Volvo 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

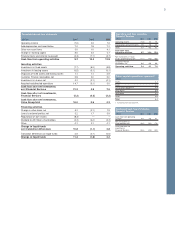

Financial performance

Volvo CE’s net sales amounted to SEK

23,154 M (21,012), up 18% adjusted for

currency effects. The increase was mainly

attributable to all-time-high volumes as a

result of the expanded product range.

Operating income in 2003 was SEK 908 M

(406) and the operating margin 3.9% (1.9).

The improved earnings were primarily related

to increased volumes, which were strongly

offset by negative currency effects.

Production and investments

Over the past two years Volvo CE has

launched more than 40 new products to the

market. The product portfolio is now in a

highly competitive position. During the spring

of 2003, production of excavators began in

the new facilities located in the Pudong area

outside Shanghai in China. The new factory

ramped up production to around 1,200

machines a year. In addition, the dealer net-

work expanded and in the beginning of

2004, there were 19 dealer partners sup-

porting Volvo CE in China.

Ambitions for 2004

Volvo CE’s ambition for 2004 is to capitalize

on the recently launched new products and

the extended product range to increase

market shares. The dealer development pro-

gram will continue, focusing on integrating

the acquired network of former Bilia dealers

in Europe and on developing and divesting

the former L.B. Smith distribution network in

the US. The Rental initiative will be further

developed and additional rental stores will

be opened in Europe and North America. In

China, the new production plant for excava-

tors is important, since China is the fastest-

growing and one of the largest markets for

crawler excavators.

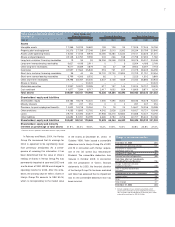

Net sales per market

Construction Equipment

SEKM 2001 2002 2003

Western Europe 10,326 10,383 11,576

Eastern Europe 341 454 772

North America 6,145 5,667 5,428

South America 847 709 636

Asia 2,773 3,048 3,707

Other markets 703 751 1,035

Total 21,135 21,012 23,154