Volvo 2003 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

The Volvo Group year 2003

Financial targets

Volvo’s ambition for the period up to 2005 is

to achieve a sustainable level of profitability

above the industry average. Sustainable

profitability is driven by strong and profitable

growth combined with a high degree of

operating efficiency. At the same time a

strong capital structure is essential in order

to maintain investments on a competitive

level – with the ultimate aim of providing

world-class products and services. In order

to achieve the strategy for growth and gen-

erate a competitive return for our sharehold-

ers, Volvo has set a number of Group-wide

financial targets covering growth, operating

margin, return on equity and capital struc-

ture. These financial targets are set and eval-

uated over a business cycle.

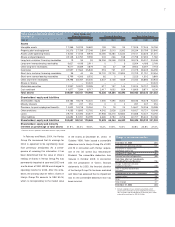

Sales growth

Volvo’s ambition is that net sales should

increase by an average of more than 10% on

an annual basis. This objective should be

achieved through both organic growth and

acquisitions. During the period from 1999 to

2003, the average annual growth rate,

excluding divested operations, was 11.7%.

Operating margin

The objective is to maintain an operating

margin of between 5% and 7% over an eco-

nomic cycle. The average annual operating

margin for the Volvo Group during 1999 to

2003 was 2.9%.

Return on equity

Over time, the return on shareholders’ equity

should more than compensate for inflation as

well as for industrial and financial risks. The

objective is to achieve a return on sharehold-

ers’ equity of between 12% and 15% over

an economic cycle. Return on shareholders’

equity during 1999 to 2003 averaged 8.1%

per year.

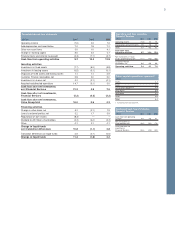

Capital structure

A strong capital structure and a competitive

cash flow is essential in order to be able to

maintain investments in research and devel-

opment, product development and in pro-

duction on competitive levels – and in the

end generate world-class products and serv-

ices.

The Group’s objective is to maintain a net

financial position ratio, excluding Financial

Services, between a net financial assets

position of 15% and a net debt position of

30%. The equity ratio, excluding Financial

Services, should not be lower than 40% and

the equity ratio in Financial Services should

not be lower than 10%.

At the end of December 2003, the net

financial position of the Volvo Group amount-

ed to a net debt of SEK 2.4 billion, corre-

sponding to a net debt ratio of 3.3%. On

December 31, 2003, the equity ratio for the

Group, excluding Financial Services, was

40.5% and the equity ratio for Financial

Services was 12.0%.

99 00 01 03

8350 (1)

Net sales growth*, %

02

(2)

99 00 01 03

6.4 5.5 (0.4) 1.4

Operating margin*, %

02

1.6

99 00 01 03

34.9 5.0 (1.7) 0.4

Return on shareholders´

equity, %

02

1.7

99 00 01 03

29.3 10.6 (8.2) (3.3)

Net financial position as percentage

of shareholders´ equity, %

02

(7.7)

99 00 01 03

67 61 42 40

Equity ratio*, %

02

42

*Excluding divested

operations

*Excluding divested

operations

0

0

7

5

*Excluding divested

operations

0

15

12

15

0

-30

40

10