Zynga 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

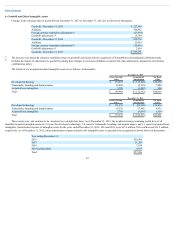

Table of Contents

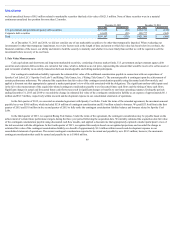

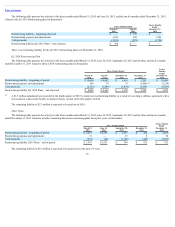

we had unrealized losses of $0.5 million related to marketable securities that had a fair value of $621.5 million. None of these securities were in a material

continuous unrealized loss position for more than 12 months.

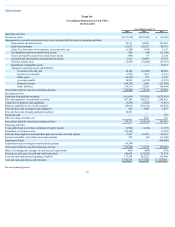

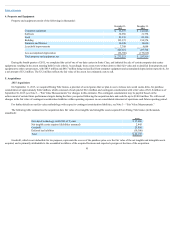

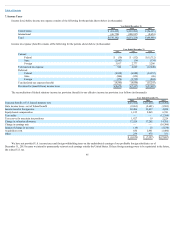

December 31, 2015 December 31, 2014

Fair Value Unrealized loss Fair Value Unrealized loss

U.S. government and government agency debt securities $137,485 $ (80) $ 222,723 $ (135)

Corporate debt securities 61,622 (58) 398,777 (365)

Total $199,107 $ (138) $ 621,500 $ (500)

As of December 31, 2015 and 2014, we did not consider any of our marketable securities to be other-than-temporarily impaired. When evaluating our

investments for other-than-temporary impairment, we review factors such as the length of time and extent to which fair value has been below its cost basis, the

financial condition of the issuer, our ability and intent to hold the security to maturity and whether it is more likely than not that we will be required to sell the

investment before recovery of its cost basis.

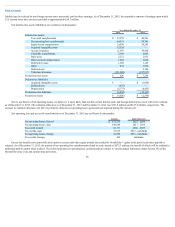

3. Fair Value Measurements

Cash equivalents and short-term and long-term marketable securities, consisting of money market funds, U.S. government and government agency debt

securities and corporate debt securities, are carried at fair value, which is defined as an exit price, representing the amount that would be received to sell an asset or

paid to transfer a liability in an orderly transaction between knowledgeable and willing market participants.

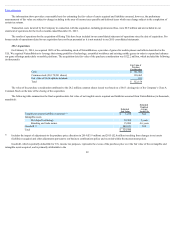

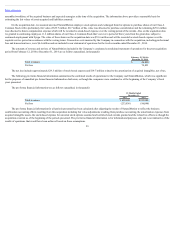

Our contingent consideration liability represents the estimated fair value of the additional consideration payable in connection with our acquisitions of

Spooky Cool Labs LLC (“Spooky Cool Labs”) and Rising Tide Games, Inc. (“Rising Tide Games”). The amount payable is contingent upon the achievement of

certain performance milestones. We estimated the acquisition date fair value of the contingent consideration payable using discounted cash flow models, and

applied a discount rate that appropriately captured a market participant’s view of the risk associated with the obligations. The significant unobservable inputs used

in the fair value measurement of the acquisition-related contingent consideration payable were forecasted future cash flows and the timing of those cash flows.

Significant changes in actual and forecasted future cash flows may result in significant charges or benefits to our future operating expenses. During the periods

ending December 31, 2015 and 2014 we recorded the change in estimated fair value of the contingent consideration liability as an expense of approximately $6.1

million and $32.7 million, respectively within research and development expense in our consolidated statements of operations.

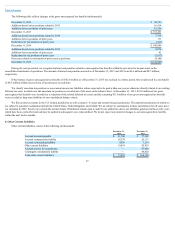

In the first quarter of 2015, we executed an amended agreement with Spooky Cool Labs. Under the terms of the amended agreement, the maximum amount

payable by us was $58.8 million, which included $53.8 million of contingent consideration and $5.0 million related to bonuses. We paid $53.8 million in the first

quarter of 2015 and $5.0 million in the second quarter of 2015 to fully settle the contingent consideration liability balance and bonuses related to Spooky Cool

Labs.

In the third quarter of 2015, we acquired Rising Tide Games. Under the terms of the agreement, the contingent consideration may be payable based on the

achievement of certain future performance targets during the three year period following the acquisition date. We initially estimated the acquisition date fair value

of the contingent consideration payable using discounted cash flow models, and applied a discount rate that appropriately captured a market participant’s view of

the risk associated with the obligations. In the fourth quarter of 2015, we updated this analysis based on our updated projections and recorded the change in

estimated fair value of the contingent consideration liability as a benefit of approximately $3.3 million within research and development expense in our

consolidated statement of operations. The current contingent consideration expected to be earned and payable by us is $18.5 million; however, the maximum

contingent consideration that could be earned and payable by us is $140.0 million.

89