Volvo 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

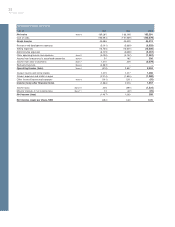

AB Volvo’s holding of shares in subsidiaries as of December 31,

2003 is shown on pages 81–83. Significant acquisitions, formations

and divestments within the Group are listed below.

L.B. Smith (SABA Holding Inc.)

On May 2, Volvo Construction Equipment purchased the assets

amounting to USD 189 M associated with the Volvo distribution

business of L.B. Smith Inc. in the US. No goodwill or real estate was

included in the deal. Because the intention is to spin off the acquired

operations, the L.B. Smith distribution business has not been consoli-

dated in the Volvo Group’s financial statements during 2003.

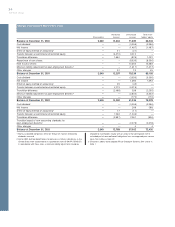

Bilia’s truck and construction equipment business

(“Kommersiella Fordon Europa AB”)

In the third quarter 2003, the acquisition of the truck and construc-

tion equipments operations of Bilia was completed. Volvo exchanged

41% of the shares in Bilia AB for 98% of the shares in Kommer-

siella Fordon Europa AB. Volvo has required compulsory acquisition

of the remaining shares. The acquired operations include dealers and

service suppliers for trucks and construction equipment in the Nordic

region and ten other european countries. The acquisition cost of the

shares has been determined to SEK 0.9 billion. The goodwill arising

from this transaction amounted to SEK 0.6 billion.

Volvo Baumaschinen Deutschland GmbH

In February 2003 Volvo Construction Equipment sold the German

dealer Volvo Baumashinen Deutschland GmbH to the Swedish dealer

partner Swecon Anläggningsmaskiner AB.

Volvo Aero Services LP

During 2002 VNA Holding Inc acquired an additional 9% of the

shares in Volvo Aero Services LP (previously The AGES Group ALP).

Thereafter, Volvo owns 95% of Volvo Aero Services LP.

Prévost Holding BV

On October 1, 2001 Volvo Buses divested 1% of Prévost Holding

Note 2Acquisitions and divestments of shares in subsidiaries

BV, a Canadian and North American bus manufacturer, to Henlys

Group Plc. Thereafter Volvo and Henlys Group Plc own 50% of

Prévost Holding BV each. Thus, effective on October 1, 2001,

Prévost Holding BV is a joint venture and reported in the Volvo

Group accounts in accordance with the proportionate consolidation

method.

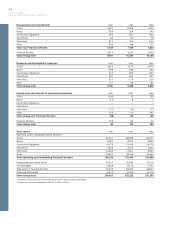

Acrivia AB (former OmniNova Technology AB)

In April 2001, Volvo Buses acquired 65% of Acrivia AB, an engineer-

ing company that develops production processes for buses and

produces frames for the new TX platform, from TWR Sweden AB.

Thereafter, Volvo Buses owns 100% of Acrivia AB.

Low Cab-Over-Engine (LCOE)

On July 27, 2001 Volvo Trucks North America agreed to sell its

LCOE business to Grand Vehicle Works Holdings, LLC. By divesting

its LCOE operations, Volvo met the condition imposed by U.S. Depart-

ment of Justice for approval of its acquisition of Mack and Renault V.I.

Volvia

On February 8, 2001, Volvo’s wholly owned subsidiary, Volvia

reached an agreement covering the divestment of its insurance

operations. The buyer is the If insurance company. The purchase

price for the operations was 562.

Renault V.I. and Mack

On January 2, 2001, AB Volvo’s acquisition of Renault’s truck opera-

tions, Mack and Renault V.I., became effective. Under the terms of

acquisition AB Volvo acquired all the shares of Mack and Renault V.I.

in exchange for 15% of the shares in AB Volvo. The purchase price

for the shares was set at SEK 10.7 billion, based on the Volvo share

price on the acquisition date. Goodwill amounting to SEK 8.4 billion

that arose in connection with the acquisition is being amortized over

20 years. In connection with the acquisition, Renault V.I. Finance was

acquired for about FRF 154 M.

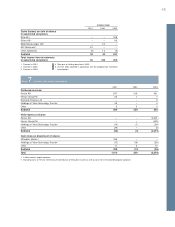

Provisions for residual value risks

Residual value risks are attributable to operational lease contracts

and sales transactions combined with buy-back agreements or resid-

ual value guarantees. Residual value risks are the risks that Volvo in

the future would have to dispose used products at a loss if the price

development of these products is worse than what was expected

when the contracts were entered. Provisions for residual value risks

are made on a continuing basis based upon estimations of the used

products’ future net realizable values. The estimations of future net

realizable values are made with consideration of current prices, ex-

pected future price development, expected inventory turnover period

and expected variable and fixed selling expenses. If the residual value

risks are pertaining to products that are reported as tangible assets

in Volvo’s balance sheet, these risks are reflected by depreciation or

write-down of the carrying value of these assets. If the residual value

risks are pertaining to products which are not reported as assets in

Volvo’s balance sheet, these risks are reflected under the line item

provisions.

Deferred taxes, allocations and untaxed reserves

Tax legislation in Sweden and other countries sometimes contains

rules other than those identified with generally accepted accounting

principles, and which pertain to the timing of taxation and measure-

ment of certain commercial transactions. Deferred taxes are provided

for on differences which arise between the taxable value and report-

ed value of assets and liabilities (temporary differences) as well as on

tax-loss carryforwards. However, with regards to the valuation of

deferred tax assets, these items are recognized provided that it is

probable that the amounts can be utilized against future taxable

income.

Tax laws in Sweden and certain other countries allow companies

to defer payment of taxes through allocations to untaxed reserves.

These items are treated as temporary differences in the consolidated

balance sheet, that is, a split is made between deferred tax liability

and equity capital (restricted reserves). In the consolidated income

statement an allocation to, or withdrawal from, untaxed reserves is

divided between deferred taxes and net income for the year.