Volvo 2003 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

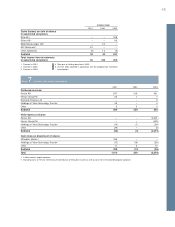

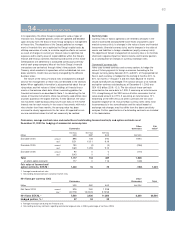

Note 23 Other provisions

Value in Value in Provisions Acquired and Trans- Value in

balance balance and divested lation Reclassi- balance

sheet 2001 sheet 2002 reversals Utilization companies differences fications sheet 2003

Warranties 5,989 5,977 5,687 (5,257) 50 (286) 4 6,175

Provisions in insurance

operations 265 419 (33) – – – 0 386

Restructuring measures 2,342 1,417 41 (516) (5) (103) 107 941

Provisions for residual

value risks 1,716 1,698 (165) (219) 21 (137) 9 1,207

Provisions for

service contracts 1,705 1,478 369 (378) 48 (91) 55 1,481

Other provisions 5,366 4,820 1,645 (1,544) 59 (323) (368) 4,289

Total 17,383 15,809 7,544 (7,914) 173 (940) (193) 14,479

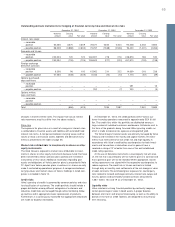

Other loans 2001 2002 2003

USD 1966–2003/ 2005–2015, 1.31–13.0% 10,023 7,280 5,634

EUR 1986–2003/ 2005–2013, 0.5–9.59% 1,453 1,841 3,245

GBP 1995–2001/ 2005–2009, 4.43–7.14% 915 1,028 1,786

SEK 1992–2003/ 2006–2013, 4.15–7.49% 650 224 349

BRL 2000–2003/ 2005–2011, 9.85–21.64% 641 435 626

CAD 2002–2003/ 2006–2008, 3.53–3.7% 80 972 1,527

AUD 2002/ 2005–2006, 5.99–6.43% – 400 208

Other loans 274 369 209

To tal other long-term loans 14,036 12,549 13,584

Deferred leasing income 1,898 1,481 1,186

Residual value liability 7,250 5,121 3,249

Other long-term liabilities 231 102 192

Total 54,130 53,123 51,301

Of the above long-term loans, 1,777 (1,358; 1,703) was secured.

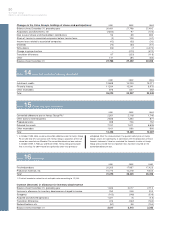

Note 24 Non-current liabilities

Bond loans 2001 2002 2003

GBP 1999/ 2003, 4.6% 154 – –

DKK 1998/ 2005, 4.0% 317 310 58

SEK 1997–2003/ 2005–2008, 3.08–9.8% 2,502 5,950 6,372

JPY 1995–2003/ 2005–2011, 0.13–3.33% 2,130 888 1,443

HKD 1999/ 2006, 7.99% 136 113 94

CZK 2001/ 2005–2010, 2.6–6.5% 466 306 514

USD 1998–2003/ 2005–2008, 1.32–1.78% 2,070 2,154 1,274

EUR 1995–2003/ 2005–2011, 0.1–7.62% 22,907 24,120 23,047

Other bond loans 33 29 288

Total 30,715 33,870 33,090

The listing below shows the Group’s non-current liabilities in which

the largest loans are distributed by currency. Most are issued by

Volvo Treasury AB and Volvo Group Finance Europe BV.

Information on loan terms is as of December 31, 2003. Volvo

hedges foreign-exchange and interest-rate risks using derivative

instruments. See Note 34.