Volvo 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

The Volvo Group

Notes to consolidated financial statements

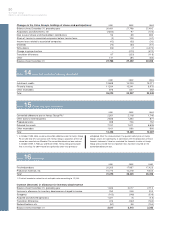

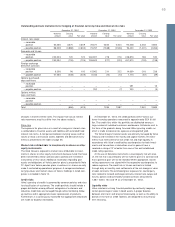

Note 29 Leasing

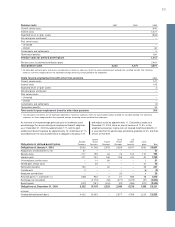

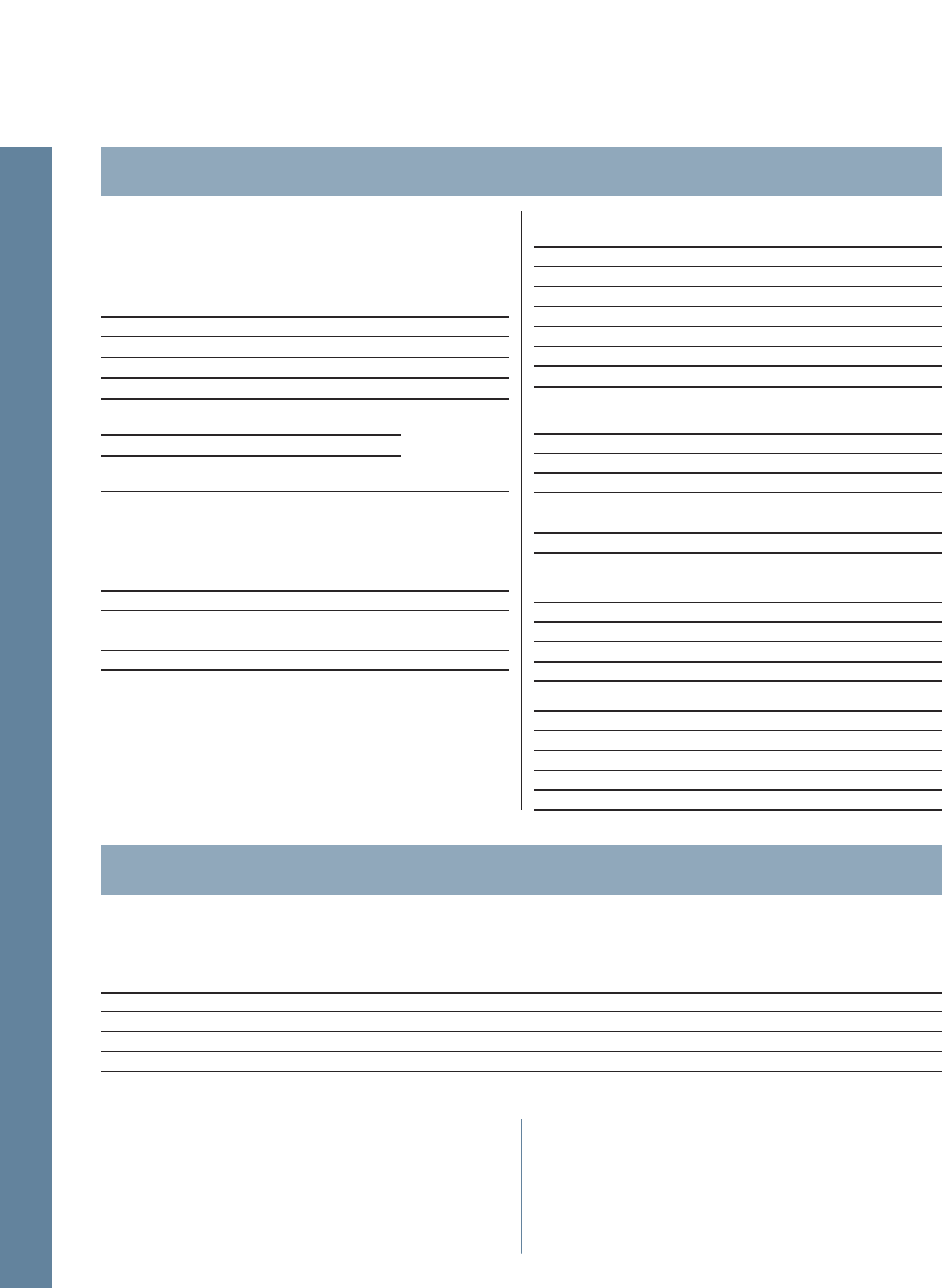

Note 30 Related parties

At December 31, 2003, future rental income from noncancellable

financial and operating leases (minimum leasing fees) amounted to

27,586 (28,327; 31,109), of which 25,548 (25,737; 28,183) pertains

to customer-financing companies. Future rental income is distributed

as follows:

Financial leases Operating leases

2004 6,480 3,976

2005–2008 10,927 7,151

2009 or later 91 747

Total 17,498 11,874

Allowance for uncollectible

future rental income (168)

Unearned rental income (1,618)

Present value of future

rental income 15,712

At December 31, 2003, future rental payments (minimum leasing

fees) related to noncancellable leases amounted to 5,009 (4,335;

5,192).

Future rental payments are distributed as follows:

Financial leases Operating leases

2004 355 1,148

2005–2008 937 1,653

2009 or later 67 849

Total 1,359 3,650

Rental expenses amounted to:

2001 2002 2003

Financial leases:

– Contingent rents (4) (11) (29)

Operating leases:

– Contingent rents (82) (46) (58)

– Rental payments (899) (1,238) (1,187)

– Sublease payments 14 16 69

Total (971) (1,279) (1,205)

Book value of assets subject to finance lease:

2002 2003

Acquisition costs:

Buildings 110 143

Land and land improvements 32 66

Machinery and equipment 24 69

Assets under operating lease 1,499 1,129

Total 1,665 1,407

Accumulated depreciation:

Buildings (62) (27)

Land and land improvements – –

Machinery and equipment (11) (3)

Assets under operating lease (646) (561)

Total (719) (591)

Book value:

Buildings 48 116

Land and land improvements 32 66

Machinery and equipment 13 66

Assets under operating lease 853 568

Total 946 816

The Volvo Group has transactions with some of its associated companies. The transactions consist mainly of sales of vehicles to dealers.

Commercial terms and market prices apply for the supply of goods and services to/ from associated companies. Bilia AB was reported as an

associated company until June 30, 2003.

2001 2002 2003

Sales to associated companies 2,179 2,813 1,486

Purchase from associated companies 18 44 24

Receivables from associated companies, Dec 31 65 370 253

Liabilities to associated companies, Dec 31 38 6 32

Group holdings of shares in associated companies are shown in Note 13, Shares and participations.

The Volvo Group also has transactions with Renault S.A. and its sub-

sidiaries. Sales to and purchases from Renault S.A. amounted to

2,893 (1,523; 1,839) and 2,756 (3,608; 3,265). Amounts due from

and due to Renault S.A. amounted to 501 (426; 568) and 537

(642;1,128) respectively, at December 31, 2003. The sales were

mainly from Renault Trucks to Renault S.A. and consisted of compo-

nents and spare parts. The purchases were mainly made by Renault

Trucks from Renault S.A. and consisted mainly of light trucks.

On May 2 2003, Volvo CE North America acquired assets associ-

ated with the distribution business of L.B. Smith Inc., which is not

consolidated since the holding is intended to be temporary. The sales

from Volvo CE to these operations from May 2 to December 31,

2003 amounted to 1,301 and the receivables at year-end amounted

to 15.