Volvo 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

The Volvo Group

Notes to consolidated financial statements

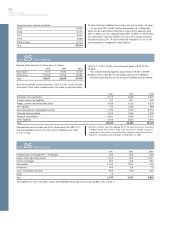

Volvo’s pension foundation in Sweden was formed in 1996 to secure

obligations relating to retirement pensions for salaried employees in

Sweden in accordance with the ITP plan (a Swedish individual pen-

sion plan). Plan assets amounting to 2,456 was contributed to the

foundation at its formation, corresponding to the value of the pension

obligations at that time. Since its formation, net contributions of 232

have been made to the foundation. The plan assets in Volvo’s

Swedish pension foundation are invested in Swedish and foreign

shares and mutual funds, and in interest-bearing securities, in accor-

dance with a distribution that is determined by the foundation’s Board

of Directors. During 2001 and 2002, the fair value of the founda-

tion’s plan assets decreased as a result of the downturn on the stock

market and provisions to cover pensions obligations in excess of the

fair value of plan assets was made with an amount of 292 in 2001

and 807 in 2002 among the Group’s pension costs. According to

RR 29, Employee Benefits, which has been applied as from 2003,

Group pension costs are affected by an expected return on the plan

assets, and discrepancies between the expected return and the

actual return are treated as actuarial gains or losses. At December 31,

2003, the fair value of the foundation’s plan assets amounted to

3,592, of which 47% was invested in shares or mutual funds. At the

same date, retirement pension obligations attributable to the ITP plan

amounted to 4,422. Swedish companies can secure new pension

obligations through balance sheet provisions or pension fund contri-

butions. Furthermore, a credit insurance must be taken out for the

value of the obligations. In addition to benefits relating to retirement

pensions, the ITP plan also includes, for example, a collective family

pension, which Volvo finances through insurance with the Alecta

insurance company. According to an interpretation from the Swedish

Financial Accounting Standards Council’s interpretations committee,

this is a multi-employer defined benefit plan. For fiscal year 2003,

Volvo did not have access to information from Alecta that would have

enabled this plan to be reported as a defined benefit plan. Accord-

ingly, the plan has been reported as a defined contribution plan.

Volvo’s subsidiaries in the United States mainly secure their pen-

sion obligations through transfer of funds to pension plans. At the

end of 2003, the total value of pension obligations secured by pen-

sion plans of this type amounted to 10,433. At the same point in

time, the total value of the plan assets in these plans amounted to

6,727, of which 63% was invested in shares or mutual funds. The

regulations for securing pension obligations stipulate certain mini-

mum levels concerning the ratio between the value of the plan assets

and the value of the obligations. During 2003, Volvo contributed 843

to the pension plans in order to comply with these regulations. Up to

and including 2002, Volvo’s subsidiaries in the United States reported

defined benefit pension plans in accordance with US GAAP. As

required by these reporting rules, Volvo’s year-end reports for 2001

and 2002 included minimum liability adjustments to cover deficits in

the Group’s US pension plans. The effect of these on the Volvo

Group’s balance sheet for the fiscal years in question are specified in

the table below.

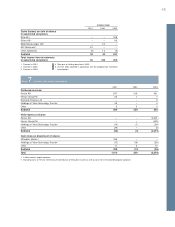

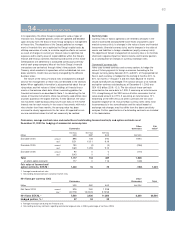

2001 2002

Long-term receivable for prepaid pensions 274 71

Deferred tax assets – 122

Total assets 274 193

Shareholders’ equity (1,417) (2,542)

Provision for post-employment benefits 1,691 2,735

Total shareholders’ equity and liabilities 274 193

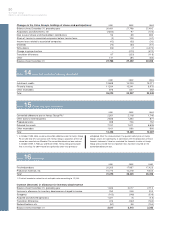

United Great US

Sweden States France Britain Other Other

Fair value of plan assets in funded plans Pensions Pensions Pensions Pensions benefits plans Total

Plan assets at January 1, 2003 3,255 6,752 – 2,221 71 1,004 13,303

Acquisitions and divestments, net – ––––––

Actual return on plan assets 337 1,201 – 227 1 66 1,832

Employer contributions – 843 – 72 81 106 1,102

Employee contributions – – – 25 – 1 26

Exchange rate translation – (1,314) – (199) (18) (21) (1,552)

Benefits paid – (755) – (92) (24) (94) (965)

Plan assets at December 31, 2003 3,592 6,727 – 2,254 111 1,062 13,746

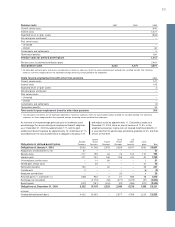

Net provisions post-employment benefits

Funded status at December 31, 2003 (1,740) (3,980) (2,333) (732) (6,167) (533) (15,485)

Unrecognized actuarial (gains) and losses (307) 157 4 (76) 619 3 400

Unrecognized past service costs – 8 (3) 2 (14) (2) (9)

Net provisions for post-employment benefits

at December 31, 2003 (2,047) (3,815) (2,332) (806) (5,562) (532) (15,094)

whereof reported as

Prepaid pensions and other assets 3 132 3 – 1 55 194

Provisions for post-employment benefits (2,050) (3,947) (2,335) (806) (5,563) (587) (15,288)