Volvo 2003 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

The Volvo Group

Notes to consolidated financial statements

In 2003, Volvo exchanged the main part of its shareholding in Bilia

AB versus 98% of the shares in Kommersiella Fordon Europa AB

(KFAB). In accordance with Swedish GAAP, the acquisition cost of

the shares in KFAB was determined to SEK 0.9 billion and the

goodwill attributable to this transaction amounted to SEK 0.6 billion.

In accordance with US GAAP, the acquisition cost of the shares

amounted to SEK 0.7 billion and the goodwill was determined to

SEK 0.5 billion. As a consequence, Volvo's capital gain on the divest-

ment of Bilia shares was 179 lower under US GAAP than under

Swedish GAAP.

In 2001, AB Volvo acquired 100% of the shares in Renault V.I.

and Mack Trucks Inc. from Renault SA in exchange for 15% of the

shares in AB Volvo. Under Swedish GAAP, the goodwill attributable

to this acquisition was set at SEK 8.4 billion while under US GAAP

the corresponding goodwill was set at SEK 11.5 billion. The differ-

ence was mainly attributable to determination of the purchase con-

sideration. In accordance with Swedish GAAP, when a subsidiary is

acquired through the issue of own shares, the purchase considera-

tion is determined to be based on the market price of the issued

shares at the time of the transaction is completed. In accordance

with US GAAP, such a purchase consideration is determined to be

based on the market price of the underlying shares for a reasonable

period before and after the terms of the transaction are agreed and

publicly announced. The goodwill may be subject to adjustment

pending resolution of the dispute between AB Volvo and Renault SA

regarding the final value of acquired assets and liabilities in Renault

V.I. and Mack Trucks.

In 1995, AB Volvo acquired the outstanding 50% of the shares in

Volvo Construction Equipment Corporation (formerly VME) from

Clark Equipment Company, in the US In conjunction with the acquisi-

tion, goodwill of SEK 2.8 billion was reported. The shareholding was

written down by SEK 1.8 billion, which was estimated to correspond

to the portion of the goodwill that was attributable at the time of

acquisition to the Volvo trademark. In accordance with US GAAP, the

goodwill of SEK 2.8 billion was amortized over its estimated useful

life (20 years) until 2002 when Volvo adopted SFAS 142 (see

above).

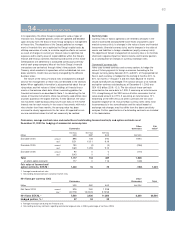

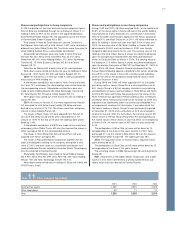

Net income Shareholders’ equity

Goodwill 2001 2002 2003 2001 2002 2003

Goodwill in accordance with

Swedish GAAP (1,058) (1,094) (873) 13,013 11,297 11,151

Items affecting reporting of goodwill:

Acquisition of Renault V.I. and Mack Trucks Inc. (153) 430 415 2,899 3,329 3,744

Acquisition of Volvo Construction

Equipment Corporation (91) 51 51 1,226 1,277 1,328

Other acquisitions – 613 407 – 613 841

Net change in accordance with US GAAP (244) 11,094 873 4,125 5,219 5,913

Goodwill in accordance with US GAAP (1,302) 0 0 17,138 16,516 17,064

1 Income under US GAAP was in total 744 lower than under Swedish GAAP, including 244 due to higher goodwill amortization and 500 due

to other differences in purchase accounting.

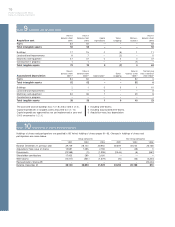

C. Investments in debt and equity securities. In accordance with US

GAAP, Volvo applies SFAS 115: “Accounting for Certain Investments

in Debt and Equity Securities.” SFAS 115 addresses the accounting

and reporting for investments in equity securities that have readily

determinable fair market values, and for all debt securities. These

investments are to be classified as either “held-to-maturity” securities

that are reported at amortized cost, “trading” securities that are

reported at quoted market prices with unrealized gains or losses

included in earnings, or “available-for-sale” securities, reported at

quoted market prices, with unrealized gains or losses being credited

or debited to Other comprehensive income and thereby included in

shareholders’ equity.

As of December 31, 2003, unrealized losses after deduction of

unrealized gains in “available-for-sale” securities amounted to 2,315

(9,763; 7,211). Sale of "available-for-sale" shares in 2003 provided

SEK – (– ; 3,2 billion) and the capital gain, before income tax, on

sales of these shares amounted to SEK – (– ; 0,6 billion).

As set out above, all “available-for-sale” securities are valued at

quoted market price at the end of each fiscal year with the change in

value being credited or debited to Other comprehensive income.

However, if a security’s quoted market price has been below the car-

rying value for an extended period of time, US GAAP include a pre-

sumption that the decline in value is “other than temporary”. Under

such circumstances, US GAAP require that the value adjustment

must be recorded in Net income with a corresponding credit to

Other comprehensive income. Accordingly, value adjustments

amounting to 62 (9,683; –), have been charged to Volvo’s net

income under US GAAP. Value adjustments during 2002 was mainly

pertaining to Volvo’s investment in Scania AB. After these value

adjustments, the remaining value of unrealized gains before tax

credited to Other comprehensive income amounted to 3,399 as of

December 31, 2003.

In accordance with Swedish accounting principles, write-downs

have been made to the extent the fair value of the investments is

considered to be lower than the acquisition cost of the investment.

During 2003, Volvos investments in Scania AB and Henlys Group

Plc was written down by 3,601 and 429 respectively under Swedish

GAAP. See further in Note 13.