Zynga 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

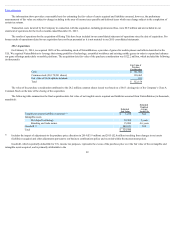

Fair value is a market-based measurement that should be determined based on assumptions that knowledgeable and willing market participants would use in

pricing an asset or liability. The valuation techniques used to measure the fair value of the Company’s debt instruments and all other financial instruments, all of

which have counterparties with high credit ratings, were valued based on quoted market prices or model driven valuations using significant inputs derived from or

corroborated by observable market data. We use a three-tier value hierarchy, which prioritizes the inputs used in measuring fair value as follows:

Level 1—Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2—Includes inputs, other than Level 1 inputs, that are directly or indirectly observable in the marketplace.

Level 3—Unobservable inputs that are supported by little or no market activity.

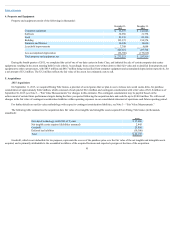

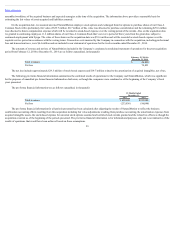

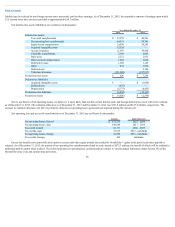

The composition of our financial assets and liabilities among the three Levels of the fair value hierarchy are as follows (in thousands):

December 31, 2015

Level 1 Level 2 Level 3 Total

Assets:

Money market funds $ 362,587 $ — $ — $ 362,587

U.S. government and government agency debt securities — 184,975 — 184,975

Corporate debt securities — 277,193 — 277,193

Total $ 362,587 $ 462,168 $ — $ 824,755

Liabilities

Contingent consideration $ — $ — $ 18,490 $ 18,490

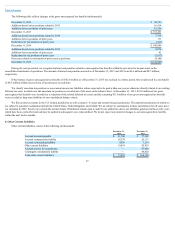

December 31, 2014

Level 1 Level 2 Level 3 Total

Assets:

Money market funds $ 41,595 $ — $ — $ 41,595

U.S. government and government agency debt securities — 404,982 — 404,982

Corporate debt securities — 611,624 — 611,624

Total $ 41,595 $1,016,606 $ — $ 1,058,201

Liabilities

Contingent consideration $ — $ — $ 44,420 $ 44,420

Includes amounts classified as cash and cash equivalents.

90

(1)

(1)

(1)

(1)