Zynga 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

of our cash, cash equivalents and short-term marketable securities are maintained with two financial institutions with high credit standings. We perform periodic

evaluations of the relative credit standing of these institutions.

Accounts receivable are unsecured and represent amounts due to us based on contractual obligations where a signed and executed contract or click-through

agreement exists. In cases where we are aware of circumstances that may impair a specific customer’s ability to meet its financial obligations, we record a specific

allowance as a reduction to the accounts receivable balance to reduce it to its net realizable value.

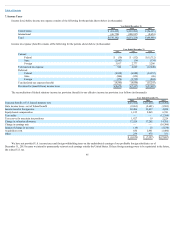

Facebook, Apple, and Google are significant distribution, marketing, promotion and payment platforms for our social games. A significant portion of our

2015, 2014 and 2013 revenue was generated from players who accessed our games through these platforms. As of December 31, 2015 and December 31, 2014,

17% and 22% of our accounts receivable, respectively, were amounts owed to us by Facebook. Additionally, as of December 31, 2015 and December 31, 2014,

17% and 23% of our accounts receivable, respectively, were amounts owed to us by Apple and 14% and 8% of our accounts receivable, respectively, were amounts

owed to us by Google.

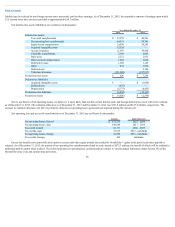

AdvertisingExpense

Costs for advertising are expensed as incurred. Advertising costs, which are included in sales and marketing expense, primarily consisting of player

acquisition costs, totaled $128.9 million, $101.7 million and $60.6 million for the years ended December 31, 2015, 2014 and 2013, respectively.

RecentAccountingPronouncements

In May 2014, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) 2014-09, “ Revenue from Contracts with Customers

,” which requires revenue to be recognized when promised goods or services are transferred to customers in an amount that reflects the consideration that is

expected to be received for those goods or services. ASU 2014-09 supersedes the existing revenue recognition guidance in “ Revenue Recognition (Topic 605) ”. In

July 2015, the FASB voted to amend ASU 2014-09 by approving a one-year deferral of the effective date as well as allowing early adoption as of the original

effective date. Accordingly, the Company may adopt the standard in either the first quarter of 2017 or 2018. We are currently in the process of evaluating the

timing of adoption of ASU 2014-09 as well as the impact on our consolidated financial statements.

In September 2015, the FASB issued an ASU 2015-16, “ Business Combinations (Topic 805): Simplifying the Accounting for Measurement-Period

Adjustments ,” which requires an acquirer in a business combination to recognize measurement-period adjustments during the period in which adjustment amounts

are determined rather than retrospectively, including the effect on earnings of any amounts that would have been recorded in previous periods if the accounting had

been completed as of the acquisition date. This standard will be applied prospectively to adjustments to provisional amounts that occur after the effective date. This

standard will be effective for the Company beginning in the first quarter of 2016. We do not expect this standard to have a material impact on our financial

statements.

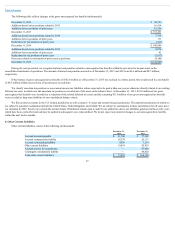

In November 2015, the Financial Accounting Standards Board issued Accounting Standards Update 2015-17, “ Balance Sheet Classification of Deferred

Taxes ”, which requires that all deferred tax assets and liabilities be classified as non-current on the balance sheet. The amendments in ASU 2015-17 are intended

to simplify the presentation of deferred income taxes. As of December 31, 2015, we adopted ASU 2015-17 on a prospective basis and have not adjusted prior

periods as a result of the adoption. As required by ASU 2015-17, all deferred tax assets and liabilities are now classified as non-current in our consolidated balance

sheets.

87