Volvo 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

The Volvo Group

Notes to consolidated financial statements

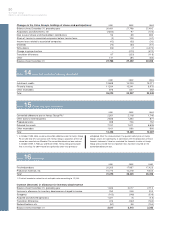

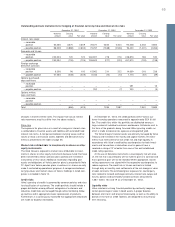

Long-term loans mature as follows:

2005 15,391

2006 9,218

2007 9,665

2008 5,688

2009 or later 6,712

Total 46,674

Of other long-term liabilities the majority will mature within five years.

At year-end 2003, credit facilities granted but not utilized and

which can be used without restrictions amounted to approximately

SEK 15 billion (18; 22). Approximately SEK 13 billion of these facili-

ties consisted of stand-by facilities for loans with varying maturities

through the year 2007. A fee normally not exceeding 0.25% of the

unused portion is charged for credit facilities.

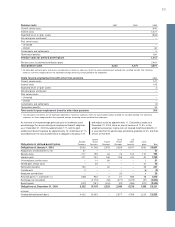

Note 25 Current liabilities

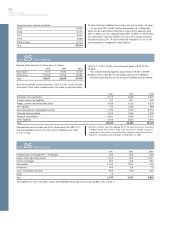

Note 26 Assets pledged

Balance sheet amounts for loans were as follows:

2001 2002 2003

Bank loans 7,417 5,442 3,430

Other loans 129,400 20,576 23,988

Total 36,817 26,018 27,418

14,470 (11,138; 12,608), and commercial paper, 5,836 (8,762;

15,966).

Non-interest-bearing liabilities accounted for 49,561 (48,599;

50,935), or 64% (65; 58) of the Group’s total current liabilities.

Balance sheet amounts for Other current liabilities were as follows:

Bank loans include current maturities, 1,659 (1,046; 1,484), of long-

term loans. Other loans include current maturities of long-term loans,

2001 2002 2003

Advances from customers 3,112 2,589 1,821

Current income tax liabilities 707 621 459

Wages, salaries and withholding taxes 4,368 4,335 4,630

VAT liabilities 772 1,056 988

Accrued expenses and prepaid income 17,724 7,315 8,113

Deferred leasing income 2,033 1,652 1,230

Residual value liability 4,341 3,985 3,201

Other liabilities 5,156 4,832 4,591

Total 28,213 26,385 25,033

Secured bank loans at year-end 2003 amounted to 96 (588; 472).

The corresponding amount for other current liabilities was 1,987

(1,775; 1,732).

The liabilities for which the above assets were pledged amounted at year-end to 3,860 (3,721; 3,907).

2001 2002 2003

Property, plant and equipment – mortgages 264 356 248

Assets under operating leases 1,246 964 2,031

Chattel mortgages 394 495 350

Receivables 1,063 1,180 678

Inventories 199 66 76

Cash, marketable securities 556 549 426

Other 15 – –

Total 3,737 3,610 3,809

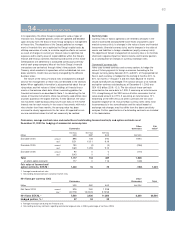

1 Effective in 2003, Volvo has adopted RR 27, Financial instrument; Disclosure

and presentation. See further in Note 1. As result of this change of account-

ing principles other loans increased by SEK 3.0 billion and accrued interest

expenses increased by SEK 0.6 billion at December 31, 2003.