Volvo 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

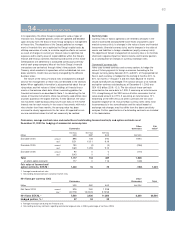

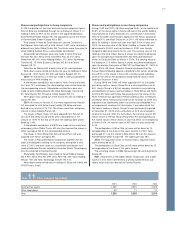

Shareholders’ equity 2001 2002 2003

Shareholders’ equity in accordance with Swedish accounting principles 85,185 78,278 72,420

Items increasing (decreasing) reported shareholders’ equity

Derivative instruments and hedging activities (A) (1,584) 188 1,054

Business combinations (B) 4,125 5,219 5,788

Investments in debt and equity securities (C) (7,328) (9,813) (2,326)

Restructuring costs (D) – – –

Post-employment benefits (E) 272 (20) 1,658

Alecta surplus funds (F) (412) (2) –

Software development (G) 542 330 119

Product development (H) (1,962) (3,263) (3,568)

Entrance fees, aircraft engine programs (I) (719) (855) (874)

Other (J) 17 54 52

Income taxes on above US GAAP adjustments (K) 3,155 1,066 467

Net increase (decrease) in shareholders’ equity (3,894) (7,096) 2,370

Shareholders’ equity in accordance with US GAAP 81,291 71,182 74,790

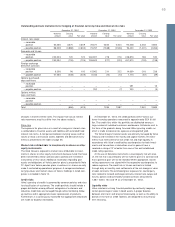

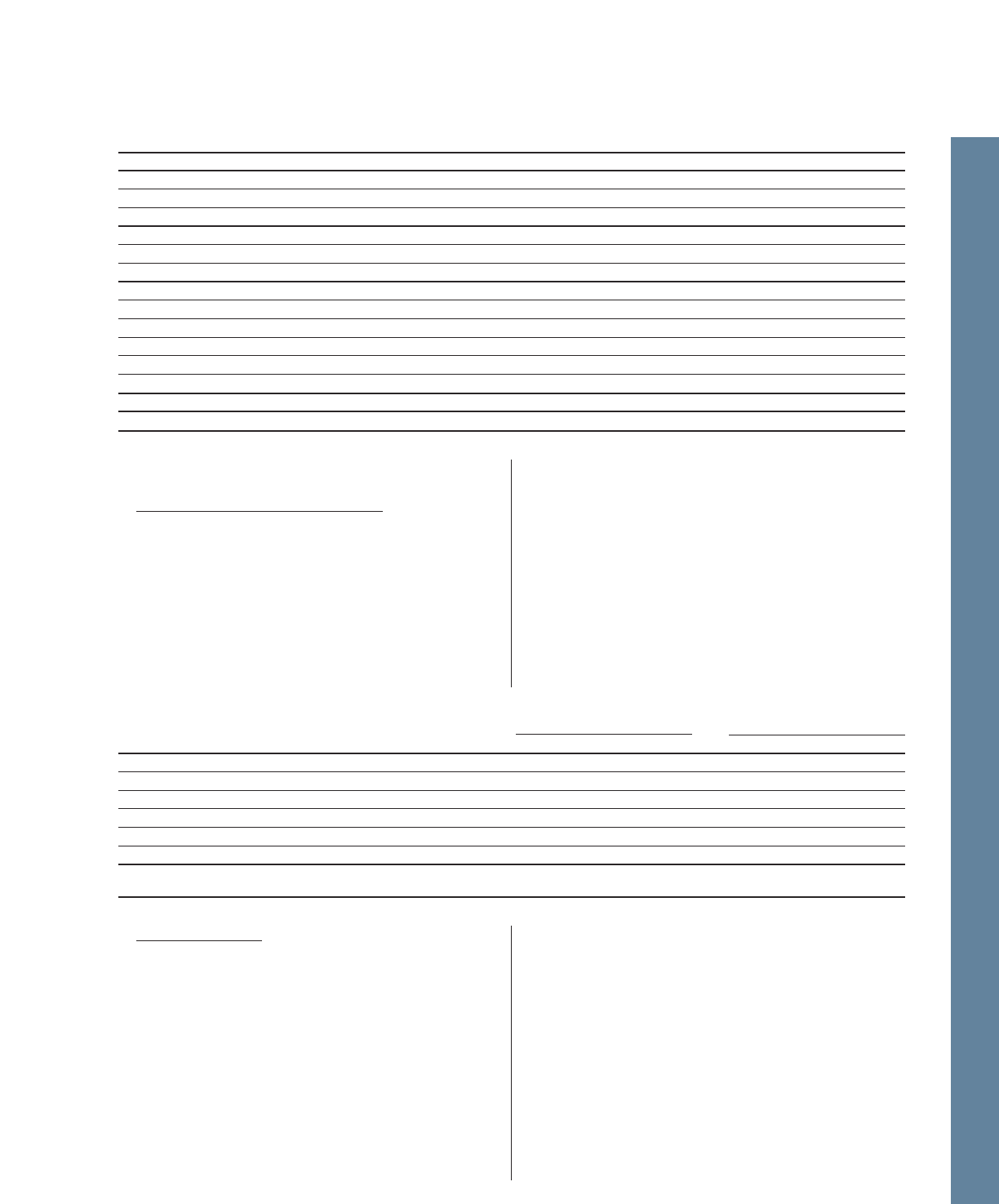

Net income Shareholders’ equity

Accounting for derivative instruments and hedging activities 2001 2002 2003 2001 2002 2003

Derivatives Commercial exposure 342 1,814 417 (944) 870 1,287

Derivatives Financial exposure (685) 43 92 (685) (642) 315

Derivatives in fair value hedges 808 426 (36) 808 1,234 315

Fair value adjustment hedged items (765) (511) 36 (763) (1,274) (138)

Transition adjustment 2–––––

Basis adjustment on derecognised fair value hedges – – 373 – – (725)

Derivative instruments and hedging activities in

accordance with US GAAP (298) 1,772 882 (1,584) 188 1,054

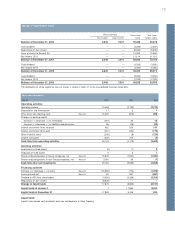

B. Business combinations. Acquisitions of certain subsidiaries are

reported differently in accordance with Volvo’s accounting principles

and US GAAP. The differences are primarily attributable to reporting

and amortization of goodwill.

Effective in 2002, Volvo adopted SFAS 141 “Business

Combinations” and SFAS 142 “Goodwill and Other Intangible Assets”

in its determination of Net income and Shareholders’ equity in

accordance with US GAAP. In accordance with the transition rules of

SFAS 142, Volvo has identified its reporting units and determined

the carrying value and fair value of each reporting unit as of January

1, 2002. No impairment loss has been recognized as a result of the

transitional goodwill evaluation. In Volvo’s income statement for 2003

prepared in accordance with Swedish GAAP, amortization of goodwill

charged to income amounted to 873 (1,094). In accordance with

SFAS 142, goodwill and other intangible assets with indefinite useful

lives should not be amortized but rather evaluated for impairment

annually. Accordingly, the amortization of goodwill reported under

Swedish GAAP has been reversed in the determination of Net

income and Shareholders’ equity under US GAAP. Furthermore,

impairment tests have been performed for existing goodwill as of

December 31, 2003. No impairment loss has been recognized as a

result of these tests.

In 2003, Volvo Construction Equipment acquired assets associat-

ed with the L.B. Smith distribution business in the United States.

Under Swedish GAAP, this operation is classified as a temporary

investment and therefore not consolidated in the Volvo Group. Under

US GAAP, the acquired operations have been consolidated and

accruals have been made for intercompany profits in the year-end

inventory of the L.B. Smith business. Consolidation of the L.B. Smith

distribution business under US GAAP affected Volvo’s income after

financial items negatively with 138. The Group’s total assets

increased by SEK 1.1 billion.

Significant differences between Swedish and US accounting

principles

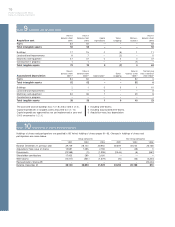

A . Derivative instruments and hedging activities. Volvo uses forward

exchange contracts and currency options to hedge the value of

future commercial flows of payments in foreign currency and com-

modity purchases. Under Swedish GAAP outstanding contracts that

are highly certain to be covered by forecasted transactions are not

assigned a value in the consolidated financial statements.

Under US GAAP Volvo does not apply hedge accounting for com-

mercial derivatives. Outstanding forward contracts and options are

valued at market rates, and unrealised gains or losses that thereby

arise are included when calculating income. Unrealized net gains for

2003 pertaining to forwards and options contracts are estimated at

1,287 (870; losses 944).

Volvo uses derivative instruments to hedge the value of the Group’s

financial position. In accordance with US GAAP, all outstanding deriv-

ative instruments are valued at fair value. The unrealised gains or

losses that thereby arise are included when calculating income. Only

part of the Group’s hedges of financial exposure qualifies for hedge

accounting under US GAAP and are accounted for as such. In fair

value hedges the derivatives are valued at fair value and the hedged

items are valued at fair value regarding the risk and period being

hedged and included when calculating income. In cash flow hedges

only the derivatives are valued at fair value and unrealised gains or

losses are included in shareholders equity (other comprehensive

income), and affect net income when the hedged transactions occur.