Volvo 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

Business Areas

In 2003, Volvo Trucks presented the new

Volvo FH16. The Volvo FH16 is equipped

with an all-new 16-liter engine, available with

a choice of two power outputs, 610 and 550

hp, making it the most powerful standard

truck ever in Europe. Also in 2003, Volvo

Trucks introduced an entirely new truck, the

Volvo VM, mainly for the South American

market in the 17- to 23-ton class. In addition,

a new generation of the Volvo NH, Volvo FH

and Volvo FM was launched in South

America . With these introductions, the entire

Volvo Trucks product range has been

renewed since 2000.

Volvo Trucks’ products are marketed in

more than 130 countries. The greater part of

the sales take place in Western Europe and

in North and South America.

Volvo Trucks has an extensive network of

dealers and service centers in both Europe

and North America. The distribution network

in Europe was stregthened in 2003 through

the acquisition of Bilia's network of truck

dealers. To further improve its customers’

ability to conduct competitive operations,

Volvo Trucks offers a broad range of services.

During 2003, Volvo Trucks delivered a

total of 75,312 trucks, an increase of 8%

compared with a year earlier. Deliveries

increased by 15% in North America and by

37% in Asia. The strong development in Asia

is largely based on high deliveries to Iran.

To t al market

The total market for heavy trucks in Western

Europe was unchanged during 2003, com-

pared with the preceding year. The markets

in Germany and in the UK strengthened by

6% and 10%, respectively, while the markets

in Italy and France weakened. Eastern

Europe continues to show a positive trend.

The total market for heavy trucks in North

America (Class 8) was unchanged at

179,000 trucks in 2003 compared with the

year-earlier period. The trend during the

fourth quarter showed positive signs in the

vocational segment, however the uncertainty

remains in other segments. The market for

heavy trucks in Brazil rose by 28% compared

with a year earlier.

Business environment

The acquisitions of Mack and Renault V.I. in

2001 were part of the restructuring that has

been under way in the heavy-truck industry

for a long time. In 1965 there were 40 inde-

pendent manufacturers of heavy trucks in

Western Europe; today, there are fewer than

ten. Deregulation and increased globalization

have created very tough competition that is

driving the trend toward fewer and larger

transport companies with increasingly

streamlined operations. As a result, demands

on truck manufacturers are also growing.

Large development resources and rational

production are required in order to meet cus-

tomers’ needs in a cost-effective way.

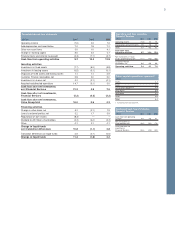

Market share development

The combined market share for heavy trucks

in Western Europe for the truck operations of

the Volvo Group was unchanged in 2003

compared with the year-earlier period at a

level of 26.6%. Volvo Trucks’ share of the

market increased to 15.2% (14.1) in the

heavy class as a result of the successful new

product range. Renault Trucks’ share of the

market declined to 11.4% in the heavy-duty

segment, down 1.5 points compared with

the year-earlier period.

In North America, the combined market

share of heavy trucks (class 8) declined to

19.8% (20.7). Volvo’s market share amount-

ed to 9.4% (7.8). This increase was due to a

high demand for the new Volvo VN. Mack’s

share of the market fell to 10.4% (12.9) in

2003, an effect of a general decline in the

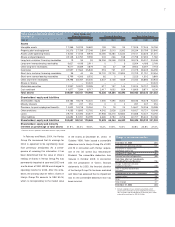

Number of vehicles invoiced Trucks

2002 2003

Western Europe 87,486 82,672

Eastern Europe 8,803 9,411

North America 36,515 34,756

South America 5,358 5,976

Asia 9,144 16,286

Other markets 9,827 6,888

Total 157,133 155,989

Largest markets Trucks

2002 2003

Registered Market Registered Market

heavy trucks share % heavy trucks share %

Volvo Trucks

US 11,025 7.5 13,711 9.7

Great Britain 5,254 16.9 5,855 17.1

Iran 2,372 n/ a 5,463 n/ a

Germany 4,035 9.3 4,241 9.2

France 4,146 10.2 4,222 11.5

Brazil 4,318 14.7 4,127 13.1

Spain 3,098 12.1 3,861 14.4

Italy 2,805 9.8 2,614 11.2

Renault Trucks

France 15,597 38.5 13,205 36.0

Great Britain 1,123 3.6 1,389 4.0

Germany 927 2.1 948 2.0

Spain 5,233 20.1 4,407 16.4

Mack Trucks

US 20,482 13.6 15,146 10.7

Canada 2,281 10.7 1,724 7.7

Renault trucks decreased by 8%, while deliv-

eries in other parts of the world rose by 6%.

Volvo Trucks

Volvo specializes in heavy trucks, with total

weight above 16 tons and began manufac-

turing trucks in 1928.

98 00 01 03

208 246 238 215

Tot al market heavy trucks, thousands

02

215

99

236

255 257 170 179179309

Western Europe

North America

Western Europe

North America