Volvo 2003 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

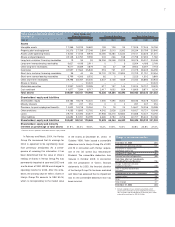

Change of operating income

SEK bn

Operating income 2002 2.8

Higher volumes and improvement of gross

margins 4.8

Higher income from Financial Services 0.4

Changes in currency exchange rates (0.9)

Lower capitalization of development costs (0.8)

Higher research and development expenditures (0.5)

Higher selling and administrative expenses (1.2)

Deficit in Swedish pension foundation 2002 0.8

Higher dividend from Scania 0.2

Write-down of shares in Scania and Henlys Group (4.0)

Other 0.9

Operating income 2003 2.5

Consolidated income statements1

SEK M 2001 2002 2003

Net sales 180,615 177,080 174,768

Cost of sales (149,477) (145,453) (141,256)

Gross income 31,138 31,627 33,512

Research and development expenses (5,391) (5,869) (6,829)

Selling expenses (14,663) (15,393) (15,891)

Administrative expenses (6,474) (5,464) (5,259)

Other operating income and expenses (3,071) (2,989) (540)

Income from Financial Services 325 490 926

Income (loss) from investments

in associated companies (88) 126 166

Income from other investments 1,410 309 (3,581)

Restructuring costs (3,862) – –

Operating income (loss) (676) 2,837 2,504

Interest income and similar credits 1,653 1,246 1,193

Interest expenses and similar charges (2,653) (1,870) (1,984)

Other financial income and expenses (190) (200) (56)

Income (loss) after financial items (1,866) 2,013 1,657

Income taxes 326 (590) (1,334)

Minority interests in net income (loss) 73 (30) (25)

Net income (loss) (1,467) 1,393 298

Income (loss) per share, SEK (3.50) 3.30 0.70

1 Financial Services reported in accordance with the equity method.

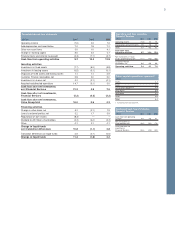

declined to a loss of SEK 44 M (income: 5).

The lower earnings were mainly a result of

provisions for expected losses on contracts

of SEK 170 M in the fourth quarter.

Operating income within Financial

Services amounted to SEK 926 M (490).

Financial Services’ favorable trend of ten

consecutive quarters of progressively in-

creasing earnings primarily pertained to

lower credit losses in the US customer

financing operations and strong results in the

operations in Europe as well as in other parts

of the world.

Group operating income included write-

down of shares in Scania AB and Henlys

Group Plc during the fourth quarter of 2003

amounting to SEK 3,601 M and SEK 429 M

respectively.

Group operating income in 2002 was

negatively affected by provisions of SEK

807 M relating to a deficit within the Volvo

Group’s Swedish pension foundation.

Operating margin during 2003, excluding

write-down of shares, was 3.7%, compared

with 1.6% in 2002.

Impact of exchange rates on

operating income

The effect of changes in currency rates on

operating income in 2003 compared with

2002 was negative by approximately SEK

900 M.

The Swedish krona strengthened during

2003 against the major part of Volvo’s inflow

currencies, with negative effects on operat-

ing income. The US dollar, the Canadian

dollar and the British pound had the greatest