Zynga 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

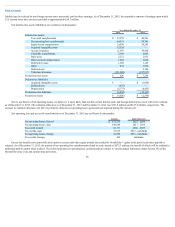

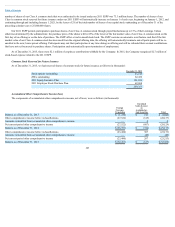

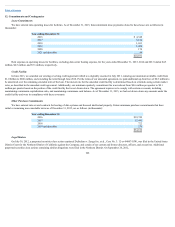

number of shares of our Class A common stock that were authorized to be issued under our 2011 ESPP was 73.3 million shares. The number of shares of our

Class A common stock reserved for future issuance under our 2011 ESPP will automatically increase on January 1 of each year, beginning on January 1, 2012, and

continuing through and including January 1, 2021, by the lesser of 2% of the total number of shares of our capital stock outstanding as of December 31 of the

preceding calendar year or 25,000,000 shares.

Our 2011 ESPP permits participants to purchase shares of our Class A common stock through payroll deductions up to 15% of their earnings. Unless

otherwise determined by the administrator, the purchase price of the shares will be 85% of the lower of the fair market value of our Class A common stock on the

first day of an offering or on the date of purchase. The ESPP offers a twelve-month look-back. The ESPP contains an automatic reset feature such that if the fair

market value of our Class A common stock has decreased from the original offering date, the offering will automatically terminate and all participants will be re-

enrolled in the new, lower-priced offering. Participants may end their participation at any time during an offering and will be refunded their accrued contributions

that have not yet been used to purchase shares. Participation ends automatically upon termination of employment.

As of December 31, 2015, there were $2.1 million of employee contributions withheld by the Company. In 2015, the Company recognized $2.7 million of

stock-based expense related to the 2011 ESPP.

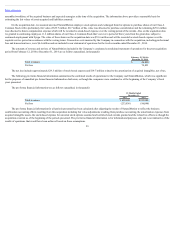

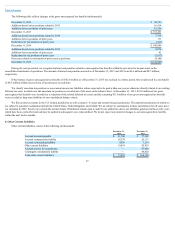

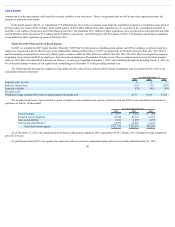

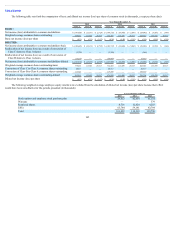

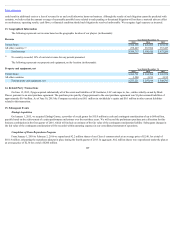

CommonStockReservedforFutureIssuance

As of December 31, 2015, we had reserved shares of common stock for future issuance as follows (in thousands):

December 31, 2015

Stock options outstanding 23,215

ZSUs outstanding 62,436

2011 Equity Incentive Plan 101,834

2011 Employee Stock Purchase Plan 62,868

250,353

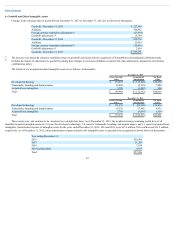

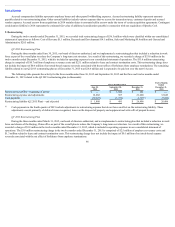

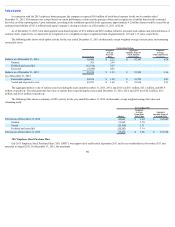

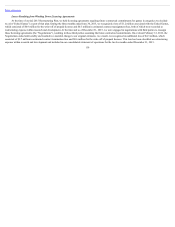

AccumulatedOtherComprehensiveIncome(loss)

The components of accumulated other comprehensive income, net of taxes, were as follows (in thousands):

Foreign

Currency

Translation

Unrealized

Gains (Losses)

on

Available-for-

Sale Securities Total

Balance as of December 31, 2013 $ (1,259) $ 213 $ (1,046)

Other comprehensive income before reclassifications (27,522) (615) (28,137)

Amounts reclassified from accumulated other comprehensive income — 8 8

Net current-period other comprehensive income (27,522) (607) (28,129)

Balance as of December 31, 2014 $ (28,781) $ (394) $(29,175)

Other comprehensive income before reclassifications (23,480) 307 (23,173)

Amounts reclassified from accumulated other comprehensive income — (40) (40)

Net current-period other comprehensive income (23,480) 267 (23,213)

Balance as of December 31, 2015 $ (52,261) $ (127) $(52,388)

103