Zynga 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

could result in additional costs or a loss of revenue for us and could otherwise harm our business. Although the results of such litigation cannot be predicted with

certainty, we believe that the amount or range of reasonably possible losses related to such pending or threatened litigation will not have a material adverse effect

on our business, operating results, cash flows, or financial condition should such litigation be resolved unfavorably. We recognize legal expenses as incurred.

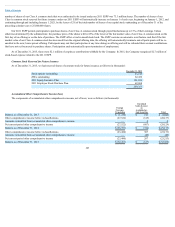

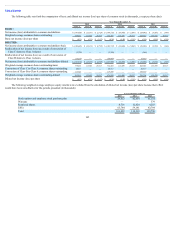

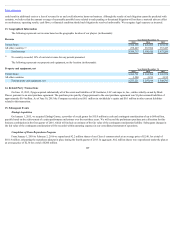

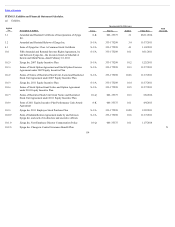

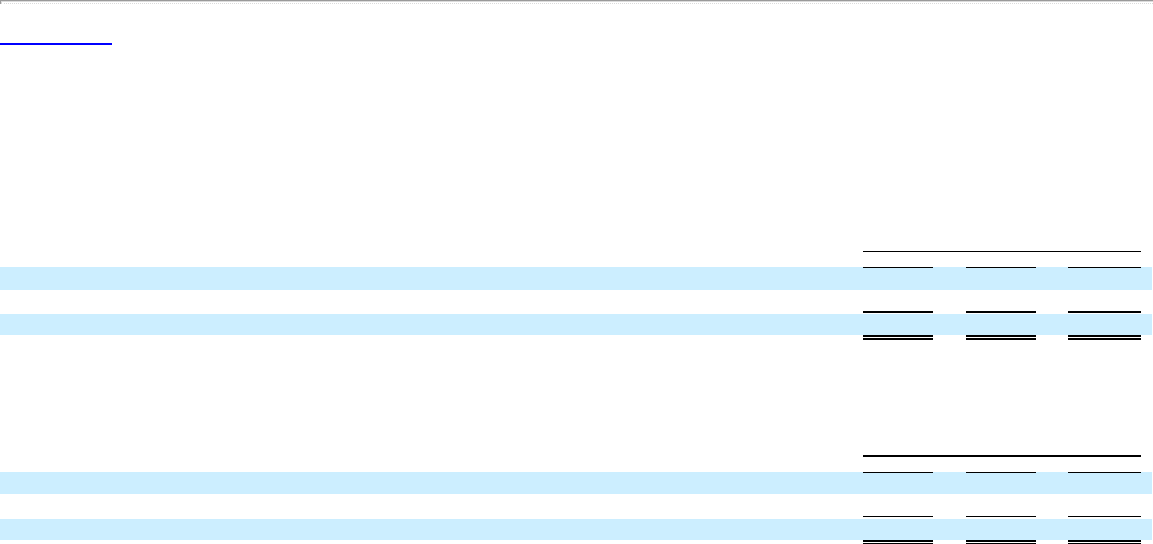

13. Geographical Information

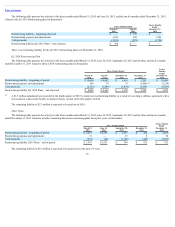

The following represents our revenue based on the geographic location of our players (in thousands):

Revenue Year Ended December 31,

2015 2014 2013

United States $ 506,268 $ 426,906 $ 519,819

All other countries 258,449 263,504 353,447

Total revenue $ 764,717 $ 690,410 $ 873,266

No country exceeded 10% of our total revenue for any periods presented.

The following represents our property and equipment, net by location (in thousands):

Property and equipment, net Year Ended December 31,

2015 2014 2013

United States $ 269,721 $ 294,708 $ 345,598

All other countries 3,500 3,211 3,195

Total property and equipment, net $ 273,221 $ 297,919 $ 348,793

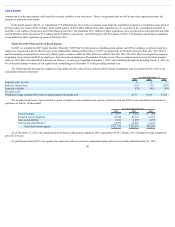

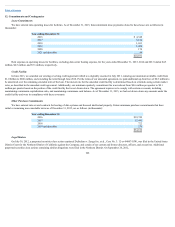

14. Related Party Transactions

On June 15, 2015, Zynga acquired substantially all of the assets and liabilities of SF Incubator, LLC and super.io, Inc., entities wholly owned by Mark

Pincus, pursuant to an asset purchase agreement. The purchase price paid by Zynga pursuant to the asset purchase agreement was $1 plus assumed liabilities of

approximately $0.4 million. As of June 30, 2015 the Company recorded a net $0.1 million in stockholder’s equity and $0.1 million in other current liabilities

related to this transaction.

15. Subsequent Events

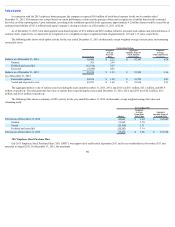

ZindagiAcquisition

On January 1, 2015, we acquired Zindagi Games, a provider of social games for $15.0 million in cash and contingent consideration of up to $60 million,

payable based on the achievement of certain performance milestones over the next three years. We will record the preliminary purchase price allocation for this

business combination in the first quarter of 2016, which will include an estimate of the fair value of the contingent consideration liability. Subsequent changes in

the fair value of the contingent consideration will be recorded within operating expenses in our consolidated statement of operations.

CompletionofShareRepurchaseProgram

From January 1, 2016 to February 2, 2016 we repurchased 42.2 million shares of our Class A common stock at an average price of $2.40, for a total of

$101.9 million, exhausting the repurchase plan put in place during the fourth quarter of 2015. In aggregate, 80.2 million shares were repurchased under the plan at

an average price of $2.50 for a total of $200 million.

109

(1)

(1)