying value. Accordingly, we concluded goodwill was not impaired.

ImpairmentofLong-LivedAssets

Long-lived assets, including other intangible assets (excluding indefinite-lived intangible assets), are reviewed for impairment whenever events or changes in

circumstances indicate an asset’s carrying value may not be recoverable. If such circumstances are present, we assess the recoverability of the long-lived assets by

comparing the carrying value to the undiscounted future cash flows associated with the related assets. If the future net undiscounted cash flows are less than the

carrying value of the assets, the assets are considered impaired and an expense, equal to the amount required to reduce the carrying value of the assets to the

estimated fair value, using a discounted future cash flow approach, is recorded in the consolidated statements of operations. Significant judgment is required to

estimate the amount and timing of future cash flows and the relative risk of achieving those cash flows.

Assumptions and estimates about future values and remaining useful lives are complex and often subjective. They can be affected by a variety of factors,

including external factors such as industry and economic trends, and internal factors such as changes in our business strategy and our internal forecasts. For

example, if our future operating results do not meet current forecasts or if we experience a continued decline in our market capitalization, we may be required to

record future impairment charges for goodwill and/or acquired intangible assets. Impairment charges could materially decrease our future net income and result in

lower asset values on our balance sheet.

RecentAccountingPronouncements

For information with respect to recent accounting pronouncements and the impact of these pronouncements on our consolidated financial statements, see

Note 1—“Overview and Summary of Significant Accounting Policies” in the notes to the consolidated financial statements included elsewhere in this Annual

Report on Form 10-K.

70