Volvo 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

The Volvo Group

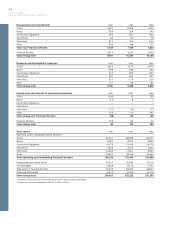

Notes to consolidated financial statements

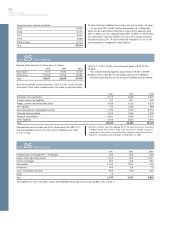

Assumptions applied for 2003

actuarial calculations January 1 December 31

Sweden

Discount rate 5.5 5.5

Expected return on plan assets 16.0 6.0

Expected salary increases 3.0 3.0

United States

Discount rate 6.75 6.25

Expected return on plan assets 17.65 7.65

Expected salary increases 3.5 3.5

France

Discount rate 5.5 5.25

Expected salary increases 3.0 3.0

Great Britain

Discount rate 5.5 5.5

Expected return on plan assets 17.0 7.0

Expected salary increases 3.5 3.5

1 Applicable for the following accounting period. These assumptions reflect

the expected long-term return rate on plan assets, based upon historical

yield rates for different categories of investments and weighted in accor-

dance with the foundation’s investment policy. The expected return has been

calculated net of administrative expenses and applicable taxes.

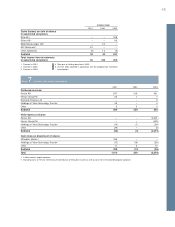

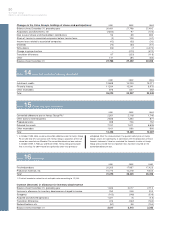

Note 22 Provisions for post-employment benefits

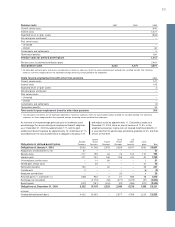

Note 21 Shareholders’ equity

The share capital of the Parent Company is divided into two series of

shares: A and B. Both series carry the same rights, except that each

Series A share carries the right to one vote and each Series B share

carries the right to one tenth of a vote.

The total number of registered shares by year end 2003 amount-

ed to 441,520,885. After repurchase of 5% of the registered shares

in 2001, the total number of outstanding Volvo shares by year end

2003 amounted to 419,444,842 whereof Series A shares

131,674,699 and Series B shares 287,770,143. Par value per share

is SEK 6.00. Total par value was 2,649 and is based on 441,520,885

registered shares. The average number of outstanding shares was

419,444,842 in 2003.

In accordance with the Swedish Companies Act, distribution of div-

idends is limited to the lesser of the unrestricted equity shown in the

consolidated or Parent Company balance sheets after proposed

appropriations to restricted equity. Unrestricted equity in the Parent

Company at December 31, 2003 amounted to 50,878.

As of December 31, 2003, Volvo-related foundations’ holdings in

Volvo were 0.17% of the share capital and 0.37% of the voting

rights.

As shown in the consolidated balance sheet as of December 31,

2003, unrestricted equity amounted to 57,002. (61,536; 70,239). It is

estimated that 0 of this amount will be allocated to restricted

reserves.

Post-employment benefits, such as pensions, healthcare and other

benefits are mainly settled by means of regular payments to inde-

pendent authorities or bodies that assume pension obligations and

administer pensions through defined contribution plans. The remain-

ing post-employment benefits are defined benefit plans; that is, the

obligations remain within the Volvo Group or are secured by own

pension foundations. Costs and the obligations at the end of period

for defined benefit plans are calculated based on actuarial assump-

tions and measured on a discounted basis. The Volvo group defined

benefits plans relate mainly to subsidiaries in the US and comprise

both pensions and other benefits, such as healthcare. Other large-

scale defined benefit plans apply for salaried employees in Sweden

(mainly through the Swedish ITP pension plan) and employees in

France and Great Britain.

As of 2003 Volvo has adopted RR 29 Employee Benefits in its

financial reporting. In accordance with the new standard, defined

benefit plans in all the Group’s subsidiaries are accounted for by use

of consistent principles. In Volvo’s financial reporting up to 2002,

such plans have been accounted for by applying the local rules and

directives in each country. In accordance with the transition rules, a

transitional liability was established as at January 1, 2003, determined

in accordance with RR 29. This transitional liability exceeded the

liability recognized as at December 31, 2002, in accordance with earlier

principles by SEK 2.3 billion. The excess liability was consequently

recognized as at January 1, 2003, as an increase in provisions for

post-employment benefits and a corresponding decrease in share-

holders’ equity. Comparable figures for prior years have not been

restated. See note 1 for further information about the effects of this

change in accounting principles.

The following tables disclose information about defined benefit

plans in the Volvo Group. The information refers to assumptions

applied for actuarial calculations, periodical costs and the value of

obligations and plan assets at year-end. The tables also include

reconciliation of obligations and plan assets during the year and the

difference between fair values and carrying amounts reported on the

balance sheet date.