Volvo 2003 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

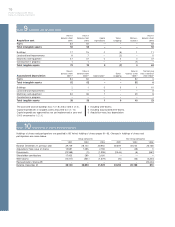

Proposed disposition of unappropriated earnings

Auditors’ report

Proposed disposition of

unappropriated earnings

Group

As shown in the consolidated balance sheet at December 31, 2003, unrestricted equity

amounted to SEK 57,002 M (61,536). Of this amount, SEK 0 M is estimated to be appropri-

ated to restricted equity.

AB Volvo SEK M

Retained earnings 53,067

Net income 2003 (2,189)

To t al 50.878

The Board of Directors and the President propose that the above sum be disposed of as

follows:

SEK M

To the shareholders, a dividend of SEK 8.00 per share 3,356

To the shareholders, a dividend of 27,060,958 shares

in the wholly owned subsidiary Ainax AB 15,403

To be carried forward 42,119

To t al 50,878

1 Each 31 shares in AB Volvo entitle to receive 2 shares in Ainax AB. The proposed dividend comprises

27,060,958 shares of totally 27,320,838 shares in Ainax AB. At the time of the dividend, the assets in

Ainax AB will consist of 27,320,838 A shares in Scania AB and working capital amounting to SEK

100,000,000. In this proposed disposition of unappropriated earnings, the value of A shares in Scania

AB have been determined to SEK 196 per share, corresponding to the market value at December 31,

2003, SEK 202 per share, reduced by SEK 6 per share, for expected dividend which will not be paid to

Ainax AB. The final value of shares in Ainax AB which are proposed to be distributed will be determined

when the Annual General Meeting decide on the dividend, based upon the market value of A shares in

Scania AB at that time.

Göteborg, March 14, 2004

Finn Johnsson

Per-Olof Eriksson Patrick Faure Haruko Fukuda

Tom Hedelius Leif Johansson

Neelie Kroes Louis Schweitzer Ken Whipple

Lars-Göran Larsson Olle Ludvigsson Johnny Rönnkvist

Our audit report was issued on March 14, 2004

PricewaterhouseCoopers AB

Olof Herolf Olov Karlsson

Authorized Public Accountant Authorized Public Accountant

Lead Partner Partner