Volvo 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

The Volvo Group

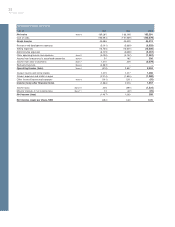

Consolidated income statements

SEK M 2001 2002 2003

Net sales Note 4 189,280 186,198 183,291

Cost of sales (155,592) (151,569) (146,879)

Gross income 33,688 34,629 36,412

Research and development expenses (5,391) (5,869) (6,829)

Selling expenses (15,766) (16,604) (16,866)

Administrative expenses (6,709) (5,658) (5,467)

Other operating income and expenses Note 5 (4,096) (4,152) (1,367)

Income from investments in associated companies Note 6 50 182 200

Income from other investments Note 7 1,410 309 (3,579)

Restructuring costs Note 8 (3,862) – –

Operating income (loss) Note 4 (676) 2,837 2,504

Interest income and similar credits 1,275 1,217 1,096

Interest expenses and similar charges (2,274) (1,840) (1,888)

Other financial income and expenses Note 9 (191) (201) (55)

Income (loss) after financial items (1,866) 2,013 1,657

Income taxes Note 10 326 (590) (1,334)

Minority interests in net income (loss) Note 11 73 (30) (25)

Net income (loss) (1,467) 1,393 298

Net income (loss) per share, SEK (3.50) 3.30 0.70