Zynga 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

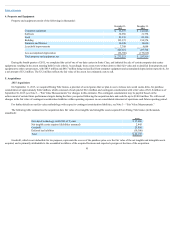

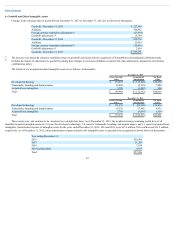

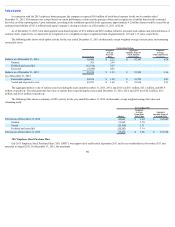

Accrued compensation liability represents employee bonus and other payroll withholding expenses. Accrued restructuring liability represents amounts

payable related to our restructuring plans. Other current liabilities include various expenses that we accrue for transaction taxes, customer deposits and accrued

vendor expenses. Accrued escrow from acquisitions in 2014 mainly relates to amounts held in escrow under the terms of certain acquisition agreements. Contingent

consideration liability in 2014 represents the estimated fair value of additional consideration payable in connection with our acquisition of Spooky Cool.

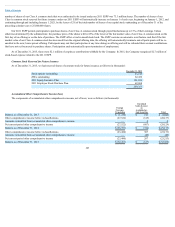

9. Restructuring

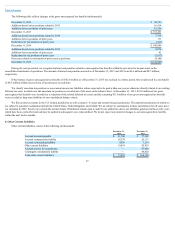

During the twelve months ended December 31, 2015, we recorded total restructuring charges of $36.5 million which were classified within our consolidated

statement of operations as follows: Cost of Revenue $1.1 million, Research and Development $14.1 million, Sales and Marketing $0.8 million and General and

Administrative $20.5 million.

Q2 2015 Restructuring Plan

During the three months ended June 30, 2015, our board of directors authorized, and we implemented a restructuring plan that included a reduction in work

force as part of the overall plan to reduce the Company’s long-term cost structure. As a result of this restructuring, we recorded a charge of $33.8 million in the

twelve months ended December 31, 2015, which is included in operating expenses in our consolidated statement of operations. The $33.8 million restructuring

charge is comprised of $10.7 million of employee severance costs and $23.1 million related to lease and contract termination costs. This restructuring charge does

not include the impact of $0.4 million of net stock-based expense reversals associated with the net effect of forfeitures from employee terminations. The remaining

liability related to our Q2 2015 restructuring plan as of December 31, 2015 was $26.4 million and is expected to be paid out over the next 6.4 years.

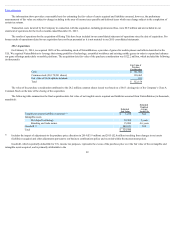

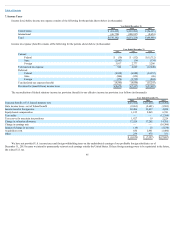

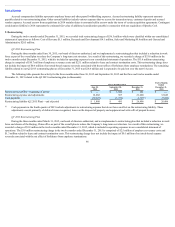

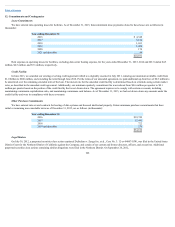

The following table presents the activity for the three months ended June 30, 2015 and September 30, 2015 and the three and twelve months ended

December 31, 2015 related to the Q2 2015 restructuring plan (in thousands):

Three Months Ended

Twelve Months

Ended

December 31,

2015

June 30,

2015

September 30,

2015

December 31,

2015

Restructuring liability—beginning of period $ — $ 1,860 $ 491 $ —

Restructuring expense and adjustments 12,282 367 21,200 33,849

Cash payments (10,422) (1,736) 4,715 (7,443)

Restructuring liability (Q2 2015 Plan)—end of period $ 1,860 $ 491 $ 26,406 $ 26,406

Cash payments in the fourth quarter of 2015 include adjustments to restructuring expense that do not have an effect on the restructuring liability. These

adjustments consist primarily of deferred items recognized, losses on the disposal of property and equipment and write-offs of prepaid licenses.

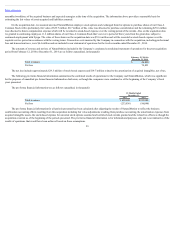

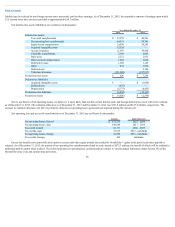

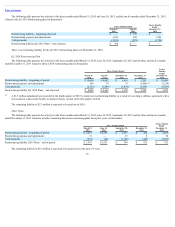

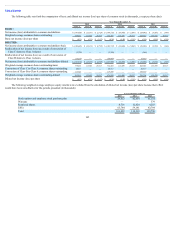

Q1 2015 Restructuring Plan

During the three months ended March 31, 2015, our board of directors authorized, and we implemented a restructuring plan that included a reduction in work

force and closure of the Beijing, China office as part of the overall plan to reduce the Company’s long-term cost structure. As a result of this restructuring, we

recorded a charge of $3.8 million in the twelve months ended December 31, 2015, which is included in operating expenses in our consolidated statement of

operations. The $3.8 million restructuring charge in the twelve months ended December 31, 2015 is comprised of $2.5 million of employee severance costs and

$1.3 million related to lease and contract termination costs. This restructuring charge does not include the impact of $0.1 million of net stock-based expense

reversals associated with the net effect of forfeitures from employee terminations.

98

(1)

(1)