Zynga 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

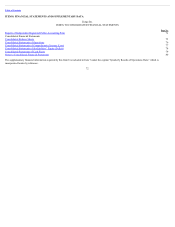

Table of Contents

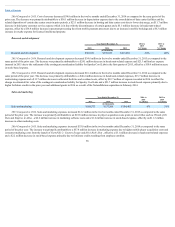

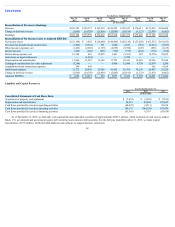

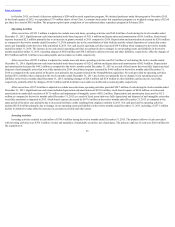

Contractual Obligations

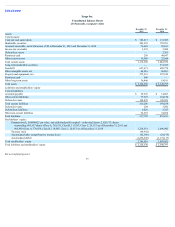

Total 2016 2017-2018 2019-2020

2021 and

thereafter

Lease commitments $10,871 $ 4,348 $ 4,847 $ 1,632 $ 44

Other purchase commitments 34,182 19,749 14,163 270 —

Contingent consideration liability 18,490 — 18,490 — —

Total contractual obligations $63,543 $24,097 $ 37,500 $ 1,902 $ 44

This amount represents the estimated fair value of the contingent consideration that could become payable in connection with our acquisition of Rising Tide

Games. This number may change over time as we continue to evaluate the likelihood of payment of the contingent consideration. Under the terms of the

agreement, the maximum amount that could be earned and payable by us is $140.0 million.

We do not have any material capital lease obligations, and all of our property, equipment and software has been purchased with cash.

Leasecommitments

Our lease commitments consist of operating leases for facilities.

Otherpurchasecommitments

We have entered into several contracts for hosting of data systems and services and licensed intellectual property.

Contingentconsiderationliability

Contingent consideration liability represents the estimated fair value of additional consideration payable in connection with our acquisition of Rising Tide

Games.

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported

amounts in our consolidated financial statements and related notes. Our significant accounting policies are described in Note 1 to our consolidated financial

statements included in this Annual Report. We have identified below our critical accounting policies and estimates that we believe require the greatest amount of

judgment. These estimates and judgments have a significant impact on our consolidated financial statements. Actual results could differ materially from those

estimates. The accounting policies that reflect our more significant estimates and judgments and that we believe are the most critical to fully understand and

evaluate our reported financial results include the following:

• Revenue recognition

• Income taxes

• Business combinations

• Stock-based expense

• Goodwill and indefinite-lived intangible assets

• Impairment of long-lived assets

65

(1)

(1)