Zynga 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

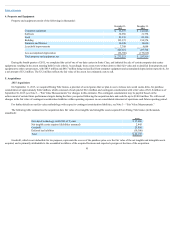

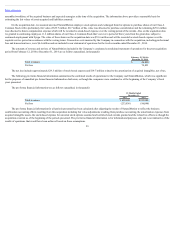

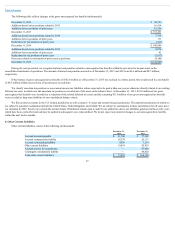

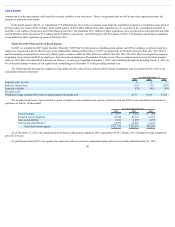

4. Property and Equipment

Property and equipment consist of the following (in thousands):

December 31,

2015

December 31,

2014

Computer equipment $ 36,373 $ 141,946

Software 30,950 31,778

Land 89,130 89,130

Building 195,372 194,574

Furniture and fixtures 10,348 10,616

Leasehold improvements 7,748 9,694

369,921 477,738

Less accumulated depreciation (96,700) (179,819)

Total property and equipment, net $ 273,221 $ 297,919

During the fourth quarter of 2015, we completed the exit of one of our data centers in Santa Clara, and initiated the sale of certain computer data center

equipment, resulting in the assets meeting held for sale criteria. Accordingly, these assets were written down to their fair value and reclassified from property and

equipment to other current assets, with $83.9 million and $80.7 million being reclassified from computer equipment and accumulated depreciation respectively, for

a net amount of $3.2 million. The $3.2 million reflects the fair value of the assets less estimated costs to sell.

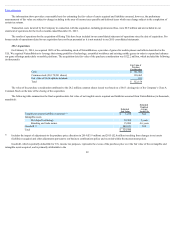

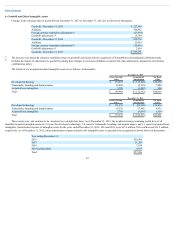

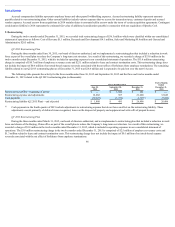

5. Acquisitions

2015Acquisitions

On September 11, 2015, we acquired Rising Tide Games, a provider of social games that we plan to use to release new social casino titles, for purchase

consideration of approximately $44.2 million, which consisted of cash paid of $22.4 million and contingent consideration with a fair value of $21.8 million as of

September 30, 2015 (see Note 3—“Fair Value Measurements” for changes in this estimate). The contingent consideration may be payable based on the

achievement of certain future performance targets during the three year period following the acquisition date and could be up to $140.0 million. We will record

changes in the fair value of contingent consideration liabilities within operating expenses in our consolidated statement of operations each future reporting period.

For further details on our fair value methodology with respect to contingent consideration liabilities, see Note 3—“Fair Value Measurements.”

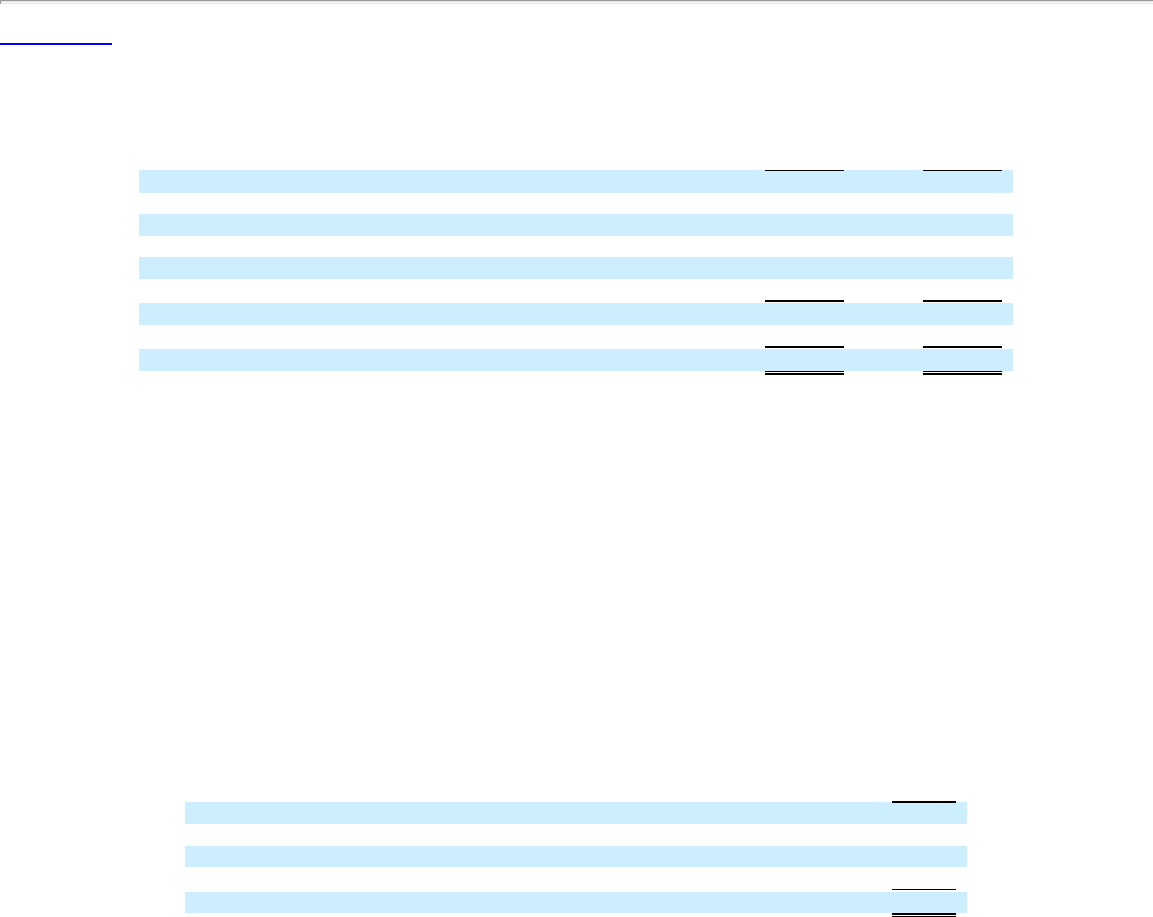

The following table summarizes the acquisition date fair value of net tangible and intangible assets acquired from Rising Tide Games (in thousands,

unaudited):

Total

Developed technology, useful life of 5 years $ 27,000

Net tangible assets acquired (liabilities assumed) 2,445

Goodwill 25,050

Deferred tax liabilities (10,300)

Total $ 44,195

Goodwill, which is not deductible for tax purposes, represents the excess of the purchase price over the fair value of the net tangible and intangible assets

acquired, and is primarily attributable to the assembled workforce of the acquired business and expected synergies at the time of the acquisition.

91