Volvo 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

The Volvo Group

Notes to consolidated financial statements

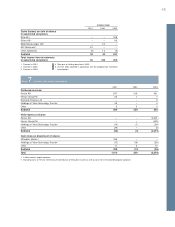

Interest-rate contracts that do not fullfil the criteria of hedge

accounting are valued at the balance sheet date at which time provi-

sions for unrealized losses are made.

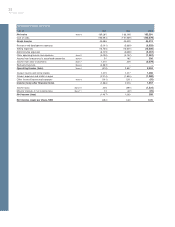

Net sales

The Group’s reported net sales pertain mainly to revenues from sales

of goods and services. Net sales are reduced by the value of dis-

counts granted and by returns.

Income from the sale of goods is recognized when significant

risks and rewards of ownership have been transferred to external

parties, normally when the goods are delivered to the customers. If,

however, the sale of goods is combined with a buy-back agreement

or a residual value guarantee, the sale is accounted for as an operat-

ing lease transaction if significant risks of the goods are retained in

Volvo. Income from the sale of workshop services is recognized

when the service is provided. Rental revenues and interest income in

conjunction with financial leasing or installment contracts are recog-

nized over the contract period.

Research and development expenses

Effective in 2001, Volvo adopted RR 15 Intangible Assets. In accord-

ance with the new accounting standard, expenditures for develop-

ment of new products, production systems and software shall be

reported as intangible assets if such expenditures with a high degree

of certainty will result in future financial benefits for the company.

The acquisition value for such intangible assets shall be amortized

over the estimated useful life of the assets. Volvo’s application of the

new rules means that high demands are established in order for these

development expenditures to be reported as assets. For example, it

must be possible to prove the technical functionality of a new prod-

uct or software prior to this development being reported as an asset.

In normal cases, this means that expenditures are capitalized only

during the industrialization phase of a product development project.

Other research and development expenses are charged to income as

incurred. Expenditures for development of new products, production

systems and software before 2001 was expensed as incurred and in

accordance with the transition rules no retroactive application of RR

15 was made.

Warranty expenses

Estimated costs for product warranties are charged to operating

expenses when the products are sold. Estimated costs include both

expected contractual warranty obligations as well as expected good-

will warranty obligations. Estimated costs are determined based upon

historical statistics with consideration of known changes in product

quality, repair costs or similar. Costs for campaigns in connection

with specific quality problems are charged to operating expenses

when the campaign is decided and announced.

Restructuring costs

Restructuring costs are reported as a separate line item in the income

statement if they relate to a considerable change of the Group struc-

ture. Other restructuring costs are included in Other operating in-

come and expenses. A provision for decided restructuring measures

is reported when a detailed plan for the implementation of the meas-

ures is complete and when this plan is communicated to those who

are affected.

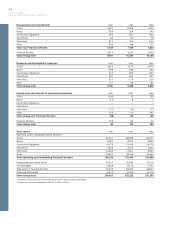

Depreciation, amortization and impairments of tangible and

intangible non-current assets

Depreciation is based on the historical cost of the assets, adjusted in

appropriate cases by write-downs, and estimated useful lives.

Capitalized type-specific tools are generally depreciated over 2 to 8

years. The depreciation period for assets under operating leases is

normally 3 to 5 years. Machinery is generally depreciated over 5 to

20 years, and buildings over 25 to 50 years, while the greater part of

land improvements are depreciated over 20 years. In connection with

its participation in aircraft engine projects with other companies,

Volvo Aero in certain cases pays an entrance fee. These entrance

fees are capitalized and amortized over 5 to 10 years. Product and

software development is normally amortized over 3 to 8 years.

The difference between depreciation noted above and deprecia-

tion allowable for tax purposes is reported by the parent company

and in the individual Group companies as accumulated accelerated

depreciation, which is included in untaxed reserves. Consolidated

reporting of these items is described below under the heading

Deferred taxes, allocations and untaxed reserves.

Goodwill is included in intangible assets and amortized over its

estimated useful life. The amortization period is 5 to 20 years. The

goodwill amounts pertaining to Renault Trucks, Mack Trucks, Volvo

Construction Equipment, Champion Road Machinery, Volvo Aero

Services, Prévost, Nova BUS, Volvo Bus de Mexico, Volvo Construc-

tion Equipment Korea, Volvo Aero Norge and Kommersiella Fordon

Europa are being amortized over 20 years due to the holdings’ long-

term and strategic importance.

If, at a balance sheet date, there is an indication that a tangible or

intangible non-current asset has been impaired, the recoverable

amount of the asset is estimated. If the recoverable amount is less

than the carrying amount, an impairment loss is recognized and the

carrying amount of the asset is reduced to the recoverable amount.

Inventories

Inventories are stated at the lower of cost, in accordance with the

first-in, first-out method (FIFO), or net realizable value.

Liquid funds

Liquid funds include cash and bank balances and marketable securi-

ties. Marketable securities are stated at the lower of cost or market

value in accordance with the portfolio method. Marketable securities

consist of interest-bearing securities, to some extent with maturities

exceeding three months. However, these securities have high liquidity

and can easily be converted to cash.

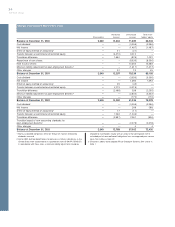

Post-employment benefits

Effective in 2003, Volvo has adopted RR 29 Employee benefits in

accounting for post-employment benefits (see “Changes of account-

ing principles in 2003”). In accordance with RR 29, actuarial calcula-

tions under the projected unit credit method should be made for all

defined benefit plans in order to determine the present value of obli-

gations for benefits vested by its current and former employees. The

actuarial calculations are being prepared annually and are based

upon actuarial assumptions that are determined close to the balance

sheet date each year. Changes in the present value of obligations

due to revised actuarial assumptions are treated as actuarial gains or

losses which are amortized over the employees’ average remaining

service period to the extent these exceed the corridor value for each

plan. Deviations between expected return on plan assets and actual

return are treated as actuarial gains or losses. Provisions for post-

employment benefits in Volvo’s balance sheet correspond to the

present value of obligations at year-end, less fair value of plan

assets, unrecognized actuarial gains or losses and unrecognized

unvested past service costs. Up to and including 2002, defined ben-

efit plans were accounted for in accordance with local rules and

directives in the respective country of Volvo’s subsidiaries. For post-

employment benefits that are financed through defined contribution

plans, Volvo’s annual contributions to such plans are expensed as

incurred. The accounting for defined contribution plans has not been

affected by the adoption of RR 29 in 2003.