Zynga 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

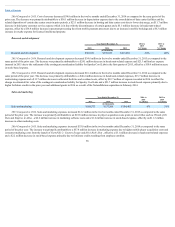

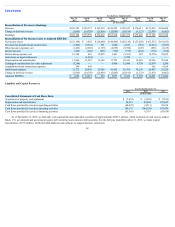

Rising Tide Games, net of cash acquired, in the third quarter of 2015. Capital expenditures were $7.8 million for the twelve months ended December 31, 2015,

which mainly related to the investment in hardware and software to support business operations. We expect capital expenditures of approximately $9.0 million in

2016.

Investing activities used $344.2 million during the twelve months ended December 31, 2014. The primary outflow of cash associated with investing

activities was the business acquisition of NaturalMotion for which $391.0 was paid in cash. The primary cash inflows were $47.7 million for the sales and

maturities of marketable securities, net of purchases. Capital expenditures were $9.2 million for the twelve months ended December 31, 2014, which mainly related

to the investment in hardware and software to support business operations.

Investing activities resulted in a cash inflow of $147.5 million during the twelve months ended December 31, 2013. The primary inflows of cash associated

with investing activities were $169.9 million for the sales and maturities of marketable securities, net of purchases. Capital expenditures were $7.8 million for the

twelve months ended December 31, 2013, which mainly related to the investment in our data centers and other hardware and software to maintain our datacenter

infrastructure.

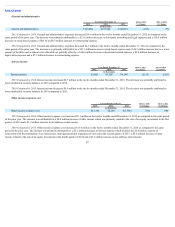

FinancingActivities

Financing activities used $93.5 million during the twelve months ended December 31, 2015. The primary outflow of cash associated with financing activities

was the repurchases of Class A common stock of $88.4 million in the fourth quarter of 2015. The remaining $10.5 million of share repurchases were recorded in

accounts payable and other current liabilities in the amounts of $3.5 million and $7.0 million, respectively, and will be paid in the first quarter of 2016.

Financing activities provided approximately $15.1 million during the twelve months ended December 31, 2014, the primary inflow of cash was $16.4 million

of cash receipts from exercises of employee stock options and employee stock purchase plan.

For the twelve months ended December 31, 2013, the primary outflow of cash associated with financing activities was $100.0 million for the repayment of

debt and $11.2 million of excess tax costs from stock-based awards. We also had a cash inflow of $18.2 million for cash received from the exercise of employee

stock options and warrants.

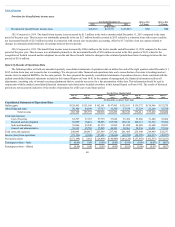

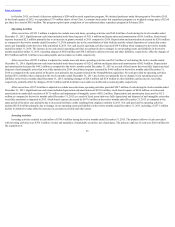

CreditFacility

In June 2013, we amended our existing revolving credit agreement which we originally executed in July 2011, reducing our maximum available credit from

$1.0 billion to $200 million, and extending the term through June 2018. Per the terms of our amended agreement, we paid additional up-front fees of $0.3 million to

be amortized over the remaining extended term of the loan. The interest rate for the amended credit facility is determined based on a formula using certain market

rates, as described in the amended credit agreement. Additionally, our minimum quarterly commitment fee was reduced from $0.6 million per quarter to $0.1

million per quarter based on the portion of the credit facility that is not drawn down. The agreement requires us to comply with certain covenants, including

maintaining a minimum capitalization ratio, and maintaining a minimum cash balance. As of December 31, 2015, we had not drawn down any amounts under the

credit facility and were in compliance with these covenants. On July 1, 2015, we made a further, technical amendment to our credit agreement.

Off-BalanceSheetArrangements

We did not have any off-balance sheet arrangements in 2015, 2014 and 2013.

64