Volvo 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

Business Areas

Buses

Volvo Buses has renewed its entire product

range in less than five years. Most of the

new models are based on a common pro-

duct platform for intercity buses and tourist

coaches. The introduction of the TX platform

has provided Volvo one of the most modern

product ranges in the bus industry. The

product range provides efficient transport

solutions and includes complete buses and

chassis for city and intercity traffic as well as

coaches, which meet customers’ and envi-

ronmental demands.

Volvo Buses offers an extended range of

facilities within servicing and financing to be

able to offer all-encompassing customer-

tailored transport solutions with the best

total economy. In 2003, an agreement was

made with Renault Trucks covering the sale

of Volvo buses through Renault’s dealer net-

work in France. The French bus market is

the second largest in Europe and the coop-

eration with Renault Trucks gives Volvo

Buses access to an extensive dealer net-

work for repair, service and spare parts.

To t al market

The market for tourist buses globally

remained very low in 2003, particularly in

North America and Europe. The total market

in Europe is weak, which is attributable

mainly to Central Europe. Strong price pres-

sures continue to prevail. In Asia, the mar-

kets in Hong Kong and Singapore are still at

a low level, while a positive trend was noted

in China. In 2003, the market was stable in

Mexico while markets in South America con-

tinued to be weak, but with a tendency

toward recovery.

Business environment

Within the OECD countries, deregulation

and privatization have altered the operating

conditions for many operators. New actors

are penetrating and establishing a foothold

in previously restricted areas, and competi-

tion between companies is increasing.

There is a move toward fewer and larger

operators who impose high demands on

good overall economics and better potential

for focusing on their core operations. Sign-

ificant bus markets in Europe are in a state

of recession, which results in increased

competition in other markets. The trend

toward consolidation in the bus industry is

prevailing.

Market share development

Volvo delivered 7,817 (9,059) buses and

bus chassis during 2003. The decline was

mainly attributable to significantly lower vol-

umes in North America, which were offset to

some extent by favorable volumes in China

and the Nordic countries.

Volvo’s market share in Europe remained

at about the same level as in 2002. In the

Nordic region, the UK and Benelux, Volvo

Buses is the market leader, while the market

position in continental Europe remains

weak. In the North American coach market,

a downturn was noted, while the market

share in Mexico, where Volvo is market

leader, showed a sharp increase. In China,

Volvo Buses increased its share of the total

market during 2003.

Financial performance

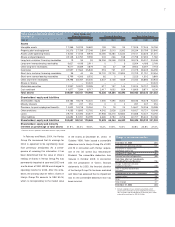

Net sales in 2003 declined to SEK 11,978

M (14,035). The decrease was largely

explained by lower deliveries, mainly in North

99 00 01 03

14 .7 17.2 16 .7 12.0

Net sales, SEK bn

99 00 01 03

224 440 (524) (361)

Operating income (loss)*, SEK M

99 00 01 03

1.52.6 (3.1) (3.0)

Operating Margin*, %

Net sales as percentage of Volvo Group sales, %

0

0

*excluding restructuring costs and write-down of shares

*excluding restructuring costs and write-down of shares

02

14.0

02

(94)

02

(0.7)

7%