Volvo 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

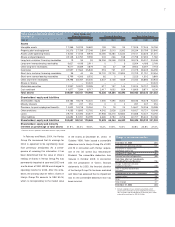

The Volvo Group year 2003

Net interest expense

Net interest expense for the year amounted

to SEK 791 M (624). The higher net interest

expense was mainly explained by lower yield

on financial assets and higher average net

financial debt during 2003, in part due to

higher provisions for post-employment bene-

fits and the acquisition of Bilia’s truck and

construction equipment operations, KFAB.

Income taxes

During 2003, an income tax expense of SEK

1,334 M was reported, compared with SEK

590 M for the year-earlier period. The income

tax expense was mainly related to current tax

expenses.

Minority interests

Minority interests in the Volvo Group were

mainly attributable to Volvo Aero Norge AS

(22%) and Volvo Aero Services LP (5%).

Net income

Net income amounted to SEK 298 M

(1,393) corresponding to an income per

share of SEK 0.70 (3.30). The return on

shareholders’ equity was 0.4% (1.7%).

Excluding the write-down of shares in Scania

AB and Henlys Group Plc, income per share

more than tripled and amounted to SEK

10.30 and the return on shareholders' equity

amounted to 5.7%.

Impact of exchange rates

on operating income

Compared with preceding year, SEK bn

Net sales1(12.3)

Cost of sales 8.0

Research and development expenses 0.3

Selling and administrative expenses 1.4

Other operating income and expenses 1.7

Income from investments in shares 0.0

Total effect of changes in exchange

rates on operating income (0.9)

1 Group sales are reported at average spot rates and the effects

of currency hedges are reported among “Other operating

income and expenses.”

Operating net flow per currency

SEKM 2001 2002 2003

USD 8,100 7,100 7,500

EUR 8,000 9,700 11,800

GBP 4,200 5,400 3,400

CAD 1,000 1,600 1,600

Other currencies 2,800 5,000 5,200

Total 24,100 28,800 29,500

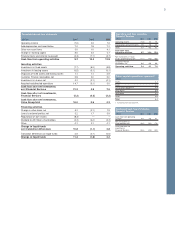

Financial position

Balance sheet

The Volvo Group’s total assets at December

31, 2003 amounted to SEK 231.3 billion,

corresponding to a decline of SEK 8.0 billion

since year-end 2002. Total assets declined

by SEK 13.4 billion due to changes in cur-

rency rates and by SEK 4.0 billion due to

write-down of shares in Scania AB and

Henlys Group Plc. The decrease was partly

offset by an increase of SEK 4.0 billion relat-

ed to changes in the Group structure, mainly

due to the acquisition of Bilia’s truck and

construction equipment operations, and an

additional increase of SEK 3.6 billion as a

consequence of the adoption of new

accounting principles for derivative instru-

ments (see Note 1).

Shareholders’ equity and minority inter-

ests amounted to SEK 72.6 billion, corre-

sponding to 40.5 % of total assets, exclud-

ing Financial Services. The Group’s net

financial debt at year-end 2003, amounted to

SEK 2.4 billion, which corresponded to

3.3% of shareholders’ equity and minority

interests. Changes in shareholders’ equity

are specified on page 34. Effective in 2003,

Volvo adopted new accounting principles for

employee benefits (see Note 1).

The carrying value of Volvo’s holding in

Scania AB at year-end 2003 has been deter-

mined to SEK 20.4 billion, a write-down of

SEK 3.6 billion has thereby been charged to

operating income. The carrying value of the

holding of Scania B shares was determined

based upon the consideration received when

Volvo divested those shares to Deutsche

Bank on March 4, 2004. The carrying value

of the holding of Scania A shares was deter-

mined based upon the closing share price of

SEK 202 on December 31, 2003.

Preparations for adoption

of International Financial

Reporting Standards

For a description of Volvo’s preparations for

adoption of International Financial Reporting

Standards (IFRS) in 2005, see further in Note 1

on page 36.

impact. Changes in spot-market rates for

other currencies had minor effects. The total

effect of changed spot-market rates was

negative, approximately SEK 2,050 M.

The effect on income of forward and

option contracts amounted to a gain of SEK

1,243 M (loss: 195), which resulted in a

positive impact of SEK 1,438 M for 2003,

compared with 2002.

Changes in spot rates in connection with

the translation of income in foreign sub-

sidiaries and the revaluation of balance

sheet items in foreign currencies had a neg-

ative effect of SEK 290 M.