Volvo 2003 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

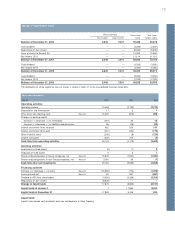

Note 11 Other long-term receivables

2001 2002 2003

Deferred tax assets 1,230 2,351 2,509

Other receivables 52 11 11

Total 1,282 2,362 2,520

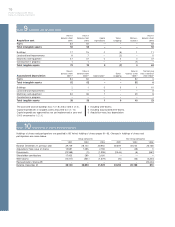

Shares and participations in Group companies

In 2003 acquisition of the truck and construction equipment opera-

tions of Bilia was completed through the exchange of Volvo’s 41%

holding in Bilia for 98% of the shares in the acquired operations,

Kommersiella Fordon Europa AB. The acquisition cost of the shares

in Kommersiella Fordon Europa AB is 855.

Total shares in Volvo do Brasil Veiculos Ltda and Comercio é

Participacao Volvo Ltda, with a total value of 1,941 were received as

dividend from Volvo Global Trucks AB. The shares were then given to

Volvo Holding Sverige AB as a shareholder contribution.

Shareholder contributions were also made to Volvo Financial

Services AB, 400, Volvo China Investment Pty Ltd, 347, Volvo

Powertrain AB, 182, Volvo Holding Mexico, 110, Volvo Technology

Transfer AB, 75, Volvo Business Services AB, 85 and Celero

Support AB, 20.

Volvo Bus de Mexico with a book value of 50, was liquidated.

Write-downs were carried out during the year on holdings in Volvo

Bussar AB, 1,054, Sotrof AB, 500 and Celero Support AB, 20.

2002: An investment of 1,054 was made in newly issued prefer-

ence shares in VNA Holding Inc.

A shareholder contribution was made to Volvo China Investment

Co Ltd of 107, whereupon the shareholdings were written down by

the corresponding amount. Shareholder contributions were also

made to Volvo Holding Mexico, 89, Volvo Technology Transfer AB,

50, Volvo Bussar AB, 28 and to Celero Support AB, 15.

Write-downs was carried out at the end of the year on holding in

Sotrof AB, 400.

2001: All shares in Renault V.I. that were acquired from Renault

SA, were paid for with Volvo shares held by AB Volvo and were

booked to an amount of 10,700. The shares were then sold group

internal to Volvo Holding France SA.

The shares in Mack Trucks Inc were acquired from Renault V.I.

for 3,225 and newly issued shares were subscribed for in the

amount of 1,490. At the end of the year the holdings were written

down by 1,490.

A shareholder contribution of 8,678 was made to the newly form-

ed company Volvo Global Trucks AB, who then aquired the shares in

Volvo Lastvagnar AB for the corresponding amount.

The shares in Volvo Powertrain AB and Volvo Parts AB were

acquired from Volvo Lastvagnar AB.

The shares in Mitsubishi Motors Corporation together with all

rights and obligations relating to the company, were given a total

value of 3,010 and were used as a shareholder contribution to a

newly established German subsidiary; Herkules VmbH. The company

was then divested to DaimlerChrysler.

Shareholder contributions were made to Volvo Holding Sverige

AB, 4,900, Volvo Aero AB, 299, Volvo Parts AB, 200, Volvo Holding

Mexico, 159 and Volvo Technology Transfer AB, 100.

Write-downs were carried out on holdings in Sotrof AB, 6,966 and

VFHS Finans, 3,460.

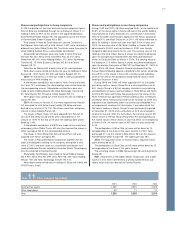

Shares and participations in non-Group companies

During 1999 and 2000, AB Volvo acquired 45.5% of the capital and

30.6% of the voting rights in Scania AB, one of the world’s leading

manufacturers of trucks and buses. As a concession in connection

with the European Commission’s approval of AB Volvo’s acquisition

of Renault V.I. and Mack Trucks Inc. in 2001, AB Volvo undertook to

divest its holding in Scania not later than April, 2004. At year-end

2003, the carrying value of AB Volvo’s holding in Scania AB was

determined to 20,424, and a write-down of 3,901 was thereby

charged to operating income for the year. The carrying value of the

holding of the 63.8 million Scania B shares was determined based

upon the consideration received when AB Volvo divested those

shares to Deutsche Bank on March 4, 2004. The carrying value of

the holding of 27.3 million Scania A shares was determined based

upon the closing share price of SEK 202 on December 31, 2003. In

March, 2004, AB Volvo’s Board of Directors proposed that the

Annual General Meeting approve a dividend to AB Volvo’s sharehold-

ers of 99% of the shares in Ainax AB, a wholly owned subsidiary,

which at the time of the distribution would hold AB Volvo’s entire

holding of Scania A shares.

During 1998 and 1999, AB Volvo acquired 9.9% of the capital

and voting rights in Henlys Group Plc at a total acquisition cost of

524. Henlys Group is a British company involved in manufacturing

and distribution of buses and bus bodies in Great Britain and North

America. AB Volvo and Henlys Group jointly own the shares of the

North American bus operations Prévost and Nova Bus. In February

and March 2004, Henlys announced that its earnings for 2004 was

expected to be significantly lower than previously anticipated. As a

consequence of receiving this information, it was determined that

AB Volvo’s holding in Henlys Group Plc was permanently impaired

at December 31, 2003, and a write-down of 429 was charged to

income for the year. After this write-down, the carrying value of AB

Volvo’s shares in Henlys Group amounted to 95, corresponding to

the market value of these shares at year-end 2003. In the beginning

of March 2004, the market value of AB Volvo’s shares amounted

to 24.

The participations in Blue Chip Jet were written down by 14,

corresponding to the share of the year’s income. In 2003, Volvo

exchanged 41% of the shares in Bilia AB for 98% of the shares in

Kommersiella Fordon Europa AB. The capital gain was 250.

2002: The acquisition costs for Scania shares, acquired in prior

years, decreased by 25.

The participations in Blue Chip Jet H B were written down by 25,

corresponding to the share of the year’s income.

The remaining shares in Eddo Restauranger AB were divested to

Amica AB.

2001: Total shares in Mitsubishi Motors Corporation, with a book

value of 2,344, were transferred to a wholly-owned German sub-

sidiary, which was then divested to DaimlerChrysler.