Volvo 2003 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

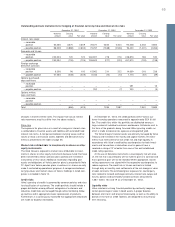

Note 5Interest income and expenses

Interest income and similar credits amounting to 139 (503; 455)

included interest in the amount of 139 (503; 420) from subsidiaries

and interest expenses and similar charges totaling 196 (261; 467),

included interest of 155 (221; 451) to subsidiaries.

74

Parent Company AB Volvo

Notes to financial statements

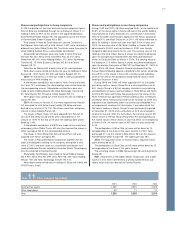

General information

Amounts in SEK M unless otherwise specified. The amounts within

parentheses refer to the two preceding years; the first figure is for

2002 and the second for 2001.

The accounting principles applied by Volvo are described in Note 1

to the consolidated financial statements. Reporting of Group contri-

butions is in accordance with a statement issued by a special com-

mittee of the Swedish Financial Accounting Standards Council. Group

contributions are reported among Income from investments in Group

companies.

As of 2003, the Volvo Group has adopted “RR 29 Employee

Benefits” in its financial reporting. The parent company is still apply-

ing the principles of FAR’s Recommendation No. 4 “Accounting of

pensions liabilities and pension costs” as in previous years. Conseq-

uently there are differences between the Volvo Group and the

Parent Company in the accounting for defined-benefit pension plans

as well as in valuation of plan assets invested in the Volvo Pension

Foundation.

Effective in 2002, all Income from investments are included as a

part of the operating income rather than as earlier among financial

items. The previous year has been restated to conform to the

changed classification.

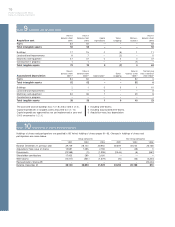

Intra-Group transactions

Of the Parent Company’s sales, 372 (320; 353) were to Group com-

panies and purchases from Group companies amounted to 173

(191; 188).

Fees to auditors

Fees and other remunerations paid to external auditors for the fiscal

year 2003 totaled 25 (23; 51), of which 5 (2; 3) for auditing, distrib-

uted between PricewaterhouseCoopers, 5 (2; 3) and others, 0 (0; 0),

and 20 (21; 48) related to non-audit services from

PricewaterhouseCoopers.

Note 1Administrative expenses

Administrative expenses include depreciation of 1 (2; 17) of which 1 (2; 3) pertain to machinery and equipment, 0 (0; 1) to buildings and

– (–; 13) to rights in the Volvo Ocean Race.

Note 2Income from investments in Group companies

Of the income reported, 4,368 (770; 24,814) pertained to dividends

from Group companies. Transfer pricing adjustments and Group con-

tributions delivered totaled a net of 406 (3,835; 3,450). Divestments of

shares resulted in capital gain of 60 (loss 3, gains 452). Write-downs

of shareholdings amounted to 1,579 (531; 12,217) and write-down

of a long-term receivable amounted to 631.

In 2001 Herkules VmbH, a subsidiary and the holder of shares in

Mitsubishi Motors Company, was sold to DaimlerChrysler, thus result-

ing in a capital gain of 172 in AB Volvo.

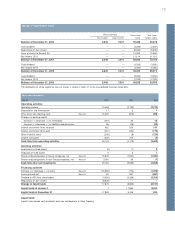

Note 3Income from investments in associated companies

Dividends from associated companies that are reported in the Group

accounts in accordance with the equity method amounted to 47 (44;

42). The participation in Blue Chip Jet HB amounted to a loss of 14

(25; 20). The exchange of shares in Bilia AB for shares in Kommer-

siella Fordon Europa AB, resulted in a capital gain of 250. Income in

2002 included a capital gain of 35 pertaining to sale of shares in

Eddo Restauranger AB.

Note 4Income from other investments

Of the income reported, 508 (326; 663) pertained to dividends from

other companies. The dividend from Scania AB was 501 (319; 637)

and from Henlys Group Plc 7 (7; 26). Write-downs of shareholdings

amounted to 4,330 (–; –), whereof Scania AB, 3,901 and Henlys

Group Plc, 429. In 2001 transfer of shares together with rights and

obligations relating to Mitsubishi Motors Corporation to a subsidiary,

Herkules VmbH, resulted in a capital gain of 595.